Master Your Money: Create a Budget Plan

Embarking on the journey of financial mastery begins with a fundamental step that many people often overlook or postpone: creating a budget plan. Budgeting is not about restricting your spending but rather about gaining control over your financial life, ensuring you're spending in alignment with your values and goals. Whether you're saving for a big purchase, looking to pay down debt, or simply wanting to understand where your money goes, a well-crafted budget can be your roadmap to financial success.

Why Create a Budget?

Before delving into the nuts and bolts of creating a budget, let’s explore why you need one:

- Visibility: A budget provides a clear picture of your income and expenses.

- Control: It gives you the reins to make conscious spending decisions.

- Goal Setting: Helps in setting and achieving financial goals like saving for retirement, buying a home, or funding education.

- Debt Management: Assists in creating a plan to tackle debts systematically.

- Emergency Fund: Ensures you set aside money for unexpected expenses.

Steps to Creating Your Budget Plan

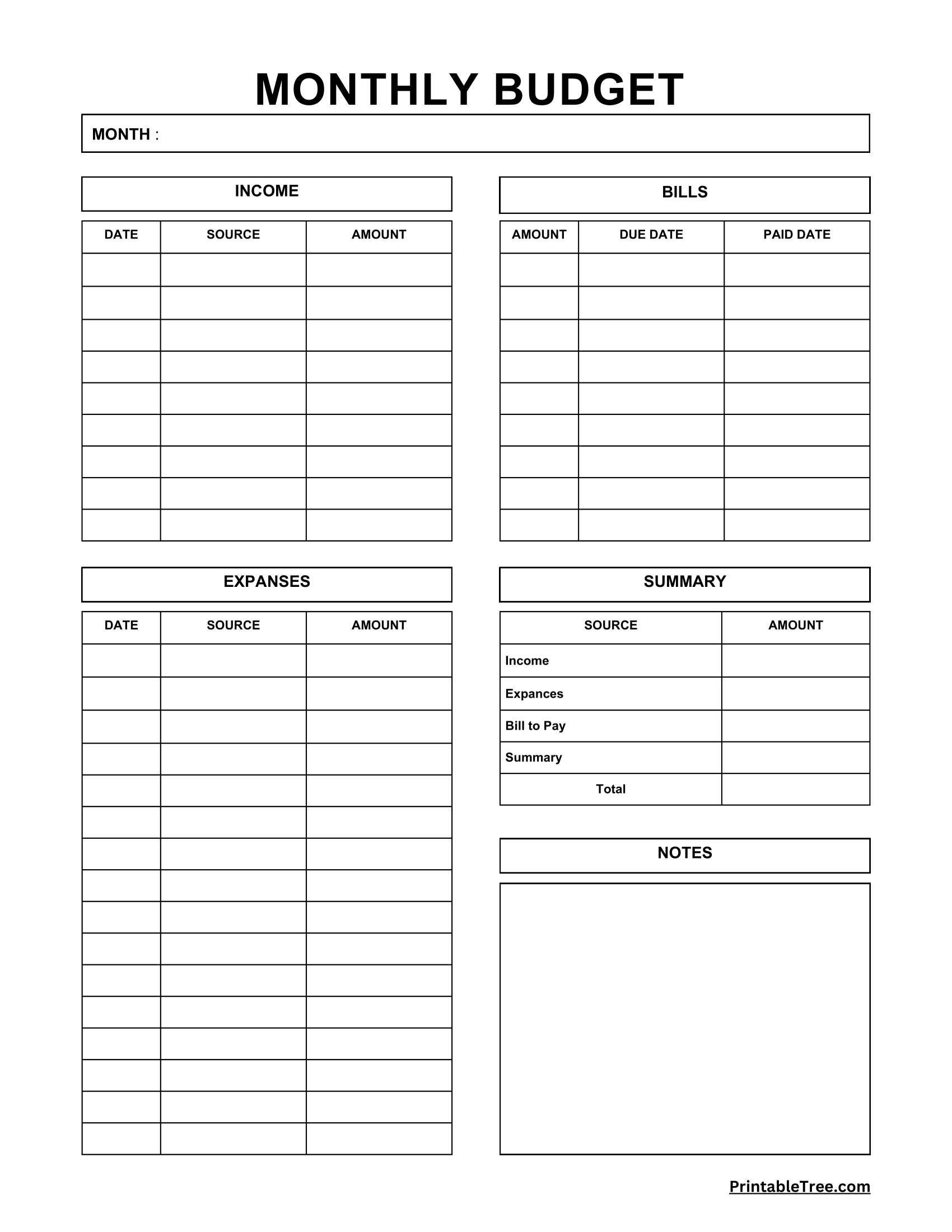

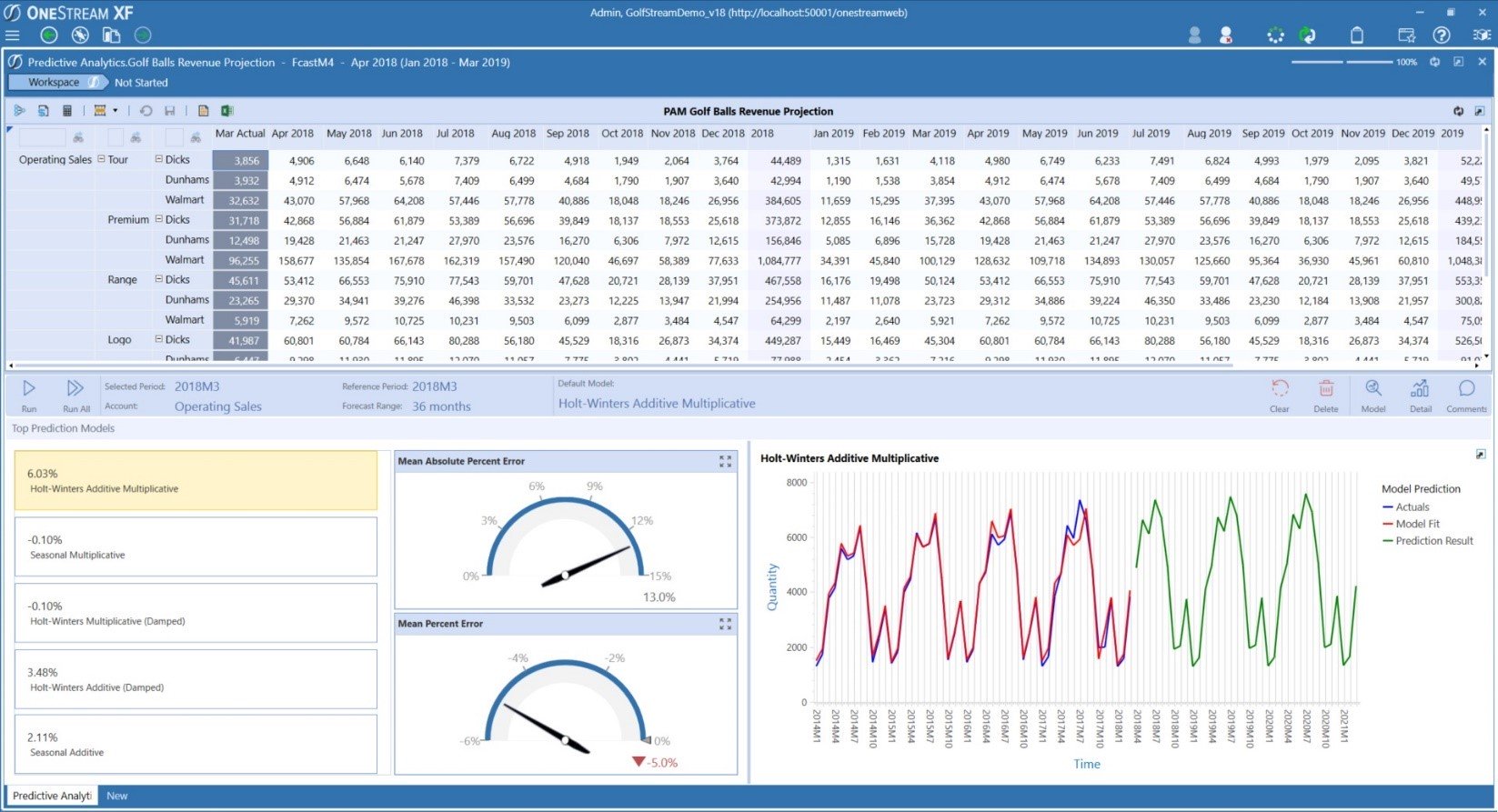

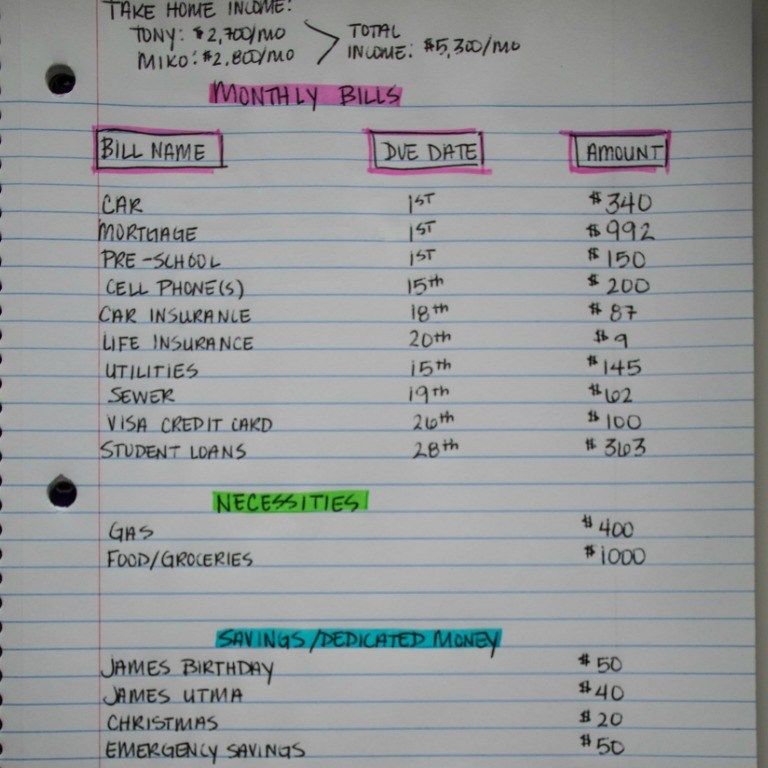

1. Calculate Your Total Income

Start by determining your total monthly income. Include:

- Your salary or wages after taxes (net income).

- Freelance or part-time work.

- Investment income.

- Any other regular or seasonal income.

If your income varies, use an average over several months to get a reasonable estimate.

