NYSE Inc: Unraveling the Stock Market Giant

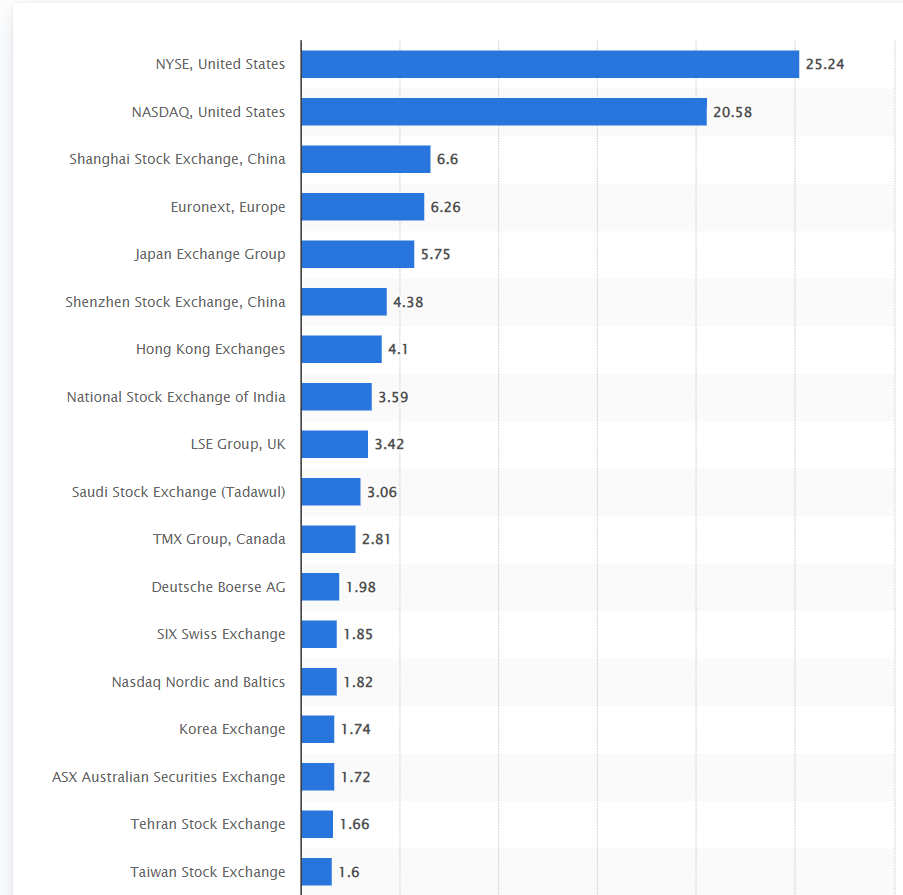

In the world of finance and investment, few institutions loom as large as the New York Stock Exchange (NYSE). For more than two centuries, the NYSE has been at the forefront of capitalism, witnessing the rise and fall of countless corporations, economic booms, and financial crises. Its reputation as the world's premier venue for buying and selling stocks makes understanding its inner workings crucial for investors, analysts, and curious minds alike. In this comprehensive exploration, we will unravel the NYSE, delve into its history, structure, trading mechanisms, influence, and the technological advancements shaping its future.

The Birth and Evolution of NYSE

Originating in 1792 when 24 prominent New York City merchants and stockbrokers signed the Buttonwood Agreement, the NYSE has evolved from an informal gathering place to the symbol of American financial prowess. The journey from trading under a Buttonwood tree to an advanced, electronic trading platform reflects not only the growth of the market but also the transformation of global finance.

Organizational Structure and Governance

The NYSE operates as a for-profit corporation under the umbrella of Intercontinental Exchange (ICE) since 2013. Here’s how its structure looks:

- Management: A blend of financial executives, who focus on the strategic direction, technology integration, and regulatory compliance.

- Board of Directors: Oversees the strategic decisions, governance, and risk management, ensuring the exchange adheres to its mission while adapting to changes.

- Regulation: The Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) oversee the NYSE’s operations to maintain fair trading practices.

Trading at the NYSE

The NYSE’s trading floor, famously located at Wall Street, stands as a beacon of tradition amidst the digital era. However, the nature of trading has significantly shifted:

- Floor Trading: Despite the decline in human-operated trading, the physical exchange still exists, symbolizing the human touch in financial markets.

- Electronic Trading: The vast majority of transactions occur electronically, driven by speed, efficiency, and global accessibility. Designated Market Makers (DMMs) and Supplemental Liquidity Providers (SLPs) play crucial roles in maintaining liquidity.

