Motorpoint Car Finance: Simple Steps to Your Ideal Car

Buying a car can be one of the most exciting purchases you'll ever make, but it also comes with its fair share of complexity, particularly when it comes to financing. At Motorpoint, understanding and simplifying the car finance process is at the heart of what we do. This guide will walk you through the simple steps to secure car finance, ensuring you get behind the wheel of your ideal car with confidence and ease.

Why Choose Car Finance?

Car finance isn’t just about spreading the cost of your car over time; it’s about leveraging the best financial options to suit your budget and lifestyle. Here’s why car finance can be an advantageous choice:

- Flexibility: Choose from various finance options like hire purchase, personal contract purchase (PCP), or leasing.

- Credit Building: Regularly paying off your car finance can help build or improve your credit score.

- Protection: Certain finance deals include protections like GAP insurance, which can be a significant advantage in case your car is stolen or written off.

- Affordability: Instead of paying a lump sum, you can drive your new car by only paying a manageable monthly amount.

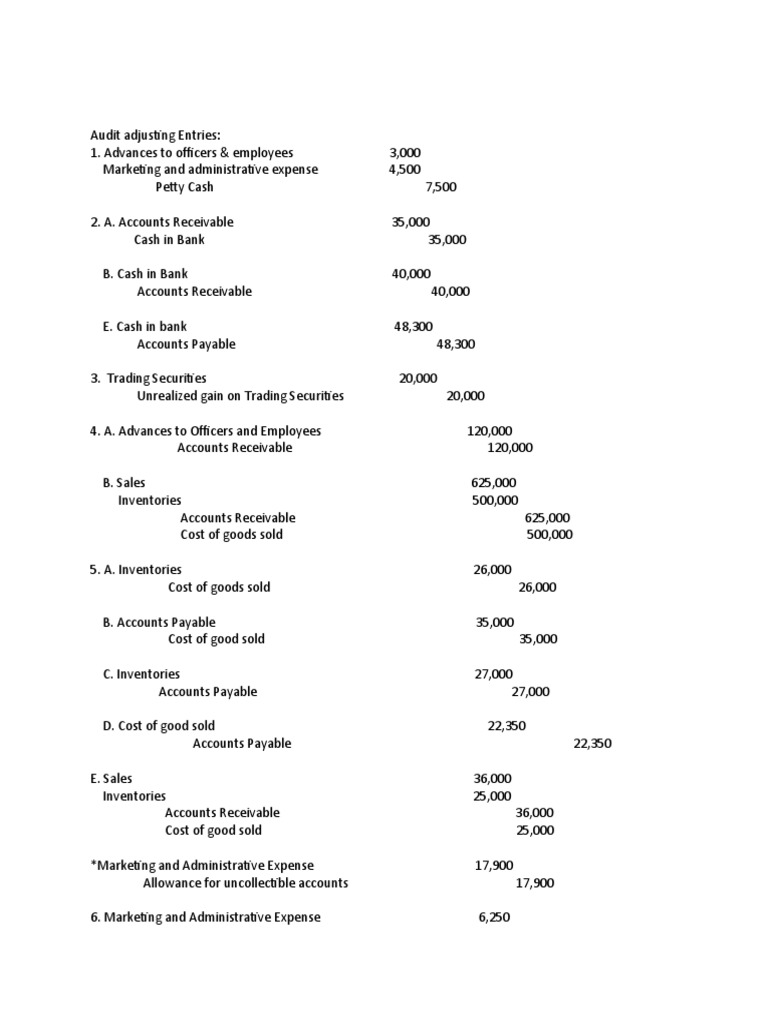

Types of Car Finance at Motorpoint

We offer several finance options to fit every buyer’s needs:

| Finance Option | Benefits |

|---|---|

| Hire Purchase (HP) | Own your car at the end of the term after all payments are made. Often includes a final balloon payment. |

| Personal Contract Purchase (PCP) | Monthly payments with an option at the end to own, part-exchange, or return the car. Flexible for those unsure about long-term commitment. |

| Personal Leasing | Fixed-cost motoring with service and maintenance usually included, perfect for those who want to drive without the long-term commitment to owning the vehicle. |

How to Apply for Car Finance at Motorpoint

Applying for car finance at Motorpoint is straightforward:

- Choose Your Car: Use our online search tool or visit a dealership to find your ideal car.

- Calculate Your Budget: Use our online car finance calculator to estimate payments based on your circumstances.

- Apply Online or In-Store: Fill out an application form with personal details, income, and employment information. Our team can guide you through this process.

- Acceptance: Once approved, you’ll receive finance options to choose from. Select the one that fits your needs best.

- Finalize the Purchase: Sign the finance agreement, choose your extras, and drive away.

🔍 Note: Ensure you have all the necessary documentation ready to speed up the application process, including ID, proof of address, and recent bank statements.

Understanding Credit Scores and Car Finance

Your credit score plays a pivotal role in securing car finance. Here are some key points:

- Score Impacts: A higher credit score often leads to better interest rates and terms. Regularly reviewing and understanding your credit report can benefit you.

- Improving Your Score: Pay bills on time, avoid new credit applications before car shopping, and manage existing credit responsibly.

The Importance of Documentation

When applying for car finance, having the following documents ready will streamline your experience:

- Proof of income (payslips, bank statements, or tax returns if self-employed)

- Proof of address (utility bills or council tax statements)

- Photographic ID (passport or driving license)

- Employment details, especially if you’ve recently changed jobs or work part-time

Wrapping Up

We’ve covered the essentials of obtaining car finance through Motorpoint, outlining the benefits, finance options, application steps, and what you need to know about credit scores. Choosing the right finance option not only makes purchasing a car more manageable but also provides you with flexibility and financial control. By understanding your budget, being prepared with documentation, and knowing your finance options, you’re well on your way to driving off with your ideal car with confidence. Remember, our finance advisors are here to help you through every step, making your journey to car ownership as smooth as possible.

What are the benefits of car finance?

+

Car finance provides affordability, flexibility in repayment terms, credit building opportunities, and potential for added protections like GAP insurance.

How does my credit score affect car finance?

+

A higher credit score can lead to lower interest rates and better finance terms. Reviewing your credit report and managing your score wisely can improve your finance options.

Can I apply for car finance online?

+

Yes, Motorpoint offers an online application process for car finance, making it convenient to start your application from home.