Unlock Government Loans for Your Limited Company Easily

Understanding Government Loans for Limited Companies

In today's volatile economic environment, securing funding can be a game-changer for a limited company. Government loans provide a unique opportunity for businesses to obtain financial assistance with more favorable terms compared to commercial loans. This guide will take you through the process of unlocking these government loans, ensuring you understand the types available, how to apply, and what to expect.

Types of Government Loans for Limited Companies

- SBA Loans: Backed by the Small Business Administration in the US, these loans cater to small businesses and startups, offering lower rates and longer repayment terms.

- UK Government Schemes: In the UK, schemes like the Start Up Loans, Regional Growth Funds, and the British Business Bank's Finance Platforms aim to support businesses at various growth stages.

- EU Funding: For companies within the EU, there are numerous programs like the Horizon 2020, COSME, and ERDF funds, which offer loans or guarantees for innovation, research, and regional development.

- Export Financing: Programs like the UK Export Finance or the Ex-Im Bank in the US provide financial support to boost exports by covering potential losses or offering credit insurance.

💡 Note: Each government loan program has specific eligibility criteria and documentation requirements, so it's crucial to research in detail which loans fit your company profile.

Eligibility Criteria for Government Loans

To qualify for government loans, your limited company must:

- Meet the definition of a small business, typically having fewer than 500 employees.

- Have a reasonable business plan or have been in operation for a specific time period.

- Provide financial statements that demonstrate your business's ability to repay the loan.

- Be for-profit, operating within legal and regulatory frameworks.

Application Process

Applying for government loans can be daunting, but with the right preparation, it can be navigated smoothly:

- Research: Identify which loan program aligns with your business needs.

- Gather Documentation: Prepare all necessary paperwork including business plans, financial statements, and legal documents.

- Application: Fill out the online or paper application form with meticulous attention to detail.

- Submission: Submit your application and wait for processing, which can take several weeks to a few months.

🔍 Note: Always double-check your application for accuracy as incomplete or incorrect forms can lead to rejection.

Managing and Repaying Your Government Loan

Once you secure a government loan, efficient management and repayment are key:

- Set Up Repayment Plan: Understand your loan's repayment terms and schedule payments accordingly.

- Maintain Records: Keep accurate records of all loan-related activities, including interest rates, payment dates, and amounts.

- Use Funds Wisely: Ensure the loan funds are used for their intended purpose to comply with government regulations.

- Seek Financial Advice: If you run into financial difficulties, consult with advisors or counselors provided by government agencies.

