Loft Conversion Finance: Your Guide to Easy Funding

Transforming a cramped attic into a livable space, known as a loft conversion, can add significant value and space to your home. However, like any home improvement project, financing a loft conversion can be a daunting task. Understanding the financial implications and finding the right funding solution can make the difference between a dream home upgrade and a financial headache. This comprehensive guide will walk you through various funding options, the pros and cons of each, and crucial steps to ensure your loft conversion is both a structural and financial success.

Understanding the Costs

Before diving into financing, it's pivotal to understand what you're likely to spend:

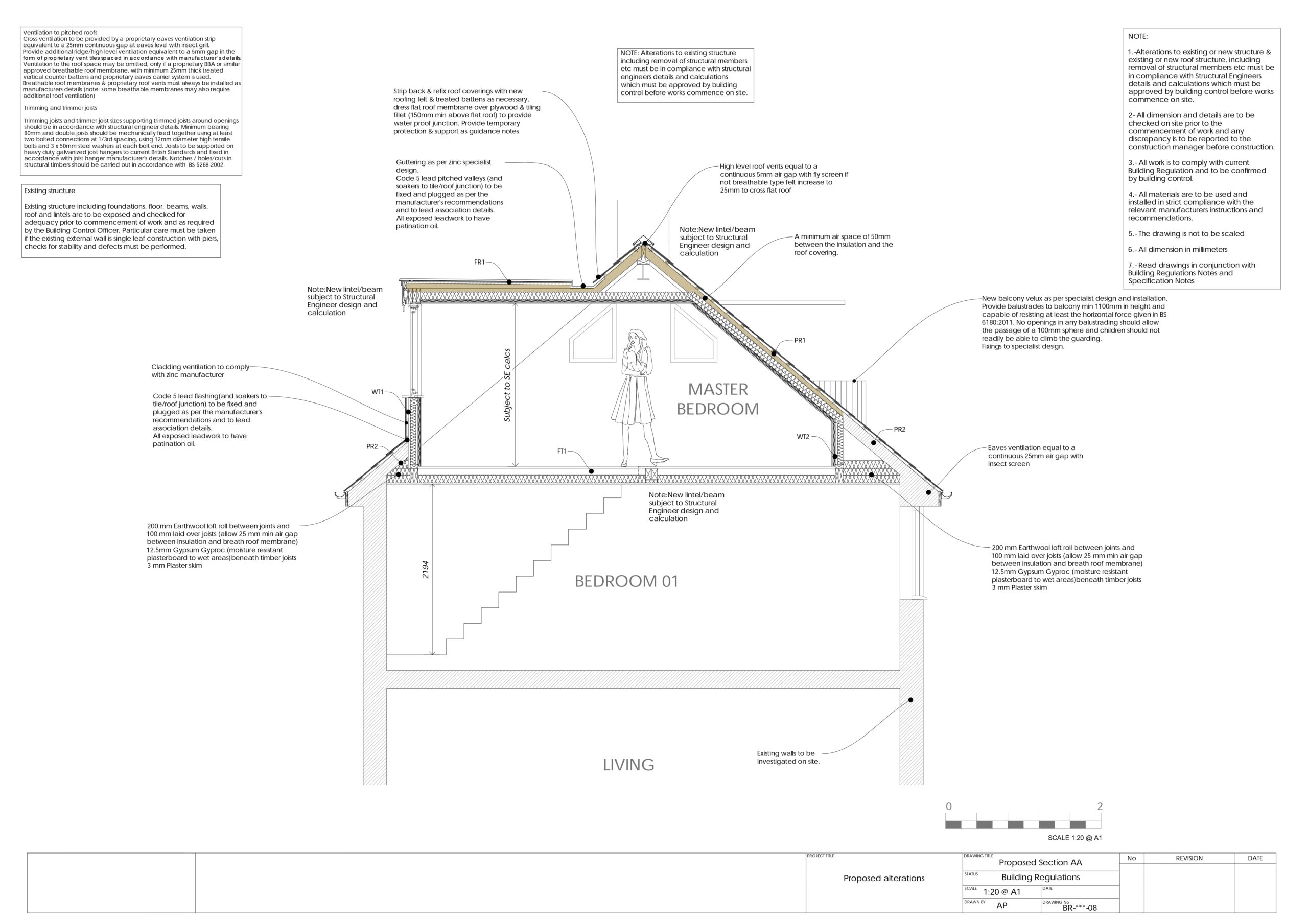

- Planning Permissions: While not always required, planning permission can incur costs, especially if you need to submit detailed plans or hire a professional.

