Used Vehicle Finance Rates: Save More Today

Discovering the best used vehicle finance rates can make a huge difference when you're looking to save money on your next vehicle purchase. Used vehicle finance rates are often overlooked when car shopping, but understanding how they work and where to find the best rates can help you reduce your monthly payments, shorten loan terms, or secure better deals.

Understanding Finance Rates for Used Vehicles

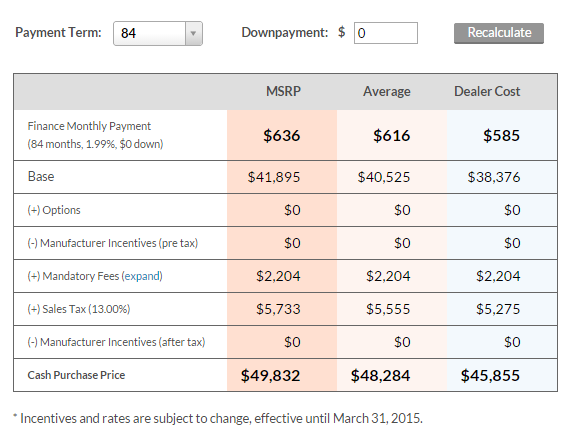

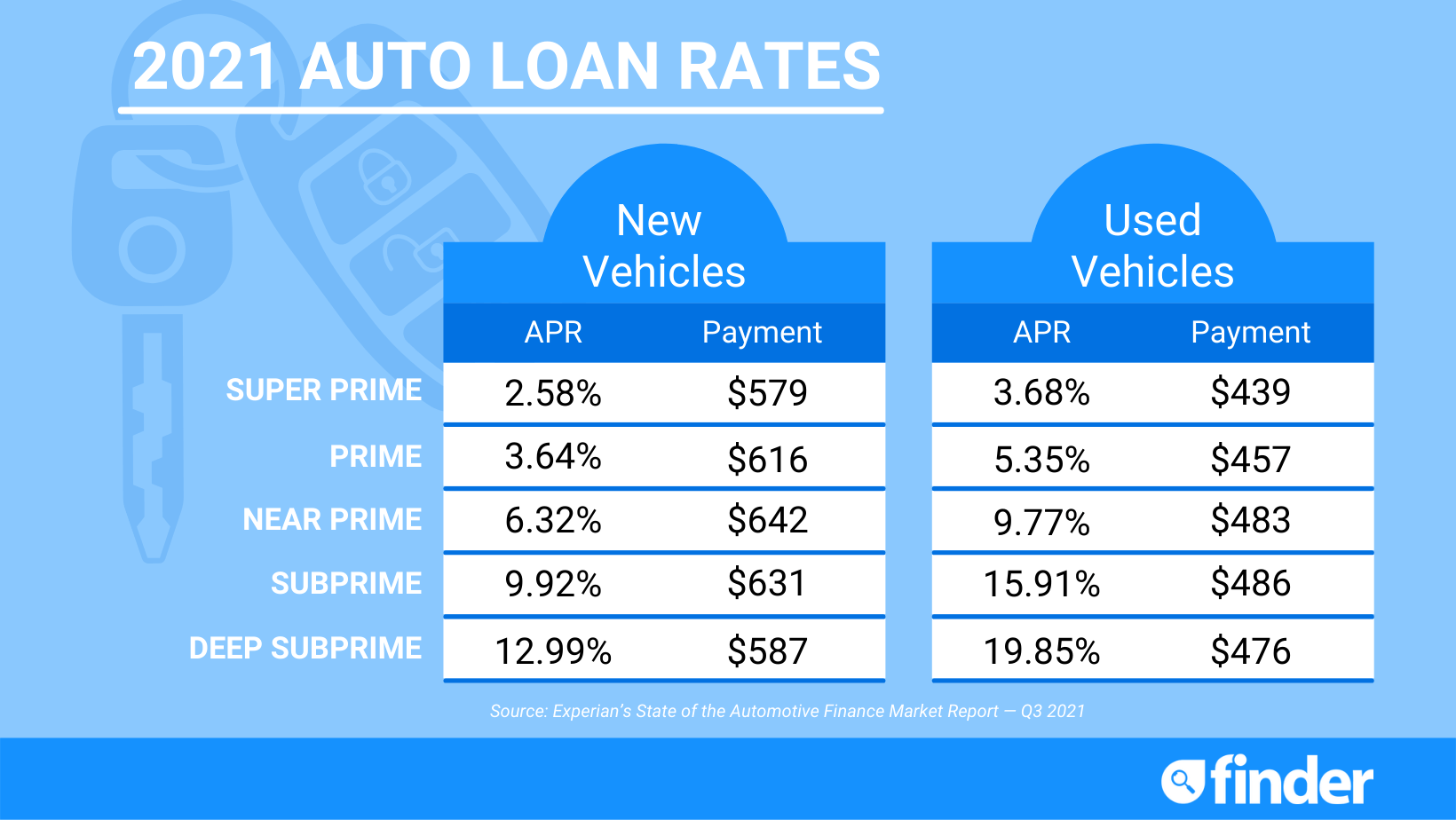

The term “finance rate” refers to the interest rate you pay for borrowing money to buy a vehicle. These rates can vary widely based on several factors:

- Credit Score: A higher credit score usually means lower interest rates.