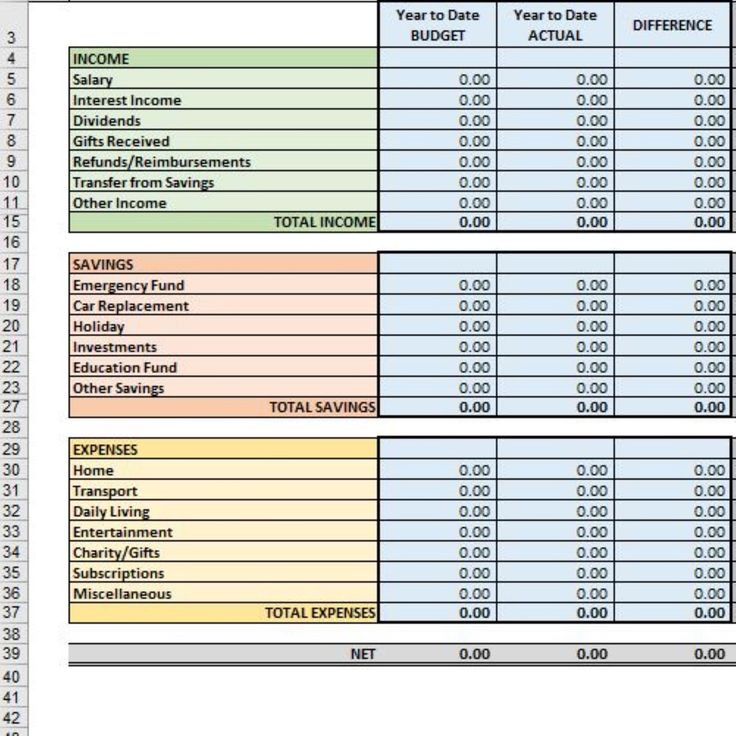

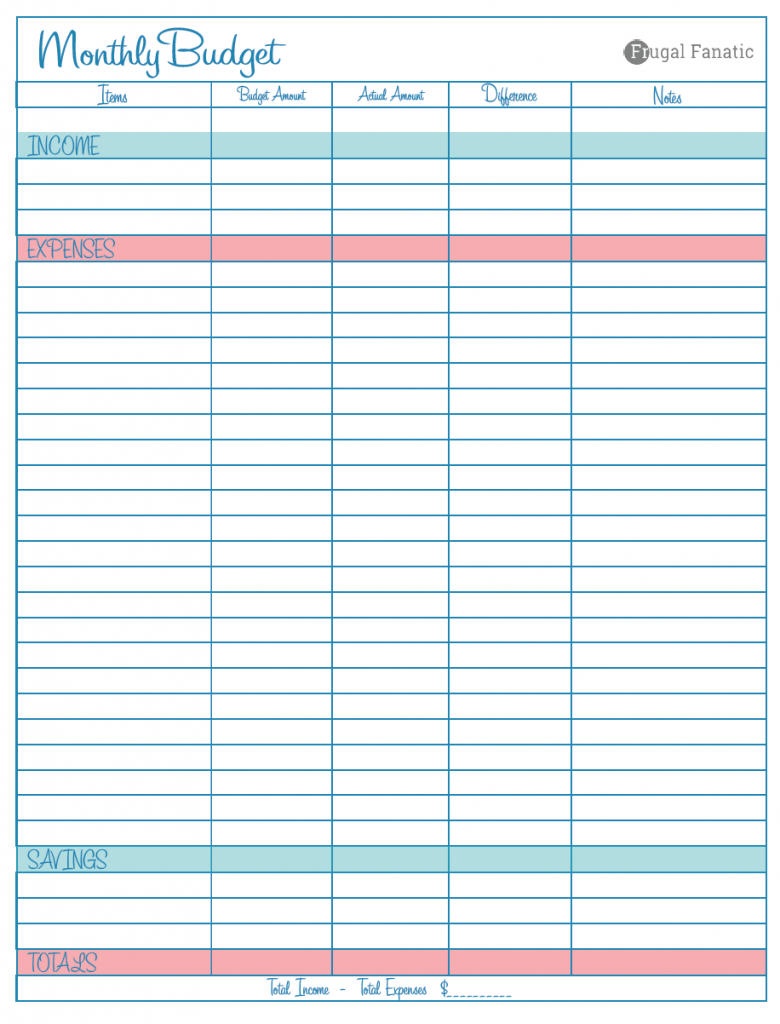

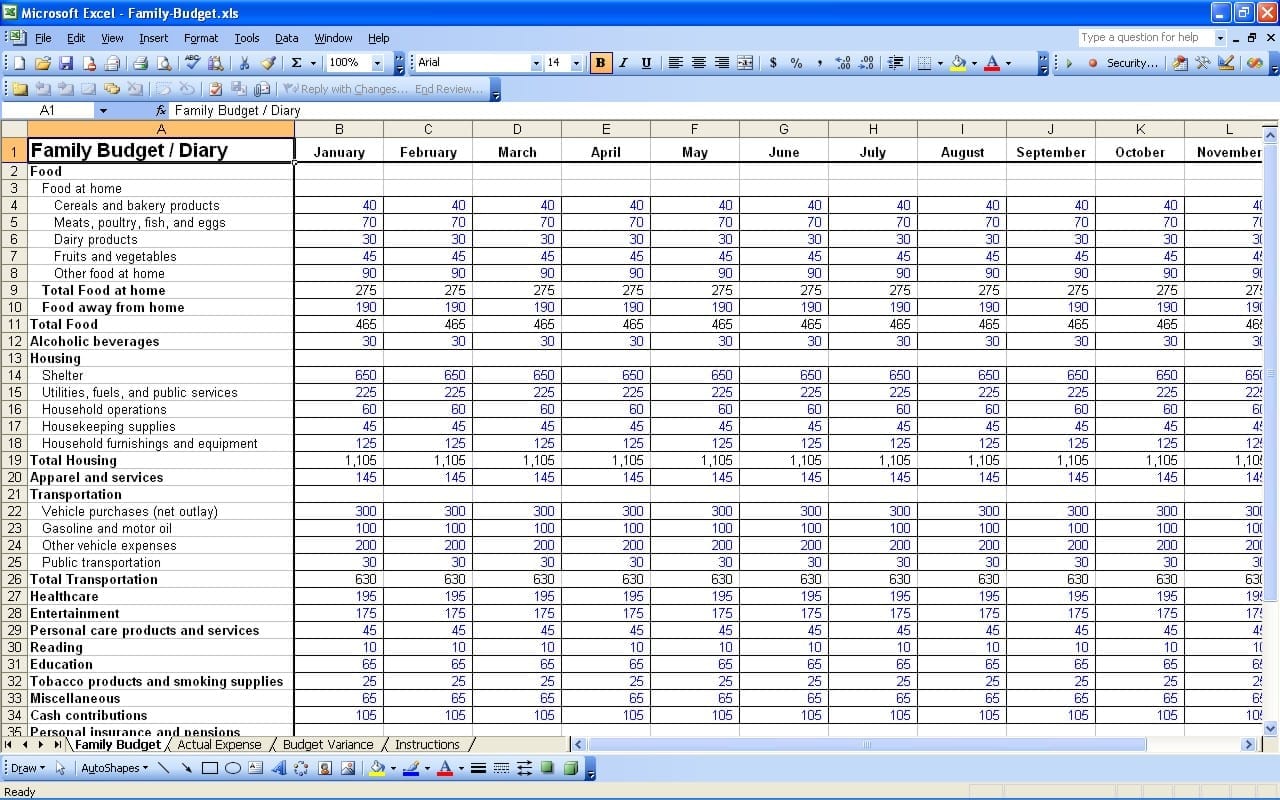

2. List All Your Expenses

Categorize your expenses into:

- Fixed Expenses: These are regular and typically unchanging costs like rent or mortgage, utilities, insurance, and loan payments.

- Variable Expenses: These can fluctuate, like groceries, entertainment, transportation, and clothing.

- Periodic Expenses: Expenses that occur infrequently but are predictable, such as annual subscriptions or car maintenance.

3. Subtract Expenses from Income

Now, subtract your total expenses from your total income. This figure is your disposable income or the amount you can either save or use for discretionary spending. Here’s a simple equation:

| Total Monthly Income | - | Total Monthly Expenses | = | Disposable Income |

|---|

🌟 Note: If your expenses exceed your income, you're in a deficit, which requires either increasing your income or cutting expenses.

4. Set Financial Goals

What do you want your money to achieve? Goals could include:

- Emergency savings fund.

- Paying off high-interest debt.

- Saving for a major purchase or vacation.

- Retirement planning.

- Investing for future growth.

5. Allocate Funds to Goals

Using the disposable income, decide how much goes towards each goal. For example:

- 10% towards retirement.

- 20% towards emergency fund.

- 30% for discretionary spending.

- Remaining for debt repayment or other savings.

6. Monitor and Adjust

Budgeting is dynamic. You need to:

- Track your actual spending against your budget.

- Adjust categories as life circumstances change.

- Revisit and potentially revise your financial goals.

Remember, the goal of a budget is not to live in a financial straitjacket but to create freedom through understanding and managing your money.

How often should I update my budget?

+

At least once a month or whenever there's a significant change in your financial situation.

What if I have irregular income?

+

Use an average income over several months and create an income buffer in your budget to account for leaner periods.

Can a budget help me with debt reduction?

+

Absolutely, by allocating funds specifically for debt repayment and adjusting your spending, you can prioritize debt payoff more effectively.

In wrapping up, creating a budget plan is like drawing a financial blueprint for your life. It guides you towards achieving your financial goals, from saving for the future to paying down debts, while also enjoying the present responsibly. The key is not just in the creation but in the commitment to monitor and adjust your budget regularly. With time and persistence, this practice will not only give you peace of mind but also the confidence to master your money and, ultimately, your life.