Master 125 Finance Strategies for Ultimate Financial Growth

Imagine achieving financial freedom through smart strategies that not only increase your wealth but also safeguard your financial future. Whether you're just starting your journey towards financial independence or looking to optimize your existing investment portfolio, understanding and applying finance strategies can make a significant difference. Here, we'll dive into 125 finance strategies that have proven effective for ultimate financial growth. From personal budgeting to sophisticated investment techniques, let's explore how you can master these approaches for sustained financial health.

Table of Contents

- Personal Budgeting

- Debt Management

- Saving and Investing

- Retirement Planning

- Tax Strategies

- Real Estate Investing

- Generating Passive Income

Personal Budgeting

Personal budgeting is the cornerstone of financial management. Here are some strategies to get you started:

- Create a Zero-Based Budget: Ensure every dollar is accounted for, with the goal of having income minus expenses equals zero.

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Automate Savings: Set up automatic transfers to savings accounts to ensure you’re saving before you can spend.

🚨 Note: Remember to review and adjust your budget monthly to reflect changes in income or expenses.

Debt Management

Debt can be overwhelming, but with the right strategies, you can manage it:

- Snowball Method: Pay off debts from smallest to largest, gaining momentum as each balance is paid.

- Avalanche Method: Tackle high-interest debts first to minimize the total interest paid over time.

- Consolidate Debt if possible to manage payments more easily.

Saving and Investing

Here’s how you can approach saving and investing for growth:

- Emergency Fund: Save at least 3-6 months’ worth of living expenses in an easily accessible account.

- Compound Interest: Invest in accounts or funds that offer compound interest for exponential growth.

