5 Long-Term Finance Examples You Should Know

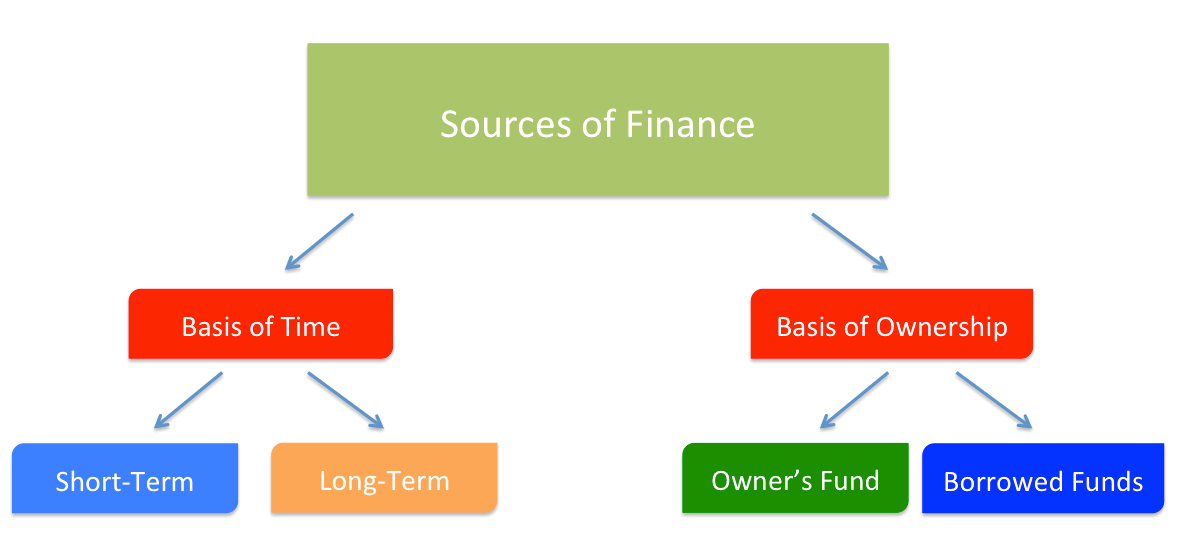

Understanding different financial strategies for the long term is crucial for anyone looking to secure their financial future. Long-term finance refers to funds that are invested or borrowed with an extended time frame in mind, typically covering several years or even decades. These strategies are essential not only for individuals saving for retirement but also for businesses planning expansion, managing cash flow, or investing in research and development. Here are five key examples of long-term finance strategies you should know:

1. Retirement Funds

Retirement funds are a cornerstone of personal finance planning. They enable individuals to accumulate wealth over their working years to support themselves after they retire. Here’s how you can approach retirement planning:

- 401(k) or Defined Contribution Plans: These employer-sponsored plans allow you to save for retirement with pre-tax dollars, reducing your taxable income while your investments grow tax-deferred.

- IRA (Individual Retirement Account): Both Traditional and Roth IRAs provide tax advantages. Traditional IRAs offer tax deductions now with taxes paid upon withdrawal, while Roth IRAs are funded with after-tax contributions, allowing for tax-free growth and withdrawals.

- Pension Schemes: Although less common now, pensions guarantee a steady income in retirement based on salary and years of service.

🔍 Note: Ensure you understand the contribution limits and the tax implications of each retirement vehicle to make the most out of these long-term finance tools.

2. Equity Investments

Investing in equities or stocks is a common way to grow wealth over a long period. Here’s what you need to know:

- Stock Market: Investing in individual stocks allows you to own a piece of a company, potentially benefiting from its growth, dividends, or both.

- Mutual Funds: These funds pool money from many investors to buy a diversified portfolio of stocks or other securities, reducing risk while providing long-term growth.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded like stocks, ETFs provide diversification with lower costs and greater tax efficiency.

3. Real Estate Investment

Real estate can serve as both a residence and an investment vehicle:

- Property Appreciation: Over time, real estate values often increase, making property ownership a way to accumulate wealth.

- Rental Income: Owning rental properties provides regular cash flow in addition to the potential for property value appreciation.

- REITs (Real Estate Investment Trusts): These allow investors to partake in real estate without owning physical property, by investing in companies that own, operate, or finance income-producing real estate.

🌟 Note: Real estate involves significant research and due diligence due to the illiquid nature of the asset and the complexity of property management.

4. Long-Term Bonds

Bonds are traditionally seen as safer long-term investment options compared to stocks, particularly if they are government or high-quality corporate bonds:

- Government Bonds: Issued by governments, these provide fixed income with typically low default risk, ideal for conservative investors.

- Corporate Bonds: These carry a higher yield but also a higher risk. They can be an essential part of a diversified bond portfolio.

- Municipal Bonds: Often offering tax-exempt interest, they are a good choice for those in higher tax brackets.

Bonds provide steady income and can stabilize a portfolio’s volatility, offering a cushion against market downturns.

5. Savings Accounts with High Interest

While not typically considered an investment, high-yield savings accounts or certificates of deposit (CDs) offer:

- Low Risk: With FDIC or NCUA insurance, the principal is safe up to the insured limit.

- Compound Interest: Interest earned on both the initial amount and the interest accumulated over time can grow your savings significantly over the long term.

- Liquidity: Savings accounts and certain CDs provide easy access to funds when needed.

As we've explored these five long-term finance examples, it's clear that each has its unique advantages and considerations. Whether saving for retirement, investing in the stock market, buying real estate, securing income through bonds, or opting for the safety of savings accounts, your choice should align with your financial goals, risk tolerance, and time horizon. By understanding these strategies, you can diversify your financial portfolio, mitigate risks, and build a solid foundation for long-term financial security.

What makes retirement funds a good long-term finance option?

+

Retirement funds benefit from tax advantages, employer contributions, and the power of compounding over many years, making them an excellent option for long-term savings and growth.

How can I ensure my investments in real estate remain profitable?

+

To keep real estate investments profitable, consider location research, property condition, rental demand, and economic cycles. A diversified property portfolio also helps manage risk.

Can bonds lose value?

+

Yes, bonds can lose value if interest rates rise or if there’s a significant increase in perceived credit risk. However, held to maturity, they generally provide predictable income.