5 Smart Ways to Manage Your Study Loan Debt

Managing study loan debt can feel like a daunting task. With the cost of education rising and student loan interest rates fluctuating, many graduates find themselves grappling with substantial financial obligations right out of the gate. However, with strategic planning and smart financial management, you can mitigate the burden of your study loans. Here are five intelligent ways to handle your student loan debt effectively.

1. Create a Comprehensive Budget

Understanding Your Financial Landscape: The first step in managing your student loan debt is to understand where every penny of your income goes. Here’s how to get started:

- Track Your Income: Know your monthly earnings from all sources.

- List Expenses: Categorize your expenses into needs (rent, groceries, utilities) and wants (entertainment, dining out).

- Identify Savings: Where can you cut back? Can you reduce unnecessary expenditures to redirect funds towards loan repayment?

A well-planned budget not only helps you understand your financial situation but also ensures you allocate funds for loan repayment without compromising your quality of life.

💡 Note: A budgeting tool or app can be invaluable for tracking your expenses and keeping you disciplined.

2. Explore Repayment Plans and Loan Forgiveness

Finding the Right Fit: Not all student loans are created equal, and neither are the repayment plans. Here are the types you might consider:

- Standard Repayment: Fixed payments that pay off your loan in 10 years.

- Graduated Repayment: Payments start lower and increase every two years, ideal if you expect your income to rise.

- Income-Driven Repayment (IDR): Payments based on your income, with potential loan forgiveness after 20-25 years.

- Extended Repayment: Lower payments over 25 years, if your loan balance qualifies.

| Repayment Plan | Best For |

|---|---|

| Standard | Minimizing interest paid over time |

| Graduated | Early career with expected income growth |

| Income-Driven | Variable income or financial hardship |

| Extended | Managing large debt over a long period |

📝 Note: Each plan affects interest accumulation and loan forgiveness differently. Reviewing your servicer's options can help you choose the best path forward.

3. Pay More Than The Minimum When Possible

Accelerating Debt Reduction: If your budget allows, paying more than the minimum due each month can drastically reduce the life of your loan. Here’s why:

- Reduced Interest: More of your payment goes toward principal, reducing the interest over time.

- Faster Payoff: You can pay off your loan earlier, freeing up future income for other financial goals.

Consider any extra income, like bonuses or tax refunds, as opportunities to make additional payments. Even small increases can make a big difference over the life of your loan.

4. Refinance Your Student Loans

Lower Interest Rates for Savings: Refinancing your student loans can be a smart move if you can secure a lower interest rate:

- Lower Monthly Payments: With a reduced interest rate, your monthly payments could decrease.

- Interest Savings: Pay less over the life of the loan with a lower rate.

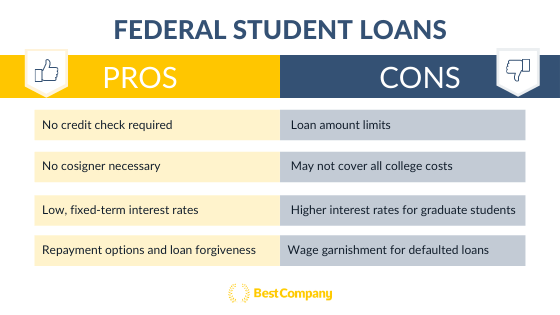

However, refinancing federal loans into private ones means losing federal benefits like income-driven plans and loan forgiveness. It's a trade-off worth considering carefully.

⚠️ Note: Refinancing federal loans into private ones means losing federal benefits like income-driven plans and loan forgiveness.

5. Understand and Utilize Grace Periods

Timing is Everything: Many student loans offer a grace period after you graduate or leave school. Here’s how to leverage it:

- Immediate Payments: If you can afford it, start paying off interest during the grace period to reduce future interest.

- Financial Buffer: Use the grace period to bolster your savings or emergency fund before full repayment begins.

Understanding the ins and outs of your loan's grace period can give you a strategic advantage in managing your debt.

Managing your student loan debt doesn’t have to be an overwhelming ordeal. By implementing these five smart strategies, you can take control of your financial future. Remember, consistency and proactive planning are key to reducing the burden of debt. By budgeting wisely, choosing the right repayment plan, accelerating payments when possible, considering refinancing, and making the most of grace periods, you'll find yourself on a path to financial freedom sooner than you might expect.

These strategies are designed to provide flexibility and control over your debt, aligning with your career trajectory and financial goals. Whether you're aiming to pay off your loans aggressively or seek relief through income-driven plans, the key is to adapt these strategies to your unique situation.

What should I do if I’m struggling to make my loan payments?

+

Contact your loan servicer immediately. They can discuss deferment or forbearance options, or you might qualify for an income-driven repayment plan that adjusts your monthly payments based on your income.

Can I pay my loans faster if I get a good job?

+

Yes, if you have extra income or your salary increases, consider allocating that money towards your loans to reduce the principal faster and save on interest over time.

Is refinancing my student loans always a good idea?

+

Not necessarily. While refinancing can offer lower interest rates and monthly payments, it might not be beneficial if you lose access to federal benefits like loan forgiveness. Evaluate your situation carefully.

What’s the importance of having an emergency fund?

+

An emergency fund provides a safety net for unexpected expenses or income changes, ensuring you can continue loan payments without going into default or needing to rely on forbearance.

Should I pay off my student loans during the grace period?

+

If possible, yes. Paying even just the interest that accrues during the grace period can reduce the total amount of interest you pay over the life of the loan.