5 Essential Tips for Securing a Business Startup Loan

Starting a new business is an exhilarating journey filled with anticipation and challenges. One of the most significant hurdles for entrepreneurs is securing funding to breathe life into their vision. Whether you're launching a tech startup, opening a brick-and-mortar store, or expanding an existing business, obtaining a business startup loan is often a critical step. However, navigating the loan application process can be daunting. This guide offers five essential tips to help you secure the financial backing you need for your startup, ensuring you're well-prepared to convince lenders to invest in your venture.

Understand the Loan Landscape

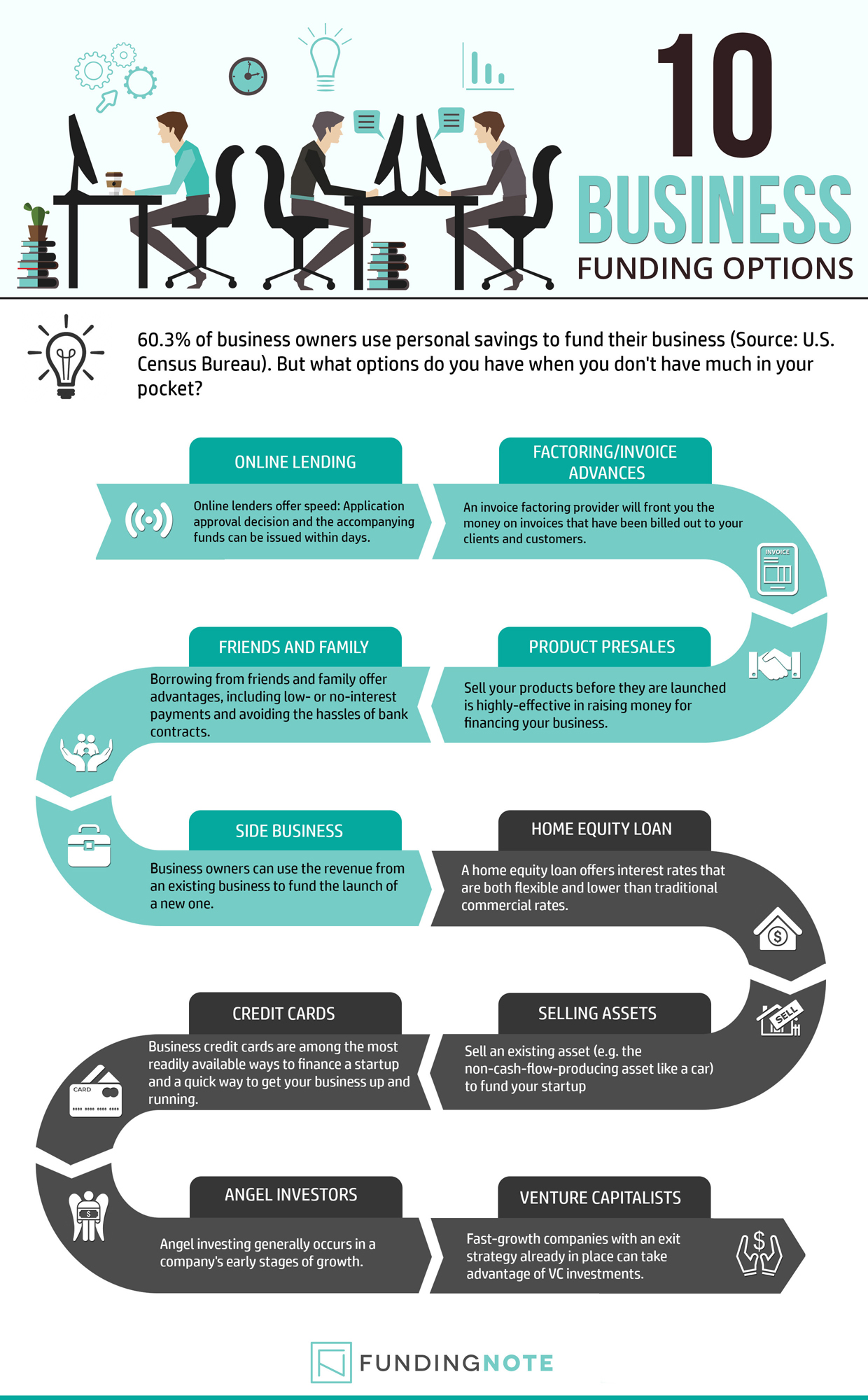

Before diving into your loan application, it’s crucial to understand the various types of business loans available:

- Traditional Bank Loans: These often require a strong credit score and collateral.

