Subaru Financing: Your Guide to Affordable Car Loans

In the world of automotive financing, Subaru stands out as a brand that not only delivers quality vehicles but also offers competitive financing options. Whether you're dreaming of cruising through city streets or tackling rugged trails, understanding Subaru's financing solutions can make your next car purchase a seamless and affordable experience. This guide will walk you through everything you need to know about Subaru Financing, ensuring you're well-equipped to make an informed decision.

Why Choose Subaru Financing?

Subaru’s finance options are designed with the customer in mind, offering several benefits:

- Flexible Terms: Options that cater to various financial situations.

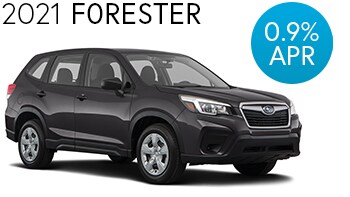

- Competitive Rates: Low APRs to keep your monthly payments manageable.

- Special Offers: Seasonal promotions that can reduce the overall cost of ownership.

- Customization: Tailor your loan to meet your personal needs.

Here’s an example of what the financing could look like:

| Loan Term | APR | Monthly Payment* |

|---|---|---|

| 36 Months | 2.9% | 295</td> </tr> <tr> <td>48 Months</td> <td>3.5%</td> <td>228 |

| 60 Months | 4.0% | $190 |

💡 Note: These rates are examples based on current market trends and may vary based on your creditworthiness and other factors.

The Process of Securing Subaru Financing

Here’s a step-by-step guide to getting approved for Subaru Financing:

- Pre-approval: Begin by applying for pre-approval online or at a dealership to understand what financing options are available to you.

- Choose Your Subaru: Decide on the Subaru model that fits your lifestyle, knowing your budget constraints.

- Negotiate the Purchase Price: Having pre-approval can give you leverage in negotiating the vehicle’s price.

- Loan Application: Fill out the official loan application with your chosen dealership, providing necessary documentation like your driving license, employment details, and income verification.

- Approval: Wait for the final approval from the Subaru finance department. This can often happen on the same day if you’re at a dealership or can take a few days if done remotely.

- Finalize Documents: Review all documents carefully, sign, and collect the keys to your new Subaru!

Tips for Maximizing Your Subaru Financing

To make the most of Subaru’s financing:

- Improve Your Credit Score: A higher credit score can secure lower interest rates. Pay down existing debts and maintain timely payments.

- Get Pre-Approved: This helps set a budget before car shopping and can lead to better negotiation power.

- Compare Offers: Even within Subaru financing, terms can vary. Look at different dealerships and special promotions.

- Understand Dealer Fees: Be aware of any add-on fees that could increase the cost of your vehicle purchase.

Protecting Your Investment

Once you’ve secured your Subaru Financing, consider these steps to protect your investment:

- Extended Warranties: These can cover unexpected repair costs and ensure long-term reliability.

- Maintenance Plans: Regular servicing under a plan can maintain your car’s condition and potentially increase its resale value.

- Gap Insurance: In case of total loss, gap insurance covers the difference between the car’s value and your outstanding loan balance.

🚗 Note: Investing in these options can add peace of mind to your ownership experience.

Closing Thoughts

Financing a Subaru through the brand’s financing solutions opens up a world of driving pleasure with the assurance of tailored financial options. From the flexibility of loan terms to competitive rates and special offers, Subaru provides a comprehensive approach to car ownership. By understanding the process, maximizing your financing, and protecting your investment, you set yourself up for a rewarding experience behind the wheel of a Subaru.

What are the benefits of Subaru Financing?

+

Subaru Financing offers competitive rates, flexible terms, and special promotional offers, making car ownership more accessible and less stressful.

How long does the financing approval process take?

+

The process can be immediate if you apply in-person at a dealership or can take a few days if applied online or remotely.

Can I negotiate the interest rate with Subaru Financing?

+

While interest rates are set by Subaru Financial Services, getting pre-approved and shopping around might give you room to negotiate or secure the best offer available.