5 Best Auto Financing Deals You Must Know

Securing the best auto financing deal can save you thousands of dollars over the life of your car loan. In today's market, there are numerous financing options available, each with its own set of benefits and potential pitfalls. Understanding which deals offer the best value for your specific situation can be quite challenging. This post will dive deep into five of the top auto financing deals that you should know, helping you make an informed decision when it's time to finance your next vehicle.

1. Low APR Loans from Credit Unions

Credit unions often provide some of the lowest annual percentage rates (APR) for car loans. Here’s what makes these deals attractive:

- Lower Interest Rates: Credit unions are not-for-profit institutions, allowing them to offer lower interest rates than many commercial banks.

- Flexible Terms: They can tailor loan terms to suit your financial situation.

- Membership Benefits: You typically need to be a member, but the benefits are significant, including higher savings rates and lower loan rates.

🚗 Note: Credit unions might require membership, which could involve a small donation to a local charity or employment in a certain sector.

2. Manufacturer Financing Incentives

Automakers often partner with finance companies to offer special financing incentives:

- Zero Percent APR: Available during promotional periods, effectively reducing the cost of your car loan to just the price of the vehicle.

- Bonus Cash: Sometimes offered in lieu of zero percent financing, adding direct cash back on the purchase.

- Leasing Options: Lower monthly payments with options to buy the car at the end of the lease term.

🏷️ Note: Always check the fine print as zero percent financing might limit other rebates or special offers.

3. Online Lenders

Online lenders have become increasingly competitive in the auto finance market:

- Convenience: Apply, get approved, and manage your loan entirely online.

- Transparent Rates: Online lenders often provide transparent rates and terms with the option to prequalify without affecting your credit score.

- Fast Funding: Quick approvals and funding, ideal for those in need of swift financing.

4. Buy Here Pay Here Dealerships

These are particularly beneficial for buyers with less than perfect credit:

- Easy Approval: Typically offer in-house financing, making approval easier for those with lower credit scores.

- Direct Relationship: You deal directly with the dealership, which can be advantageous for customer service.

- Vehicle Variety: Often have a wide range of used cars to choose from.

💳 Note: Interest rates at BHPH lots can be significantly higher than other financing options, so consider this carefully.

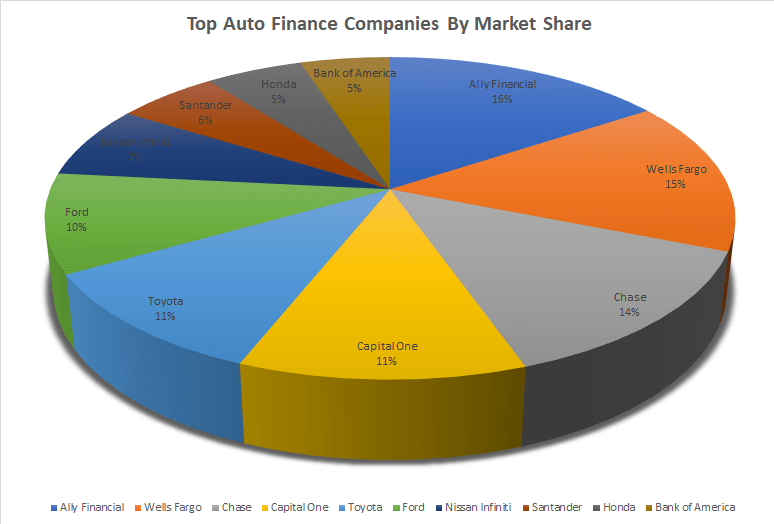

5. Captive Finance Companies

Manufacturers like Toyota, Ford, and Honda have their own finance companies:

- Brand Loyalty Rewards: Discounts or incentives for brand loyalty.

- Special Offers: Often come with promotions tailored to boost sales, like reduced rates or cash back.

- Longer Warranty Periods: Financing through these companies can sometimes extend your vehicle warranty.

🏭 Note: While captive financing can be convenient, compare their offers with other banks and credit unions for the best deal.

Choosing the right auto financing deal involves balancing the interest rate, loan terms, and any additional incentives or conditions. Remember, the lowest rate isn't always the best deal if it means a shorter repayment period or higher monthly payments than you can comfortably manage. Take the time to understand each option's pros and cons, evaluate your financial situation, and ensure the deal aligns with your long-term financial goals. By considering these five auto financing deals, you are better equipped to make a smart, informed choice that will benefit you throughout the life of your car loan.

What is a good APR for a car loan?

+

A good APR for a car loan can vary, but for well-qualified buyers, anything below 4% is considered excellent. Credit unions often offer rates in this range, while banks and dealerships might have rates from 5% to 7% or higher for standard credit.

Can I finance a used car with a manufacturer’s finance company?

+

Yes, most captive finance companies will finance used vehicles, especially certified pre-owned (CPO) cars from their brand. However, the rates might be slightly higher than for new cars, and they might not offer special promotions.

Are online lenders safe to use for auto financing?

+

Yes, reputable online lenders are safe to use, just ensure they are accredited by recognized financial authorities. Always read reviews, look for secure website protocols (HTTPS), and be wary of any unsolicited offers.

How does bad credit impact my auto financing options?

+

Bad credit will generally lead to higher interest rates, fewer loan options, and potentially less favorable terms. However, ‘Buy Here Pay Here’ dealerships might still offer you a chance to finance a vehicle, albeit at a higher cost.

What if I miss a payment on my car loan?

+

Missing a car loan payment can negatively affect your credit score, and after several missed payments, the lender might initiate repossession proceedings. It’s important to contact your lender if you anticipate payment issues to discuss possible adjustments or deferments.