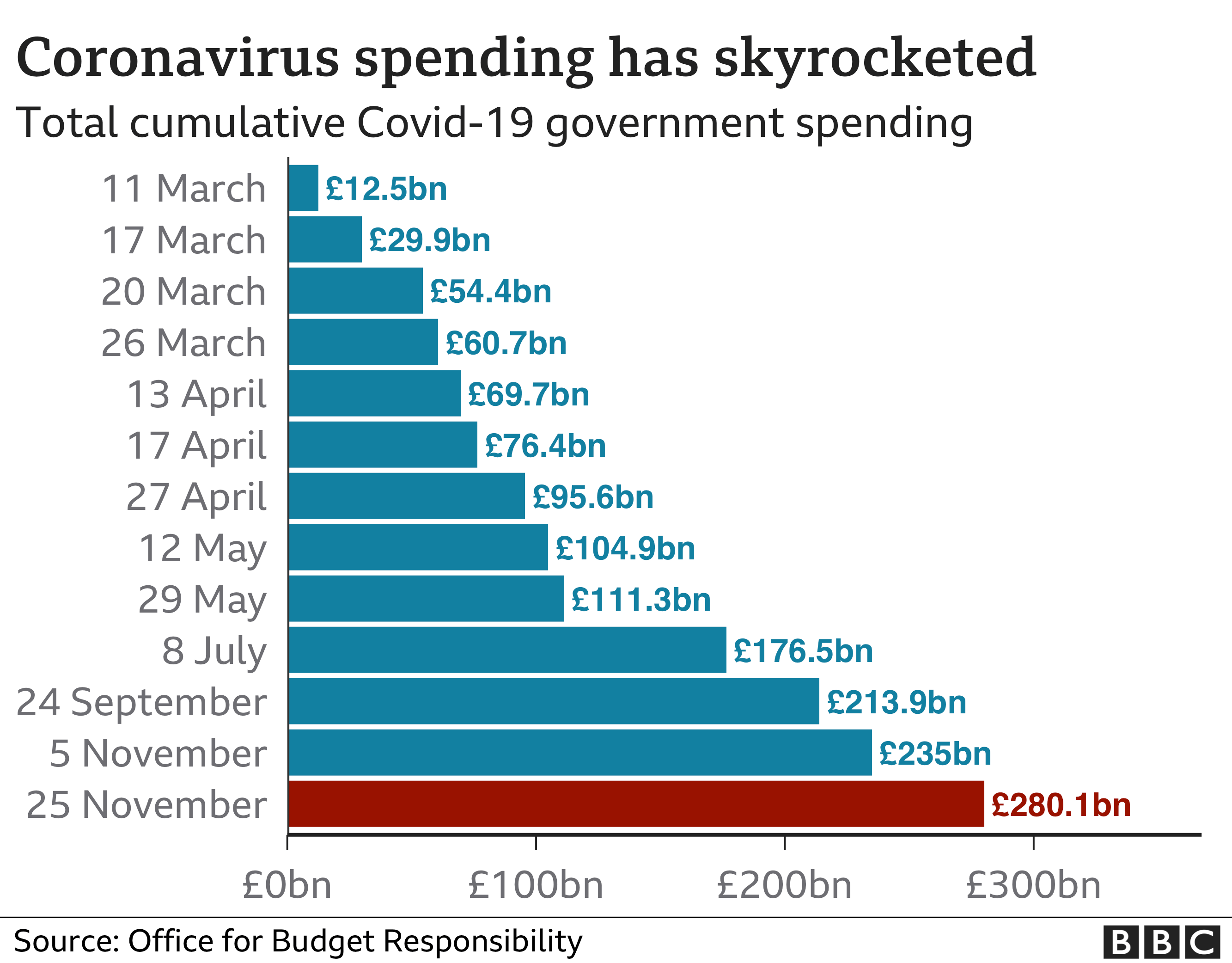

The Impact of Government Loans

Government loans not only provide funding but also bring additional benefits:

- Lower Interest Rates: Compared to private lenders, government loans often come with more favorable rates.

- Business Growth: These funds can be utilized for expansion, R&D, hiring, or capital investments, fostering growth.

- Credit Building: Successfully repaying a government loan can improve your company's credit score, making future financing easier.

📝 Note: Remember that while government loans offer benefits, they also require strict adherence to usage and repayment terms to avoid penalties or disqualification.

Wrapping up, understanding and obtaining government loans can significantly bolster your limited company's financial position. With a focus on preparation, eligibility, and responsible management, these loans pave the way for sustained growth and stability. Whether you're looking to fund a new project, expand operations, or simply stabilize cash flow, exploring the world of government financing can open doors that might otherwise remain closed.

Can a startup apply for a government loan?

+

Yes, startups can apply for specific government loans designed to encourage entrepreneurship and innovation, like the Start Up Loans in the UK or SBA’s microloan program in the US.

What if my application for a government loan is denied?

+

If denied, you can appeal the decision, seek alternative funding sources, or apply to different government loan programs that might have different criteria.

Are there government loans specifically for minority-owned businesses?

+

Yes, various programs exist, like the SBA’s Minority Business Development Agency or the UK’s Minority Ethnic-Led Business Support to encourage and support minority-owned companies.