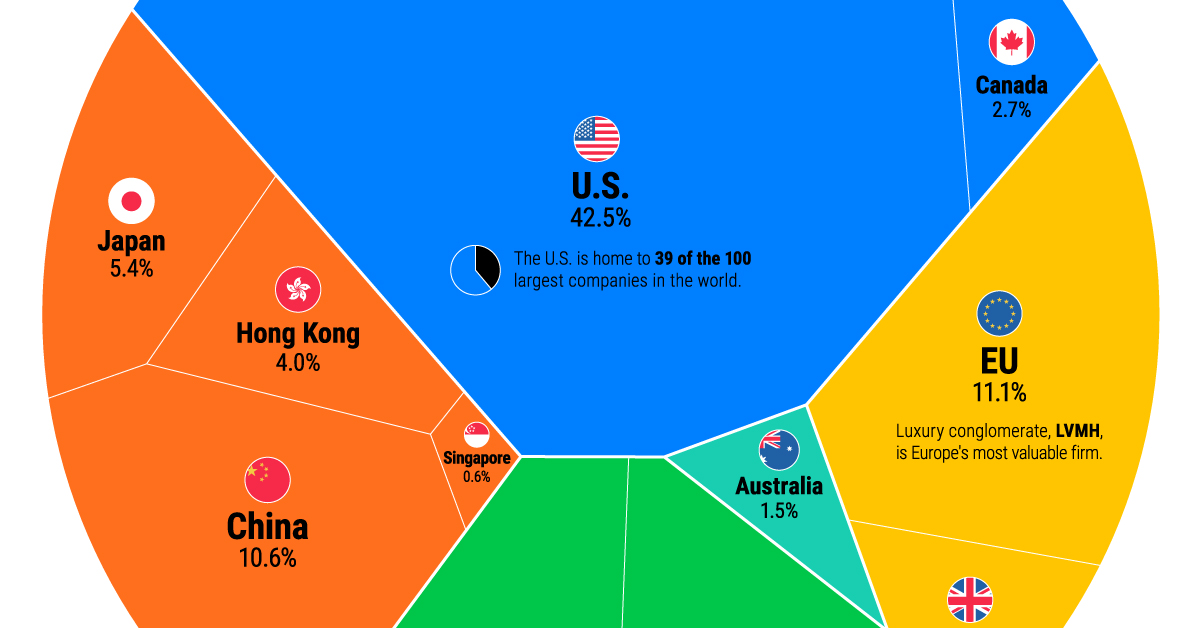

NYSE’s Role in the Global Economy

The NYSE’s influence transcends borders, functioning as a bellwether for the global economy. Its role includes:

- Price Discovery: Setting benchmark prices for stocks, which are used worldwide to gauge company value and market sentiment.

- Liquidity Provision: By ensuring there are enough buyers and sellers, the NYSE facilitates trades with minimal impact on price.

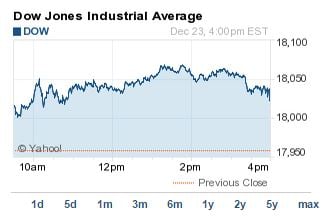

- Economic Indicator: Movements in the NYSE indices like the Dow Jones Industrial Average (DJIA) and S&P 500 offer insights into the health of the economy.

Key Players on the NYSE

Who are the actors in this vast financial theater?

- Investors: From individual investors to hedge funds, they buy and sell shares with hopes of capital gains or dividends.

- Brokers: Act as intermediaries, executing trades on behalf of clients.

- Market Makers: Entities or individuals that continuously quote buy and sell prices for securities to ensure market liquidity.

- Companies: Corporations that list their stocks, seeking capital for growth, innovation, or acquisitions.

Trading Mechanisms and Processes

The NYSE employs sophisticated systems to match buyers with sellers:

- Auctions: The iconic opening and closing auctions set the tone for trading sessions.

- Continuous Trading: Orders are matched in real-time through the NYSE’s trading platforms like the NYSE Integrated Trading System.

- Dark Pools: Off-exchange trading venues offer anonymity and reduced market impact for large trades.

Technological Advancements and the Future

Technology has transformed how trading is conducted at the NYSE:

- High-Frequency Trading (HFT): Uses algorithms to execute trades at microseconds, capturing fleeting opportunities for profit.

- AI and Machine Learning: Powering predictive analytics, risk management, and personalized investor experiences.

- Blockchain and Distributed Ledger Technology: Potential for secure, transparent, and instantaneous trade settlements.

The future of the NYSE will likely be marked by:

- Decentralization: With blockchain, the need for centralized exchanges might diminish.

- Personalization: Custom trading experiences tailored to individual investor preferences.

- Environmental, Social, and Governance (ESG) Focus: Integrating sustainability into investment strategies and NYSE operations.

🌟 Note: While technology promises to streamline and democratize trading, it also brings challenges like market manipulation and cybersecurity risks.

Throughout its history, the NYSE has navigated through economic upheavals, technological revolutions, and regulatory shifts. As we look back at its storied past and gaze into the future, one thing remains clear: the NYSE's adaptability and resilience are key to its enduring relevance. With a commitment to transparency, fairness, and efficiency, the NYSE continues to be the epicenter where capital meets innovation, shaping not just markets, but the future of global economics.

What is the significance of the NYSE’s opening bell?

+

The opening bell ceremony at the NYSE signals the start of the trading day, symbolizing a fresh opportunity for trading activity. It’s not just a tradition; it also represents the official opening of the market, setting initial stock prices through an auction process.

How does the NYSE impact the economy?

+

The NYSE serves as a barometer for the economy by setting benchmark prices for stocks. These prices influence investment decisions, corporate strategies, and economic indicators like the DJIA and S&P 500, affecting market sentiment globally.

What role do Designated Market Makers (DMMs) play at the NYSE?

+

DMMs are responsible for maintaining fair and orderly markets for their assigned securities. They ensure that there’s enough liquidity in the market, manage the opening and closing auctions, and step in during volatile conditions to stabilize the market.