- Vehicle Age and Mileage: Older cars or those with high mileage might come with higher rates due to increased risk of depreciation.

- Down Payment: A larger down payment can reduce the loan amount, thereby potentially reducing the interest rate.

- Loan Term: Shorter loan terms might carry lower interest rates but higher monthly payments.

- Current Economic Conditions: Interest rates fluctuate with economic changes, impacting finance rates.

How to Find the Best Rates

Finding the best used vehicle finance rates involves a strategic approach:

- Check Your Credit Report: Ensure all information is accurate. Dispute any errors to potentially improve your score.

- Get Pre-Approved: Obtain pre-approval from multiple lenders to compare rates without hard credit inquiries.

- Shop Around: Never settle with the first offer; compare rates from banks, credit unions, and online lenders.

- Consider a Larger Down Payment: This can reduce the loan amount, thus reducing the interest rate.

- Look for Promotions: Occasionally, dealers or manufacturers offer incentives or special financing rates.

📝 Note: Lenders see used vehicles as a higher risk due to their depreciation rate. Therefore, the rates might be higher compared to new car finance rates.

Common Pitfalls to Avoid

When seeking finance for used vehicles, here are common pitfalls to avoid:

- Ignoring Your Credit Score: A low score can lead to high rates or loan rejections.

- Choosing In-Store Financing Without Comparison: Dealerships often offer higher rates.

- Not Understanding the Loan Terms: Terms like prepayment penalties, balloon payments, or early payoff fees can cost you.

- Overlooking the Total Cost: Only focus on monthly payments can lead to overlooking the total interest paid over the life of the loan.

Negotiating Finance Rates

You can often negotiate used vehicle finance rates by:

- Using Pre-Approvals: Show lenders or dealers pre-approvals to leverage for a better deal.

- Explaining Your Situation: Sometimes, sharing your circumstances (like buying for the first time or having a high credit score) can result in better rates.

- Bundle or Buy-in: Financing additional services or products through the dealer can sometimes lead to lower rates on the vehicle finance.

- Market Conditions: Utilize the competitive environment if several lenders are vying for your business.

📝 Note: Not all rates are negotiable, but it’s always worth a try, especially when armed with knowledge and pre-approvals.

Alternatives to Traditional Bank Financing

| Option | Pros | Cons |

|---|---|---|

| Peer-to-Peer Lending | More competitive rates, flexible terms | May require good credit, higher fees |

| Credit Unions | Lower rates for members, community focus | Membership requirements |

| Dealer Financing | Convenience, potential incentives | Potentially higher rates, less flexibility |

| Online Lenders | Convenient, quick approval | Watch for hidden fees, not all offer the best rates |

These alternatives can provide different benefits depending on your financial situation and requirements.

Securing the best used vehicle finance rates requires research, understanding of financial metrics, and negotiation. By following these steps, you'll position yourself to save on your vehicle purchase, allowing you to put that money towards other financial goals or perhaps even accelerating your car loan repayment.

Remember, while interest rates are crucial, consider the entire cost of ownership, including insurance, maintenance, and depreciation. This holistic approach ensures you're making a financially sound decision when purchasing a used vehicle.

What is a good finance rate for a used vehicle?

+

A good finance rate for a used vehicle is generally considered to be under 5% for buyers with excellent credit. However, rates can go as high as 15-20% or more for those with poor credit. Always compare offers to ensure you’re getting the best rate possible for your situation.

Can I negotiate the finance rate with a dealership?

+

Yes, you can often negotiate the finance rate at a dealership. Bring in pre-approvals from other lenders to leverage for better rates. Be open about your situation and show you’re willing to walk away if the terms aren’t favorable.

Should I finance through a dealership or a bank?

+

It depends. Dealerships might offer convenience and incentives like cash-back or promotional rates, but often with higher interest rates. Banks and credit unions generally provide lower rates but might take longer to process. Shop around and compare terms from both to see what suits your needs best.

What can I do to lower my finance rate?

+

To lower your finance rate:

- Improve your credit score before applying.

- Make a larger down payment to reduce the loan amount.

- Shop around for the best rates and terms.

- Consider buying during sales events or promotional periods for special rates.

- Choose a shorter loan term if you can afford the higher monthly payments; rates are usually lower.