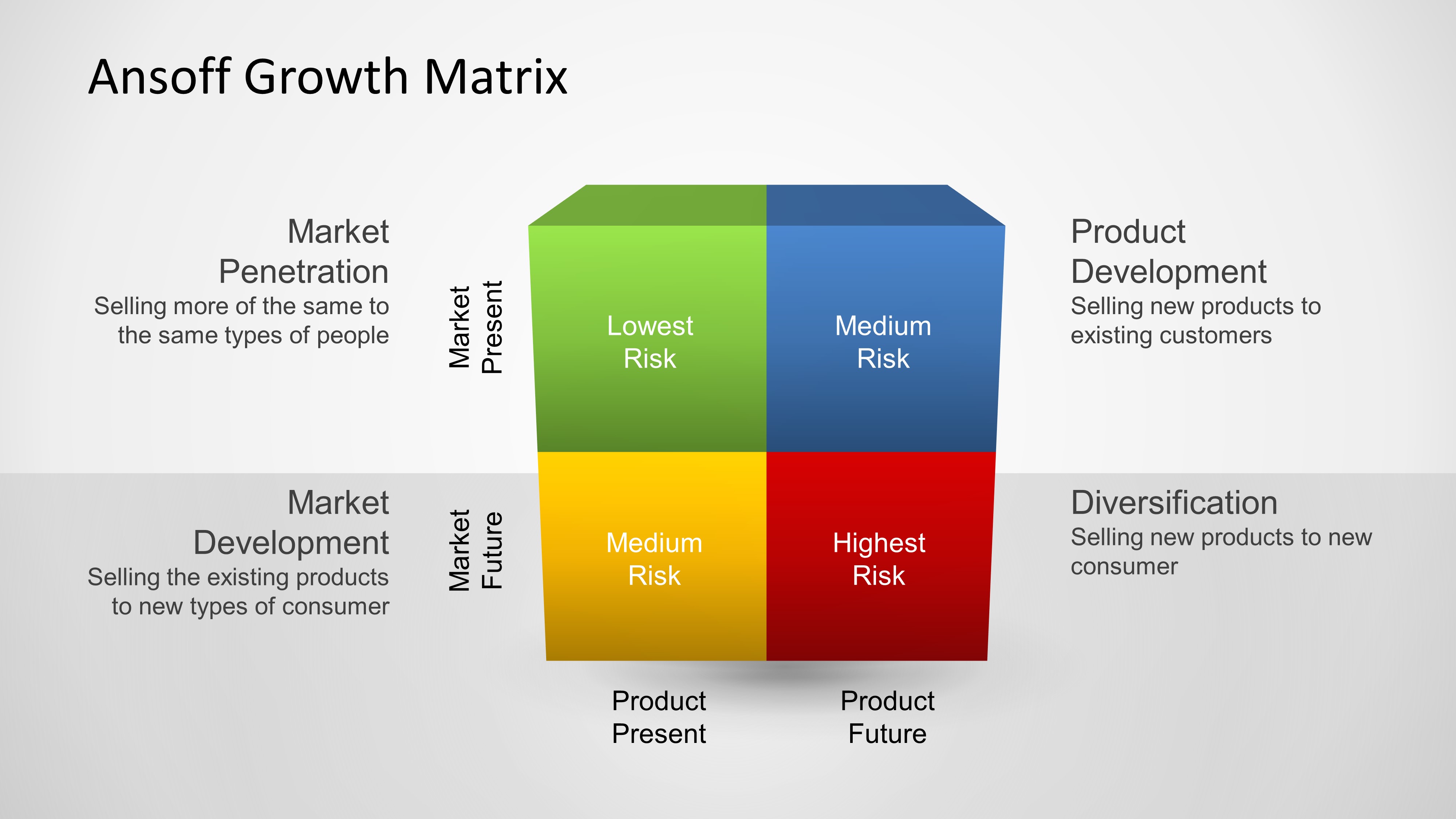

- Diversify Investments: Don’t put all your money in one basket. Spread investments across various asset classes.

| Investment Type | Risk Level | Expected Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low to Medium | Moderate |

| Real Estate | Medium | Variable |

Retirement Planning

Planning for retirement ensures you live comfortably post-work:

- Start Early: The power of compound interest means starting early significantly impacts your retirement savings.

- Consider a 401(k) or an IRA for tax-advantaged retirement savings.

- Understand your risk tolerance and adjust your retirement portfolio accordingly as you age.

Tax Strategies

Tax planning is crucial to retain more of your earnings:

- Maximize Deductions: Use allowable deductions to reduce your taxable income.

- Invest in Tax-Advantaged Accounts: Utilize HSAs, IRAs, and 401(k)s for tax benefits.

- Offset Capital Gains: Use capital losses to offset capital gains for tax efficiency.

Real Estate Investing

Real estate can provide steady income and capital growth:

- REITs: Invest in Real Estate Investment Trusts for dividends without property management.

- Flipping Properties: Buy, renovate, and sell properties at a profit.

- Rental Properties: Earn passive income through rental payments.

Generating Passive Income

Passive income streams offer financial security:

- Dividend Stocks: Invest in companies known for consistent dividend payouts.

- Online Ventures: Create blogs, YouTube channels, or apps that generate ad revenue or affiliate income.

- Licensing Intellectual Property: Music, books, or patents can provide ongoing revenue.

📘 Note: Passive income does require initial effort and setup but can lead to significant financial growth over time.

The journey towards financial growth involves understanding and applying a multitude of strategies. From budgeting meticulously to diversifying investments, from managing debt to planning for retirement, these 125 finance strategies provide a comprehensive guide. Tailor them to your personal financial situation, risk tolerance, and long-term goals. Embrace this knowledge not just for wealth accumulation but for the peace of mind and freedom it brings. Remember, mastering finance is a continuous process, adjusting strategies as your life and economic conditions evolve.

What is the best way to start budgeting?

+

Begin by tracking all your income and expenses for a month, categorize them, and then use the zero-based or 50/30/20 budgeting methods to allocate your funds accordingly.

How do I choose between the snowball and avalanche debt repayment methods?

+

If you need psychological wins to stay motivated, go with the snowball method. If you’re focused on minimizing interest paid, the avalanche method is more effective.

What’s a good strategy for starting passive income?

+

Consider investing in real estate through REITs or creating online content that can generate ad revenue or affiliate marketing income. The key is to find something you can leverage over time.