- Architectural Plans: Detailed drawings and structural engineering are essential and will come with a fee.

- Building Materials: The cost varies based on the quality and type of materials used.

- Labor: Skilled labor, including carpenters, electricians, and roofers, forms a significant portion of the expense.

- Unexpected Costs: Always have a contingency fund for unforeseen issues like structural problems or changes in design.

Funding Options for Your Loft Conversion

1. Home Equity Loan

A home equity loan allows you to borrow against the equity in your home, which is the property’s current market value minus any outstanding mortgage balance. Here’s why it might be a good choice:

- Lower Interest Rates: Typically, these loans come with lower interest rates because they are secured by your home.

- Fixed Payments: You know exactly what you’ll owe each month, making budgeting straightforward.

- Potential Tax Benefits: In some cases, interest paid on home equity loans for home improvements can be tax-deductible.

🔑 Note: Be cautious about over-borrowing, as your home acts as collateral. Failure to repay could risk losing your home.

2. Home Improvement Loans

These are unsecured loans specifically for home improvement projects like loft conversions:

- Don’t Risk Your Home: Since these are unsecured, your home isn’t at risk.

- Quick Access to Funds: Approval can be faster than for equity-based loans.

- Flexible Use: Funds can be used for any home-related expense, including loft conversions.

However, they might come with higher interest rates due to the unsecured nature.

3. Personal Loans

A personal loan can be an option for smaller conversions or if you need funds quickly:

- Fixed Interest Rates: You know exactly what you’ll be paying each month.

- Unsecured: No need to put your home at risk.

Remember, personal loans might come with higher interest rates compared to home equity loans.

4. Remortgaging

This involves changing your mortgage or taking out a new one to release equity:

- Access Large Amounts: This can provide significant funds, especially if your property value has increased.

- Consolidation: You can potentially consolidate your existing mortgage into a better deal.

However, remortgaging involves closing costs and could mean longer repayment terms.

5. Savings and Investments

Using your own savings or investments can eliminate the need for borrowing:

- No Interest Payments: Avoid paying interest, saving money in the long run.

- Control: Full control over your finances without the burden of additional debt.

⚠️ Note: Ensure this doesn’t impact your financial security or emergency funds.

Additional Funding Tips

- Shop Around: Compare rates and terms from different lenders to find the best deal.

- Home Improvement Grants: Check for any available government grants, especially if your project involves energy efficiency improvements.

- Family or Friends: Borrowing from loved ones can sometimes be an option, but ensure agreements are formal to avoid future disputes.

- Overdrafts and Credit Cards: While not advisable as primary funding, they can cover unexpected costs or shortfalls.

Managing the Conversion Process

To ensure your loft conversion doesn't turn into a financial disaster:

- Get Multiple Quotes: Always compare contractors to ensure you're getting the best price for quality work.

- Hire a Reputable Builder: A good contractor can save money in the long run by avoiding costly mistakes.

- Keep Track of Expenses: Use software or a notebook to monitor all costs associated with the project.

- Plan for Contingencies: Have a buffer fund, typically around 10% to 15% of the total project cost, to cover unexpected expenses.

Here is a quick comparison of different funding options:

| Funding Option | Pros | Cons |

|---|---|---|

| Home Equity Loan | Low interest, tax benefits | Risk of losing home if defaulted |

| Home Improvement Loan | No risk to home, quick approval | Higher interest rates |

| Personal Loan | Unsecured, fixed rates | Higher interest than secured loans |

| Remortgaging | Access large sums, potential consolidation | Longer repayment terms, costs |

| Savings/Investments | No debt, control over finances | Depleting emergency funds |

As we've explored, funding a loft conversion can be approached in various ways. Each method has its merits and drawbacks, tailored to different financial situations and risk tolerance. By understanding your costs, exploring funding options thoroughly, and managing your project diligently, your loft conversion can transform not only your home but also your lifestyle without breaking the bank.

What is a loft conversion?

+

A loft conversion is the process of transforming an unused attic space into a livable or functional room, such as a bedroom, office, or playroom. It involves structural alterations and often requires planning permission and professional work from builders and designers.

How much does a loft conversion typically cost?

+

The costs can vary widely, but expect to pay anywhere from 30,000 to 100,000 or more. The final price depends on factors like the size of the loft, the type of conversion (e.g., dormer, hip-to-gable), location, quality of materials, and complexity of the project.

Do I need planning permission for a loft conversion?

+

Not always. Many loft conversions can be done under Permitted Development rights in the UK, which means no planning permission is needed if you stay within certain limits. However, if you’re making significant changes or expanding the volume of the roof space, you’ll likely need to apply for planning permission.