Discover if You're Owed Money from Your Car Finance

Are You Owed Money from Your Car Finance?

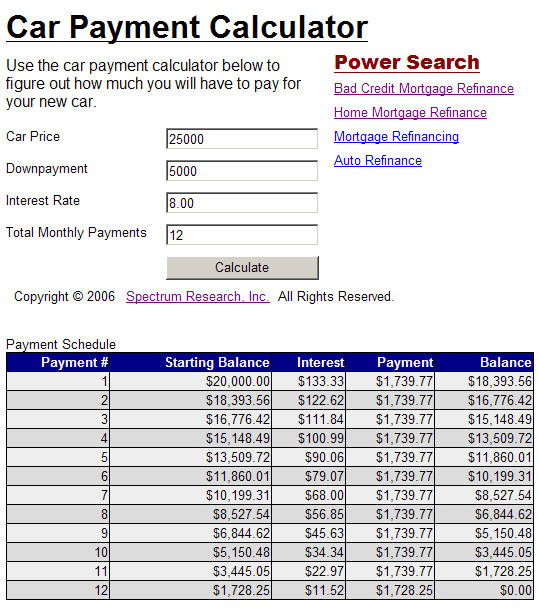

Car finance has become a common way for many people to purchase a vehicle, spreading the cost over several years. However, what many aren’t aware of is the possibility of reclaiming money from their car finance deals due to mis-sold agreements or commissions. If you’ve ever financed a car, you could potentially be owed money back. Let’s delve into how you can discover if you’re among those eligible for a refund.

What Are Mis-sold Car Finance Agreements?

Car finance agreements can be mis-sold in various ways:

- Hidden Commission: Dealerships or brokers might receive hidden commissions for selling specific finance products, which could have increased your finance cost.

- High-Interest Rates: You might have been given a higher interest rate than what was necessary, possibly due to undisclosed practices or commissions.

- Incomplete or Misleading Information: Finance companies or dealers could provide inaccurate or incomplete information, leading to uninformed decision-making.

- Unnecessary Products: Sometimes, additional products like extended warranties or insurance are pushed onto consumers that they don’t need.

💡 Note: If you feel your car finance deal wasn't entirely transparent or you were not fully informed about the terms and conditions, you might have grounds to claim back money.

How to Check if You’re Owed Money

Determining whether you’re owed money from your car finance deal involves several steps:

Gather Documentation

Collect all documents related to your car finance, including:

- Your finance agreement

- Statements

- Any communication related to your deal

Look for Signs of Mis-selling

Review your documents for:

- High or unexplained finance charges

- Added products or services you didn’t request

- Any discrepancies between what was promised and what you received

Check for Regulatory Changes

Stay updated on any regulatory changes or recent court rulings that could impact car finance agreements. Organizations like the Financial Ombudsman Service (FOS) often highlight issues that could lead to successful claims.

Contact Your Finance Company

If you believe there are grounds for a claim:

- Reach out to your finance provider

- Explain your concerns

- Request clarification or a review of your agreement

The Claims Process

If you’ve identified potential mis-selling, here’s what you might do next:

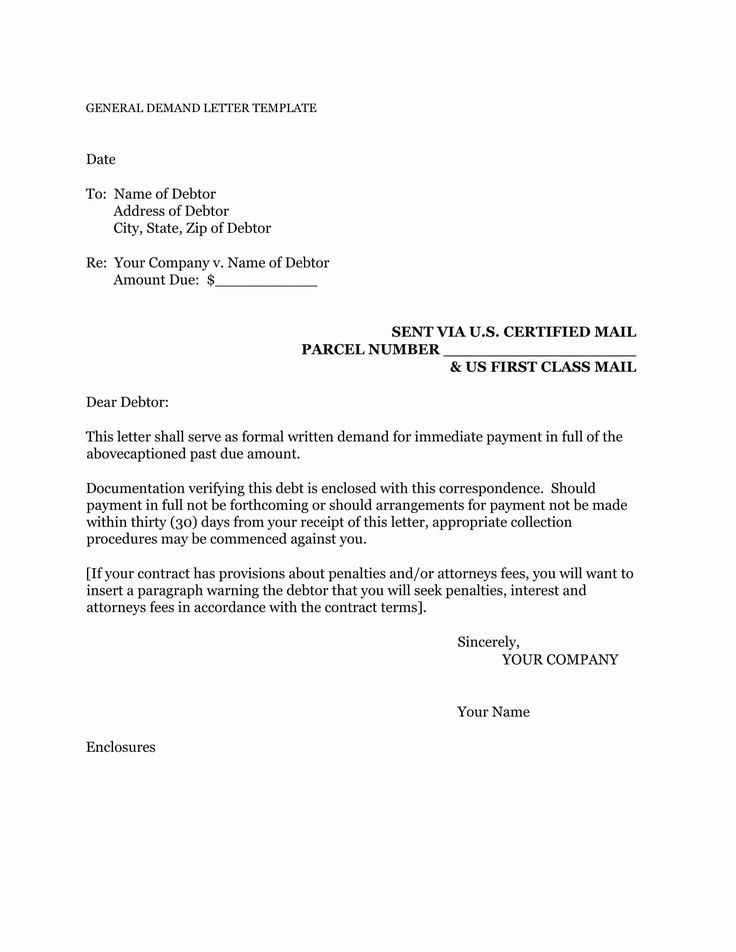

File a Complaint

Submit a formal complaint to your car finance provider:

- Detail the issue

- Request compensation or an adjustment to your finance terms

Seek Professional Advice

Consider speaking with a solicitor or using a claims management company. They can provide expert advice, manage your claim, and negotiate on your behalf.

Escalate to the Ombudsman

If your complaint isn’t resolved satisfactorily:

- You can escalate it to the Financial Ombudsman Service for a free and impartial review

Refund and Compensation

If your claim is successful:

- You might receive a refund of some or all finance charges

- In some cases, you could be eligible for compensation for any inconvenience or loss suffered

- You may be offered an option to alter your finance terms

💹 Note: The amount you can claim back depends on various factors, including the type of mis-selling, the finance company's policies, and regulatory support for claims.

In recent years, the auto finance industry has faced scrutiny for potentially unfair practices. This scrutiny has opened up opportunities for consumers to reclaim money from what could be considered mis-sold car finance deals. By understanding your agreement, recognizing potential issues, and taking action, you could not only reclaim money but also highlight areas where the industry needs to improve transparency and fairness.

How long do I have to make a claim?

+

You generally have six years from the date of the finance agreement, or up to three years from when you first became aware of the issue, to submit a complaint.

Do I need professional help for a claim?

+

Not necessarily. However, legal or claims management services can provide valuable assistance, especially if the claim process becomes complex.

Can I claim if I’ve already paid off the finance?

+

Yes, you can still claim even if your finance has been settled. The focus is on whether the agreement was mis-sold, not on the current status of your finance.