Hedge Your Bets: Understanding Finance Hedges

In the ever-evolving world of finance, one term that consistently garners interest among investors is hedging. This sophisticated strategy is designed to minimize risk in an unpredictable market environment, thereby protecting investments from adverse price movements. In this comprehensive guide, we will explore what hedging is, the various types of hedge strategies, and why they are an indispensable tool for financial stability.

What is Hedging?

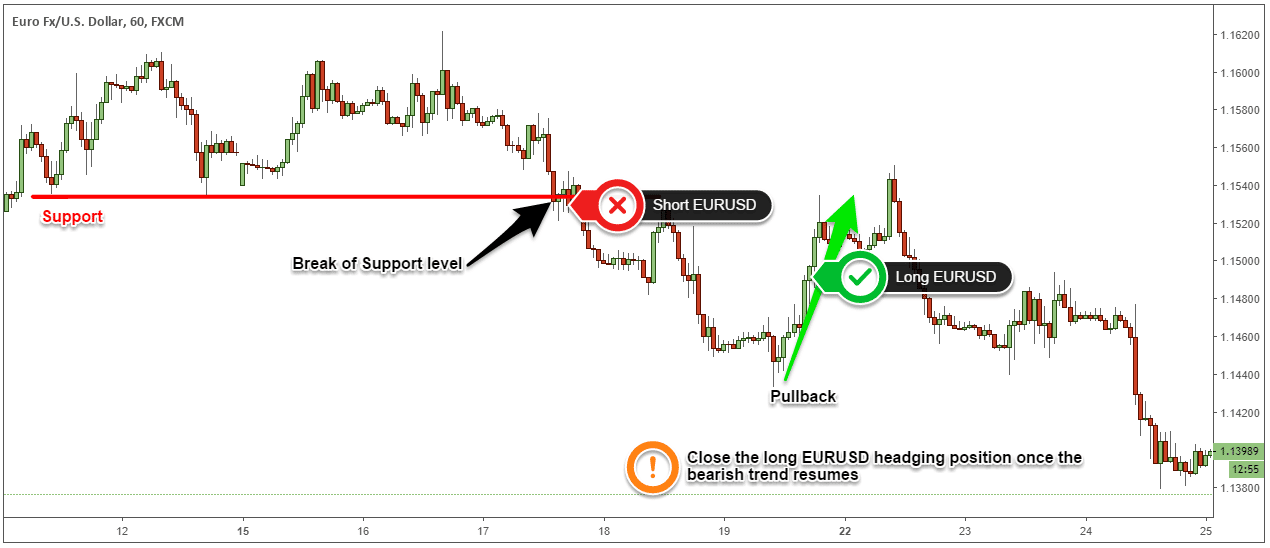

Hedging refers to a risk management strategy used in financial markets where an investor reduces potential losses from fluctuations in asset prices. Essentially, it’s akin to taking out an insurance policy on your investment. The objective isn’t necessarily to make a profit from the hedging strategy but to mitigate losses from price movements that could be detrimental to the investor’s portfolio.

💡 Note: Hedging is not about making money, but about protecting against losses.

Types of Hedging Strategies

Hedging comes in various forms, each tailored to address specific risks:

- Currency Hedging - Protecting against fluctuations in foreign exchange rates.

- Commodity Hedging - Managing risks associated with commodity price changes.

- Stock Hedging - Using options, futures, or other derivatives to hedge against stock price movements.

- Interest Rate Hedging - To protect against interest rate risks, for instance, using swaps or options.

Currency Hedging

For investors with international exposure, currency hedging is vital to manage the risk of fluctuating exchange rates:

- Forward Contracts - Lock in exchange rates for future transactions.

- Currency Futures - Standardized contracts to buy or sell a currency at a set price on a specified date.

- Options - Giving the right, but not the obligation, to exchange currency at a predetermined rate.

🌍 Note: Currency hedging can help international companies protect their profit margins from currency fluctuations.

Commodity Hedging

Commodities like oil, gold, or agricultural products are prone to price volatility. Here are common ways to hedge:

| Instrument | Description |

|---|---|

| Futures | Standardized contracts to buy/sell a commodity at a future date. |

| Options | The right to buy/sell a commodity at a set price. |

| Swaps | Exchanging cash flows from commodity prices for a fixed rate. |

Stock Hedging

Equity hedging involves protecting against the potential downturns in stock prices:

- Put Options - Grant the holder the right to sell shares at a specified price.

- Short Selling - Selling borrowed stock to buy back later at a lower price.

- Index Funds - Investing in an index fund to hedge against broad market movements.

Interest Rate Hedging

Interest rate changes can affect loan payments, bond values, and more. Here’s how one can hedge:

- Interest Rate Swaps - Exchange fixed and variable interest rate payments.

- Interest Rate Caps - A financial derivative that limits the interest rate an entity pays on a floating rate loan.

- Interest Rate Floors - Ensures a minimum interest rate paid on floating rate investments.

📉 Note: Interest rate hedging is particularly crucial for financial institutions and borrowers with large debt portfolios.

Why Hedge?

Hedging has multiple benefits:

- Risk Mitigation - Protect against adverse price movements.

- Stability - Provides predictability in cash flows and profits.

- Investment Opportunity - Allows investors to take calculated risks elsewhere knowing their primary investments are safeguarded.

- Corporate Management - Companies can use hedging to ensure cost certainty and maintain competitive edges in pricing.

In summary, hedging is a strategic approach to protect financial assets from unfavorable market movements. It's an insurance for investors, allowing them to navigate through financial turbulence with confidence. By using various hedging tools like forward contracts, options, futures, and swaps, individuals and corporations alike can ensure their investments are shielded from excessive risk while potentially improving their financial outcomes.

What is the main purpose of hedging in finance?

+

The primary goal of hedging is to manage risk by minimizing the exposure to loss from price movements in an asset or portfolio.

Can hedging guarantee a profit?

+

No, hedging does not guarantee a profit; it’s designed to limit potential losses or manage volatility, not to generate income directly.

Is hedging only for large corporations?

+

While big corporations often engage in sophisticated hedging, individual investors and small businesses can also use basic hedging strategies to protect their investments.

What are some costs associated with hedging?

+

Hedging can involve costs like premiums for options, transaction fees, margin requirements, and the potential opportunity cost of not being fully exposed to market movements.

Related Terms:

- Hedging meaning with example

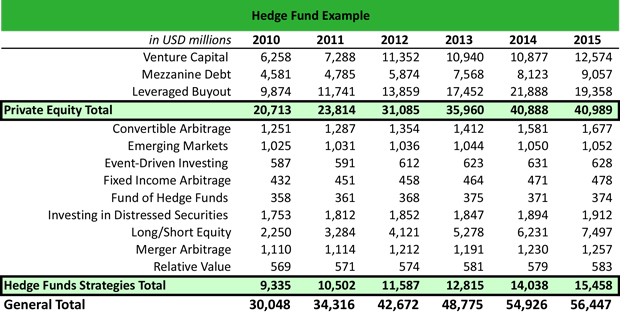

- Hedge fund

- Hedge meaning

- Contoh hedging

- What is hedging in trading

- What is hedging in business