5 Smart Financing Options for Your Caravan Adventure

Embarking on a caravan adventure promises unforgettable experiences, but it also comes with its fair share of financial considerations. Whether you're a seasoned traveler or a novice looking to hit the road, understanding your financing options can make all the difference in your journey. From innovative loans to creative saving methods, let's dive into five smart financing options tailored for your caravan lifestyle.

Option 1: Caravan Loans

Getting a loan specifically tailored for caravans can be a straightforward way to finance your mobile lifestyle. Here’s what you need to know:

- Specialized Loans: Look for banks or financial institutions that offer loans with competitive interest rates specifically for purchasing caravans or RVs.

- Pre-Approval: Consider getting pre-approved for a loan to understand how much you can borrow without affecting your credit score.

- Terms: Pay attention to repayment terms. Longer terms might lower monthly payments but increase overall interest costs.

💡 Note: Always compare interest rates, terms, and conditions from multiple lenders to secure the best deal.

Option 2: Personal Savings

The time-tested method of saving for your adventure can also be the most financially savvy. Here’s how to make it work:

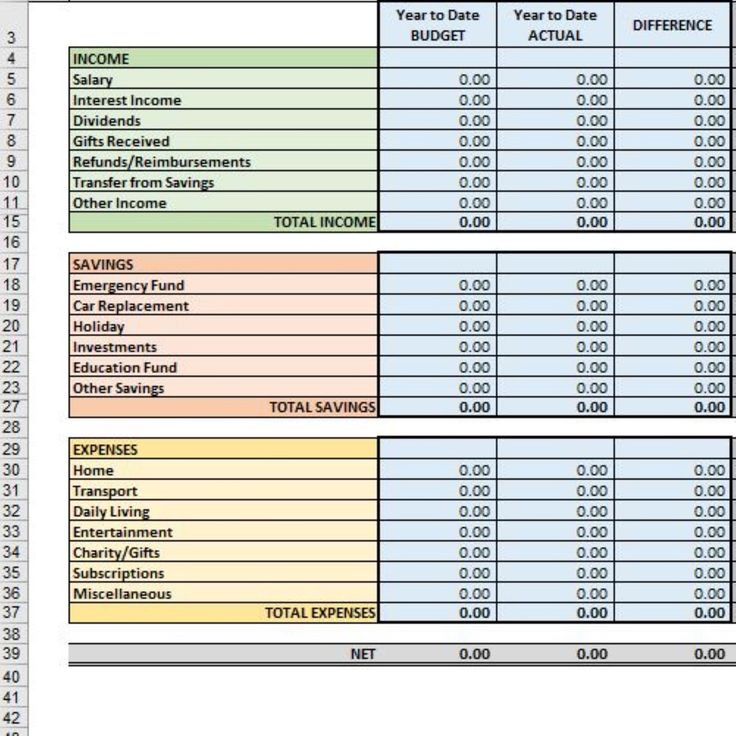

- Create a Dedicated Savings Account: Set up an account where you save specifically for your caravan, allowing you to earn a small interest on your savings.

- Automate Savings: Set up automatic transfers to this account each time you get paid, ensuring you save without thinking about it.

- Reduce Expenses: Look for areas where you can cut back on unnecessary spending, redirecting that money into your caravan fund.

Option 3: Peer-to-Peer Lending

Peer-to-peer lending platforms offer an alternative to traditional loans:

- Community Funding: Borrow from individuals rather than banks. Interest rates can be competitive, and the process might be less stringent.

- Online Platforms: Utilize platforms that connect borrowers with investors, often providing quicker funding options.

- Flexible Terms: Sometimes, you can negotiate terms directly with lenders, offering more flexibility than standard bank loans.

Option 4: Rent-to-Own

Renting with the option to own could be ideal if you’re not ready to commit fully:

- Try Before You Buy: This option allows you to experience caravan life without the initial investment, with part of your rent payments counting towards ownership.

- Equity Building: As you pay rent, you might also build equity in the caravan, reducing the amount you finance later.

- Flexibility: This arrangement can be particularly beneficial if you’re unsure how long you’ll need a caravan or if your lifestyle might change.

Option 5: Share Costs with Others

Traveling with others can significantly reduce individual costs:

- Co-Ownership: Consider buying the caravan with friends or family to share the financial load and the joy of the journey.

- Carpooling: Split fuel, maintenance, and camping fees. More people also mean more hands to set up camp!

- Financial Agreement: Ensure there’s a clear understanding or contract about the financial responsibilities of all involved parties.

Embarking on a caravan adventure can seem daunting from a financial perspective, but with the right strategy, it can be both feasible and rewarding. Each option has its merits, whether you're looking for traditional financing, innovative lending methods, or a more communal approach. The key is to choose a path that aligns with your financial health, your travel aspirations, and the level of risk you're comfortable with. Remember, the road to your next great adventure isn't just about the journey but also about making smart financial decisions that enhance your overall experience.

What are the benefits of caravan loans over personal loans?

+

Caravan loans often come with lower interest rates than personal loans because they are secured against the caravan itself. This reduces the lender’s risk, which can lead to more favorable terms for the borrower.

How can I save for a caravan adventure?

+

To save effectively, start by setting a clear savings goal, automate your savings, reduce unnecessary expenses, and perhaps even consider taking on side gigs to boost your savings.

Is peer-to-peer lending safe for financing a caravan?

+

Yes, peer-to-peer lending can be safe if you use reputable platforms. Always research the platform, understand their policies, and consider the terms carefully before committing.