Unlock Yamaha Finance: Ride Smarter, Not Harder

Embarking on the journey of purchasing your dream Yamaha vehicle is an exciting endeavor. However, financing such an investment requires a strategic approach to ensure you're not only enjoying the ride but also managing your finances smartly. Yamaha finance offers a range of solutions tailored to make this process smoother, providing options that cater to diverse financial situations. In this comprehensive guide, we'll explore the intricacies of Yamaha finance, offering insights into how you can ride smarter, not harder.

Understanding Yamaha Financing Options

Yamaha understands that each rider has unique needs and financial circumstances. To address these, they offer several financing programs:

- Standard Financing: Fixed-rate loans with predictable monthly payments.

- Low APR Financing: Interest rates as low as 1.99% APR for qualifying models and buyers.

- Payment Deferral: Deferred payments for up to 90 days after purchase, giving you breathing room to organize finances.

- Customized Lease Programs: Ideal for those looking to upgrade often without a significant down payment.

- Promotional Offers: Special financing rates or terms linked to certain models, promotions, or events.

| Financing Type | Key Features | Best For |

|---|---|---|

| Standard Financing | Fixed rates, predictable payments | Consistency seekers |

| Low APR Financing | Lower interest rates | Buyers with excellent credit |

| Payment Deferral | Up to 90 days to start payments | Those needing initial financial flexibility |

| Customized Lease | Low or no down payment, lease term options | Frequent upgraders |

| Promotional Offers | Varied terms, event-specific | Opportunity seekers |

⚠️ Note: Always review the terms and conditions of any financing offer. Understand the total cost of borrowing, including interest rates and any additional fees.

Key Steps to Secure Yamaha Finance

To ensure a smooth financing experience, follow these key steps:

- Pre-Approval: Begin by getting pre-approved to understand your borrowing capacity.

- Assess Your Credit Score: Knowing your credit standing helps in securing favorable rates.

- Compare Lenders: Don’t settle for the first offer; explore what different lenders provide.

- Negotiate Terms: Once you’ve chosen a lender, negotiate terms, especially the interest rate.

- Finalize Documentation: Have all necessary documents ready to expedite the process.

💡 Note: Pre-approval not only gives you peace of mind but also positions you as a serious buyer, potentially improving your bargaining power when negotiating the vehicle purchase.

Tips for Effective Financial Management

After securing your finance, managing your money smartly is crucial for a trouble-free ownership experience:

- Understand Your Loan Agreement: Be familiar with every aspect, from interest rates to any potential fees.

- Create a Payment Schedule: Use automatic payments or reminders to avoid late payments.

- Save for Maintenance: Regular maintenance extends your vehicle’s life and can prevent costly repairs.

- Consider Making Extra Payments: If possible, pay more than the minimum to reduce the principal faster.

- Monitor Market Changes: Interest rates and promotions can change; staying informed could lead to refinancing opportunities.

Beyond Finance: Owning a Yamaha Experience

Financing your Yamaha is just the beginning of your journey with this iconic brand. Here’s how to make the most of your ownership:

- Explore Yamaha Events: Attend rallies, rides, or exclusive events to connect with other enthusiasts.

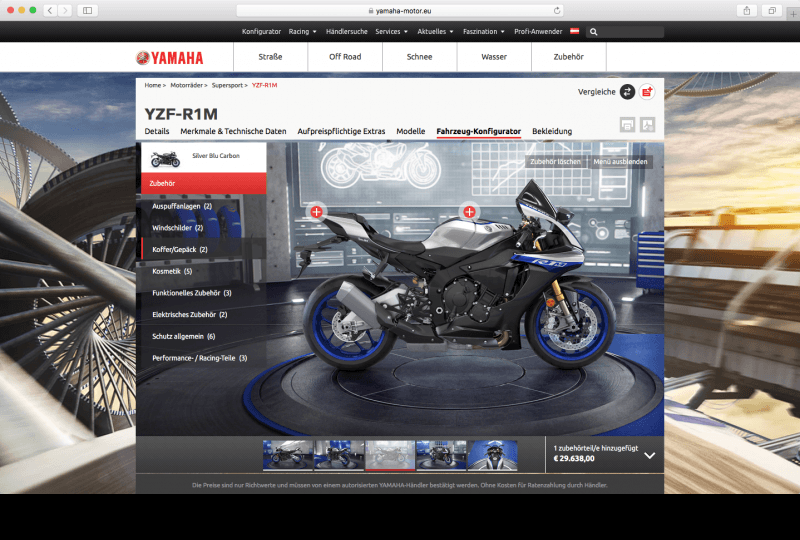

- Customization: Personalize your Yamaha with aftermarket parts for an experience as unique as you are.

- Yamaha Owner’s Club: Join or form a club for shared experiences, maintenance tips, and group activities.

- Expand Skills: Use your Yamaha to learn or perfect new riding skills through courses or on your own.

🚴♂️ Note: Engaging in the community not only enhances your riding experience but also provides support for maintenance, learning, and fun events.

In summary, financing your Yamaha vehicle involves more than just securing a loan. It's about understanding the financial landscape, making informed choices, and managing your financial commitments efficiently. With the right approach, you can enjoy the ride without the financial strain, making your journey on a Yamaha a joyful and rewarding experience.

What Credit Score Do I Need for Yamaha Financing?

+

Yamaha, like many financial institutions, considers a variety of factors for loan approval, but a good credit score generally ranges between 670 to 850, though there might be special programs for lower credit scores.

Can I Get a Yamaha Motorcycle Without Any Down Payment?

+

It’s possible through certain lease programs or zero down payment promotions, but this typically results in higher monthly payments and potentially higher interest rates.

How Long Does It Take to Get Financing?

+

If you’re pre-approved, the process can be expedited, taking anywhere from a few hours to a couple of days. For non-pre-approved cases, it might extend to a week or more depending on document processing and credit checks.

Related Terms:

- Yamaha Finance phone number

- Yamaha Finance login

- Yamaha login

- Yamaha Finance address

- Yamaha configurator

- Yamaha global