5 Proven Strategies for Financial Freedom with Samuel Leeds

Embarking on a journey toward financial freedom is something many aspire to achieve, and who better to guide us than Samuel Leeds? As a property mogul, entrepreneur, and investor, Samuel has been in the real estate game for years, amassing wealth through savvy investments and business acumen. His strategies have been battle-tested and have proven to be effective for those willing to roll up their sleeves. In this comprehensive guide, we'll dive into 5 Proven Strategies for Financial Freedom with Samuel Leeds.

1. Property Investment: The Leeds Way

Samuel Leeds made his fortune through real estate, and it’s no secret that he considers property investment the cornerstone of building wealth. Here’s how you can follow his approach:

- Start with Education: Before diving into the deep end of real estate, it’s crucial to educate yourself. Attend courses, seminars, and read books on property investment. Samuel often emphasizes the importance of knowledge over instant action.

- Focus on Cash Flow: Properties that generate positive cash flow are your bread and butter. Samuel looks for properties where the rent covers the mortgage, maintenance, and provides some surplus.

- The ‘Rent to Rent’ Strategy: If capital is an issue, consider the ‘rent to rent’ model. This involves leasing a property from a landlord and renting it out at a profit without the initial large capital investment.

- Utilize Networking: Real estate is often about who you know. Networking can provide access to off-market deals, partnerships, and valuable advice. Samuel is known for his networking events.

Here’s a simple comparison of investment options:

| Strategy | Initial Capital | Risk | Cash Flow Potential |

|---|---|---|---|

| Traditional Investment | High | Medium | High |

| Rent to Rent | Low | Medium-High | Medium |

| Joint Ventures | Low to Medium | Low | High |

📝 Note: Property investment can be lucrative but requires patience, education, and a willingness to manage properties or delegate effectively.

2. Mindset and Education: Shaping the Wealth Builder

Samuel Leeds attributes a significant portion of his success to his mindset. Here’s how you can cultivate a wealth-building mindset:

- Continuous Learning: Never stop learning. Whether it’s property market trends, investment strategies, or personal development, ongoing education is key.

- Embrace Failure: Failure is not a setback but a stepping stone. Samuel has had his share of failures, but he learned from them and moved forward.

- Surround Yourself with Winners: Success breeds success. Network with like-minded individuals who push you to grow.

- Think Long-Term: Wealth is not an overnight phenomenon. It’s about long-term strategy and delayed gratification.

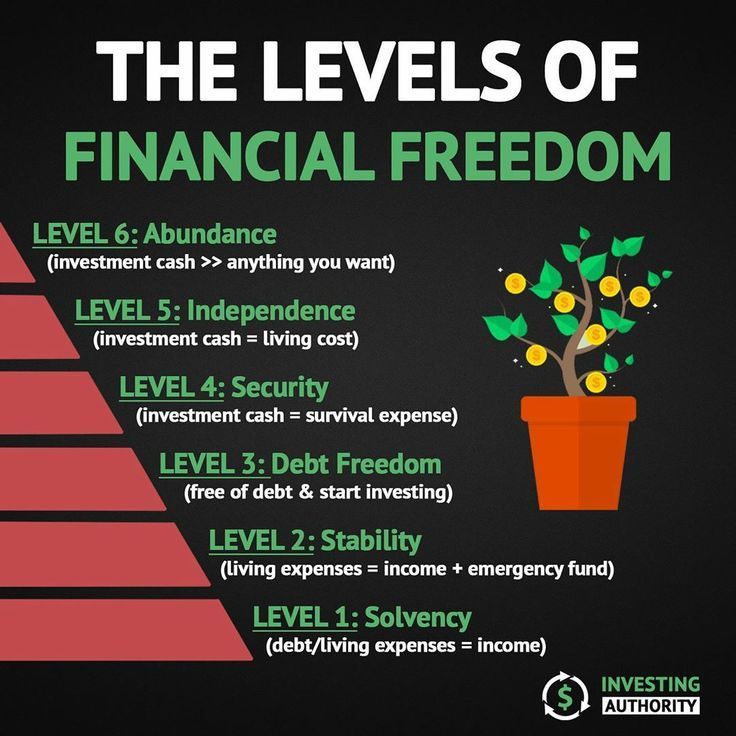

3. Diversify Your Portfolio

While property investment is a core strategy, Samuel Leeds also advocates for diversification to spread risk and capitalize on other opportunities:

- Other Asset Classes: Consider stocks, bonds, or cryptocurrencies. However, understand these markets thoroughly before diving in.

- Business Ventures: Entrepreneurship can yield high returns if you have a viable business idea or can partner with those who do.

- Alternative Investments: Peer-to-peer lending, art, or wine investment can offer unique opportunities for returns.

💼 Note: Diversification is not about spreading funds thinly across all assets; it's about having a calculated approach to risk and return balance.

4. Personal Development: The Inner Game

Samuel Leeds also focuses on personal development to enhance one’s financial journey:

- Health and Wellbeing: Your health is your wealth. Physical and mental wellbeing directly impacts your capacity to work and think strategically.

- Goal Setting: Clear, achievable goals are the roadmap to success. Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals.

- Financial Literacy: Understanding finance beyond just property investment is key. Learn about tax strategies, financial planning, and wealth preservation.

5. Advanced Strategies: Taking Wealth to the Next Level

Once you’ve laid the foundation, here are advanced strategies for those looking to amplify their financial freedom:

- Property Development: Moving from buying to building allows you to add value and potentially multiply returns.

- Joint Ventures: Partner with others to pool resources and reduce risk while tackling larger projects.

- Private Lending: As an established investor, you can become a bank for other investors, securing high returns while minimizing risk.

To recap our journey toward financial freedom with Samuel Leeds as our guide, here are the key takeaways:

In the realm of wealth creation, Samuel Leeds has proven that property investment, with its multiple entry points like 'rent to rent' or joint ventures, can be a powerful strategy. Furthermore, the mindset of continuous learning, embracing failure, and focusing on long-term goals is essential. Diversifying your investments, not just sticking to one asset class, helps mitigate risks and capitalize on various opportunities. Personal development in areas like health and goal setting enhances your capability to build and maintain wealth. Finally, advanced strategies like property development and private lending allow for exponential growth when the foundation is solid.

As we move forward, adopting these strategies could pave the way for a financially free life, where work becomes an option, not an obligation.

What is Samuel Leeds’ primary source of wealth?

+

Samuel Leeds’ primary source of wealth is through property investment, particularly in residential real estate.

Is ‘rent to rent’ a good strategy for beginners?

+

Yes, ‘rent to rent’ can be a low-risk way for beginners to enter the real estate market, provided they educate themselves and manage properties efficiently.

How can networking events benefit property investors?

+

Networking events allow you to connect with others in the field, offering access to off-market deals, partnerships, and mentorship opportunities.

Why is mindset important in wealth building?

+

A wealth-building mindset fosters resilience, continuous learning, and strategic long-term planning, all crucial for achieving financial freedom.