- Small Business Administration (SBA) Loans: Government-backed loans can be more accessible, with favorable terms for small businesses.

- Online Lenders: They offer a quicker application process but may come with higher interest rates.

- Microloans: Suitable for small amounts, often provided by non-profit lenders or community development institutions.

- Merchant Cash Advances: These are based on future credit card sales, not ideal for businesses with low credit card transactions.

💡 Note: Each loan type has its own set of requirements, repayment terms, and interest rates. Knowing which one suits your business model is key.

Craft a Stellar Business Plan

A compelling business plan is your roadmap and your pitch to potential lenders. Here’s how to make it stand out:

- Executive Summary: Capture the essence of your business in a succinct, compelling way.

- Market Analysis: Demonstrate thorough research of your market, competition, and potential customers.

- Marketing and Sales Strategy: Show how you will attract and retain customers.

- Financial Projections: Include detailed forecasts for income, expenses, and cash flow. Use graphs or charts if possible.

- Management Team: Highlight the expertise and experience of your team members.

| Section | Description |

|---|---|

| Executive Summary | Overview of your business's purpose, objectives, and uniqueness. |

| Market Analysis | Your understanding of the industry, customer needs, and competition. |

| Marketing Strategy | How you plan to reach your target market and convert them into customers. |

| Financial Projections | Detailed forecasts of your startup's financial health. |

| Management Team | Profiles and roles of key players in your business. |

Maintain a Strong Credit Score

Your personal and business credit scores play a pivotal role in securing a startup loan:

- Check Your Credit Reports: Look for errors and dispute inaccuracies promptly.

- Reduce Debt: Lower your debt-to-income ratio before applying for a loan.

- Pay Bills on Time: Consistent, timely payments boost your creditworthiness.

- Manage Credit Lines: Keep your credit utilization low and avoid unnecessary applications for new credit.

Prepare Your Financial Documentation

Proper documentation is essential when you apply for a business loan. Here’s what you should gather:

- Business and Personal Tax Returns: Lenders need to see your financial history.

- Bank Statements: Reflect your liquidity and cash flow.

- Business Financial Statements: Profit and loss statements, balance sheets, and cash flow statements.

- Projected Financial Statements: These help lenders understand your business’s potential.

- Legal Documents: Business licenses, articles of incorporation, and any contracts or agreements.

🗂 Note: Organized financial records not only expedite the loan process but also build trust with lenders.

Develop a Compelling Pitch

When presenting your loan application to potential lenders:

- Highlight Your Business’s Unique Value Proposition: What makes your business stand out?

- Showcase Market Need: Demonstrate a clear demand for your product or service.

- Emphasize Your Experience and Expertise: Lenders invest in people as much as they do in ideas.

- Present a Risk Mitigation Plan: Explain how you’ll handle potential challenges.

- Be Concise and Confident: Keep your pitch focused and exude confidence in your business’s success.

In wrapping up, securing a business startup loan is not just about the funds; it’s about demonstrating to lenders that you have a viable business idea, sound financial management, and a plan to make your business thrive. By understanding the loan landscape, crafting an impeccable business plan, maintaining good credit, organizing your financial documentation, and delivering a compelling pitch, you enhance your chances of securing the financial backing your startup needs. Remember, each step in this process not only positions your business for loan approval but also sets a strong foundation for its future growth and success.

What documents do I need to apply for a startup loan?

+

To apply for a startup loan, you’ll generally need business and personal tax returns, bank statements, business financial statements, projected financials, and legal documents like business licenses and contracts.

How can I improve my credit score before applying for a business loan?

+

Improving your credit score can involve checking your credit reports for errors, reducing outstanding debt, paying all bills on time, keeping credit card balances low, and avoiding multiple credit applications.

Is collateral required for a business startup loan?

+

Many traditional bank loans require collateral, but there are also unsecured loan options like online lenders or SBA loans that might not require collateral, especially for newer businesses.