PCP Car Finance Claims: What You Need to Know

If you're exploring ways to finance a car, Personal Contract Purchase (PCP) might be one of the options you come across. PCP finance has become increasingly popular due to its flexible nature, offering a way to drive a new car every few years with relatively low monthly payments. However, understanding how to claim or what to do when something goes awry with your PCP agreement can be tricky. In this comprehensive guide, we'll dive deep into the intricacies of PCP car finance claims, ensuring you're well-informed about what to expect, how to proceed, and what to be cautious about.

What is PCP Car Finance?

PCP, or Personal Contract Purchase, is a type of car finance agreement where the buyer pays for the depreciation of the car over the contract term rather than the car’s full value. Here’s how it works:

- Initial Deposit: You’ll make a down payment, which is usually less than with other finance options.

- Monthly Installments: Pay for the car’s loss in value during the contract, not its total cost.

- Optional Balloon Payment: At the end of the term, you have the choice to make a final lump sum payment (called the balloon payment) to own the car or return the vehicle.

This structure makes PCP appealing because it allows car buyers to:

- Switch cars regularly with lower initial outlays.

- Get into a car they might not be able to afford outright.

- Protect against negative equity since you’re essentially renting the car’s value over time.

Why Make a PCP Finance Claim?

There are several scenarios where car owners might consider making a PCP claim:

- Overvalued Balloon Payment: If the final balloon payment is set too high compared to the car’s market value at the end of the term.

- Mis-sold PCP: If the PCP agreement was sold to you under misleading terms or if you were not fully informed about the terms of the agreement.

- Car Faults: If the car has had significant issues from the outset, which could entitle you to claim under consumer rights.

- Unfair Termination Fees: If you’ve been hit with unexpected or unjustifiable fees for terminating the agreement early.

How to Make a PCP Car Finance Claim

Here’s a step-by-step guide on how to proceed with a PCP car finance claim:

- Document Your Case: Collect all relevant documents, including your finance agreement, communication with the finance company, and any records of payments or issues with the car.

- Contact the Finance Company: Begin by reaching out to the finance provider. Express your concern and outline why you believe a claim is necessary.

- Understand Your Rights: Familiarize yourself with consumer rights, particularly those under the Consumer Credit Act and FCA regulations, which might aid your case.

- Use Resolution Services: If direct negotiations fail, consider using a mediation or alternative dispute resolution service provided by the finance company.

- Legal Action: As a last resort, seek legal advice or proceed with legal action, especially if you believe the finance provider has significantly breached consumer protection laws.

💡 Note: Keep in mind that making a claim can affect your credit score and future borrowing potential. Consider this before proceeding.

Common Issues with PCP Car Finance

Many PCP finance agreements come with their share of issues. Here are some common complaints:

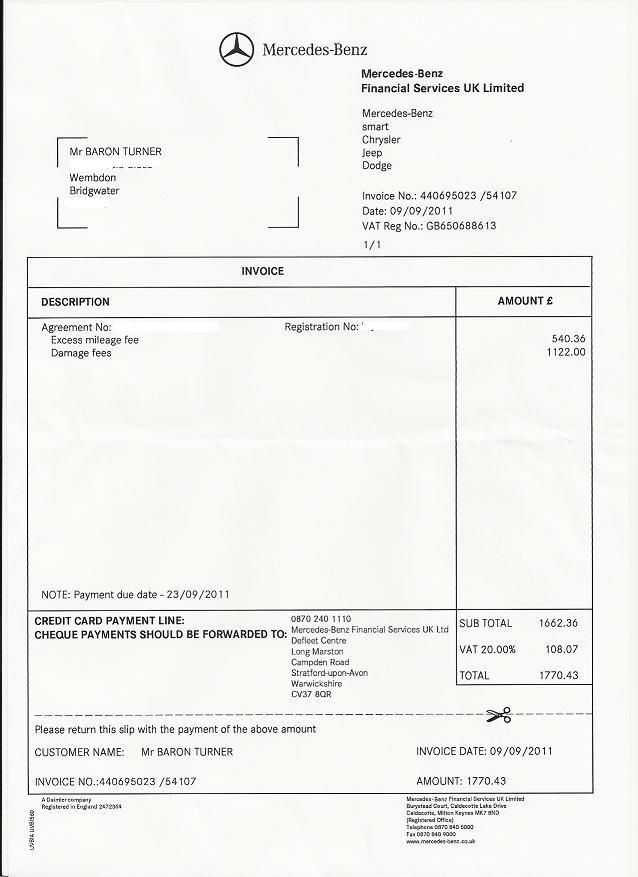

- High Mileage Penalties: Exceeding the agreed mileage can lead to substantial charges, which might come as a surprise to some buyers.

- Negative Equity: If the car depreciates more than anticipated, you might find yourself in negative equity, especially if considering early termination.

- Insurance Costs: PCP agreements often require gap insurance, which can significantly increase your monthly motoring expenses.

Steps to Avoid Issues with PCP Car Finance

While PCP can offer flexibility, here are steps to minimize potential problems:

- Read the Agreement: Understand every term, especially those regarding mileage, maintenance, and termination.

- Negotiate Terms: Where possible, negotiate the interest rate, deposit, and mileage allowance to suit your needs.

- Regular Maintenance: Keep the car well-maintained to avoid penalties related to wear and tear.

- Track Mileage: Be vigilant about your mileage to avoid extra costs at the end of the contract.

🚗 Note: If you're considering early termination, make sure to calculate the financial implications, including any penalties, to ensure it's cost-effective.

PCP vs. Other Finance Options

To help you decide if PCP is the right choice, here’s a comparison with other car finance options:

| Finance Type | Key Features |

|---|---|

| PCP (Personal Contract Purchase) | Low monthly payments, option to return or purchase at the end, can leave you with negative equity if not careful. |

| Hire Purchase (HP) | Eventually own the car outright, typically higher monthly payments than PCP. |

| Personal Loan | Use for cash purchase, can shop around for best interest rates, ownership from the start. |

In wrapping up this extensive guide on PCP car finance claims, it's evident that while PCP offers certain advantages like flexibility and lower monthly payments, it also comes with its complexities and potential pitfalls. Understanding the process, your rights, and how to handle disputes or claims is crucial to making informed decisions. Whether you're thinking about entering into a PCP agreement or already in one and facing issues, remember that knowledge is your best tool for navigating the financial landscape of car ownership.

What happens if I exceed the mileage on my PCP agreement?

+

Exceeding the agreed mileage can lead to excess mileage charges, calculated per mile over the limit. Always check your contract for these rates and try to stay within your limit.

Can I end my PCP agreement early?

+

Yes, but be aware that ending your PCP early might involve substantial costs like the remaining balance, termination fees, and any negative equity. Contact your finance provider for an exact calculation.

What are my rights if the car I finance through PCP has major faults?

+

You have consumer rights that allow you to claim for repairs or a replacement, depending on the nature and severity of the fault. Contact the dealership or finance company with your concerns.

Is PCP the cheapest way to finance a car?

+

PCP can offer lower monthly payments than other forms of finance like HP, but it might not be the cheapest option over the car’s lifetime due to interest, balloon payment, and potential charges.