Master SAP for Better Financial Management

Managing finances within an organization is a complex task that involves various processes such as accounting, auditing, compliance, and reporting. One of the best tools to streamline these processes is SAP (Systems, Applications, and Products in Data Processing). SAP provides a suite of applications that can help businesses optimize their financial operations, making them more efficient, accurate, and transparent. Here's how mastering SAP can significantly enhance financial management:

Understanding SAP Financials

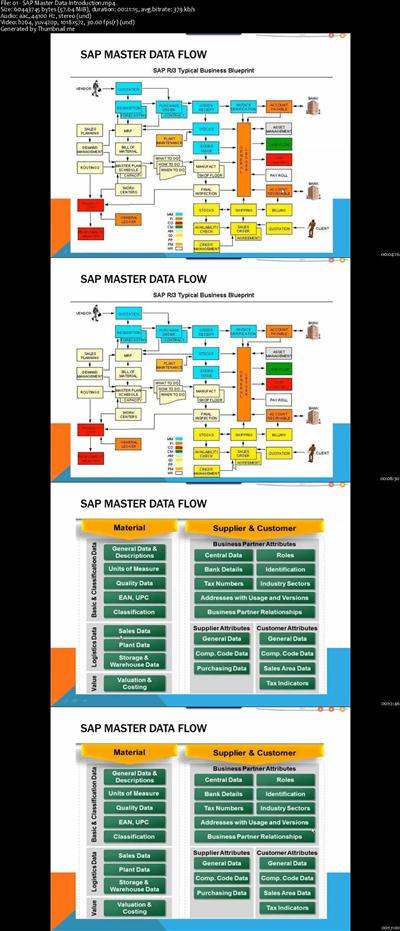

SAP Financials, often referred to as SAP FI (Financial Accounting), offers functionalities for managing and tracking financial transactions. It's part of the larger SAP ERP (Enterprise Resource Planning) system, which integrates various business processes into one complete solution.

- Financial Accounting: This module helps in recording, summarizing, and evaluating all business transactions.

- Accounts Receivable & Payable: Manages the process of invoicing, payment tracking, and collection.

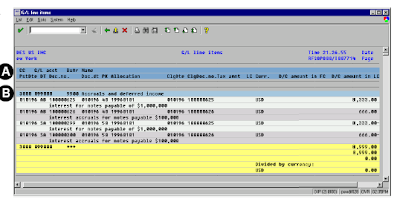

- General Ledger: Central repository for accounting data where all transactions are recorded.

- Fixed Assets: Tracks the lifecycle of physical assets from acquisition to disposal.

- Banking: Provides bank communication management, electronic bank statements, and bank accounting functions.

Benefits of Using SAP for Financial Management

Implementing SAP for financial management comes with numerous benefits:

- Integration: SAP integrates with other modules like Sales & Distribution or Materials Management, ensuring real-time financial data processing.

- Automation: Automate recurring tasks, reduce manual entries, and decrease the likelihood of errors.

- Real-Time Insights: Gain immediate access to financial information, which aids in swift decision-making.

- Compliance: Easily comply with local and international financial reporting standards like IFRS or GAAP.

- Transparency: Full audit trails and documentation provide clear visibility into financial transactions.

- Scalability: As your business grows, SAP scales with it, supporting complex financial operations effortlessly.

How to Master SAP Financial Management

1. Start with Education

Begin your journey by gaining comprehensive knowledge of SAP:

- Take courses on SAP Finance modules (FI, CO, etc.)

- Engage with official SAP training materials and certification.

- Join SAP user groups or forums to stay updated on new features and best practices.

2. Hands-On Experience

There’s no substitute for practical experience:

- Participate in live SAP implementations, either at work or through internships.

- Use SAP’s sandbox environments to simulate real-world scenarios.

- Work on SAP projects, starting with configurations and moving to more complex financial processes.

3. Understand Business Processes

Your financial management knowledge should extend beyond SAP:

- Learn about accounting principles, financial reporting standards, and regulatory requirements.

- Understand how different departments like procurement, sales, and inventory management impact finances.

- Familiarize yourself with the financial implications of various business decisions.

4. Configure and Customize SAP for Your Business

SAP can be configured to meet the unique needs of your organization:

- Set up Chart of Accounts, Fiscal Year Variants, and Document Types.

- Configure general ledger, accounts receivable, payable settings.

- Implement workflow processes for approval of financial transactions.

- Customize reporting tools to generate financial statements relevant to your business.

🔍 Note: Customization should be approached cautiously, ensuring that changes align with standard practices and do not compromise future upgrades or compliance.

5. Enhance with Add-ons and Modules

SAP provides various add-ons that can enhance financial management:

- SAP Business Planning and Consolidation (BPC): For budgeting, planning, and forecasting.

- SAP Governance, Risk, and Compliance (GRC): To ensure compliance and mitigate risks.

- SAP Treasury Management: To optimize cash flow and liquidity.

- SAP Analytics Cloud: For financial analysis and visualization.

6. Continuous Improvement and Learning

Financial management and SAP are both evolving fields:

- Stay informed about SAP upgrades, new modules, and technological advancements.

- Participate in SAP events, webinars, and conferences to learn from experts.

- Encourage cross-functional training within your organization for better SAP utilization.

To summarize, mastering SAP for better financial management involves a structured approach of learning, practical application, understanding of business processes, and ongoing adaptation. By leveraging SAP's robust features, businesses can ensure accuracy, compliance, and efficiency in their financial operations, leading to better strategic decision-making and performance.

What is the difference between SAP FI and SAP CO?

+

FI (Financial Accounting) focuses on external reporting requirements, like balance sheets and income statements, whereas CO (Controlling) deals with internal cost accounting, planning, and controlling, helping managers make informed decisions.

Can SAP help with multi-currency transactions?

+

Yes, SAP has robust capabilities for managing multi-currency transactions, with functionalities for foreign currency valuation, translation, and reporting in different currencies.

How do I ensure data security in SAP?

+

SAP provides several security features including user authentication, authorization controls, encryption, and audit logs to ensure financial data is secure and only accessible to authorized users.

Is SAP integration complex?

+

While SAP integration can be complex due to its extensive functionalities and need for customization, proper planning, phased implementation, and experienced consultants can make the process smoother.

What is the benefit of SAP Analytics Cloud?

+SAP Analytics Cloud provides advanced analytics, data visualization, and predictive analytics capabilities, helping businesses gain deeper insights into their financial performance and make data-driven decisions.