7 Tips to Choose the Best Finance Company

Selecting the best finance company can significantly impact your financial well-being. With various firms vying for your business, it's essential to evaluate several key aspects before making your choice. Here are seven tips to guide you through the selection process.

1. Assess Reputation and Reliability

Start with the company’s track record:

- Read Reviews: Look for customer feedback on trusted platforms to understand general satisfaction levels.

- Check Ratings: Organizations like the Better Business Bureau or other consumer reporting agencies can provide insights into how the company handles complaints.

- Ask for Recommendations: Personal insights from friends or family can be invaluable.

📢 Note: A company's reputation often reflects its commitment to customer service and ethical practices.

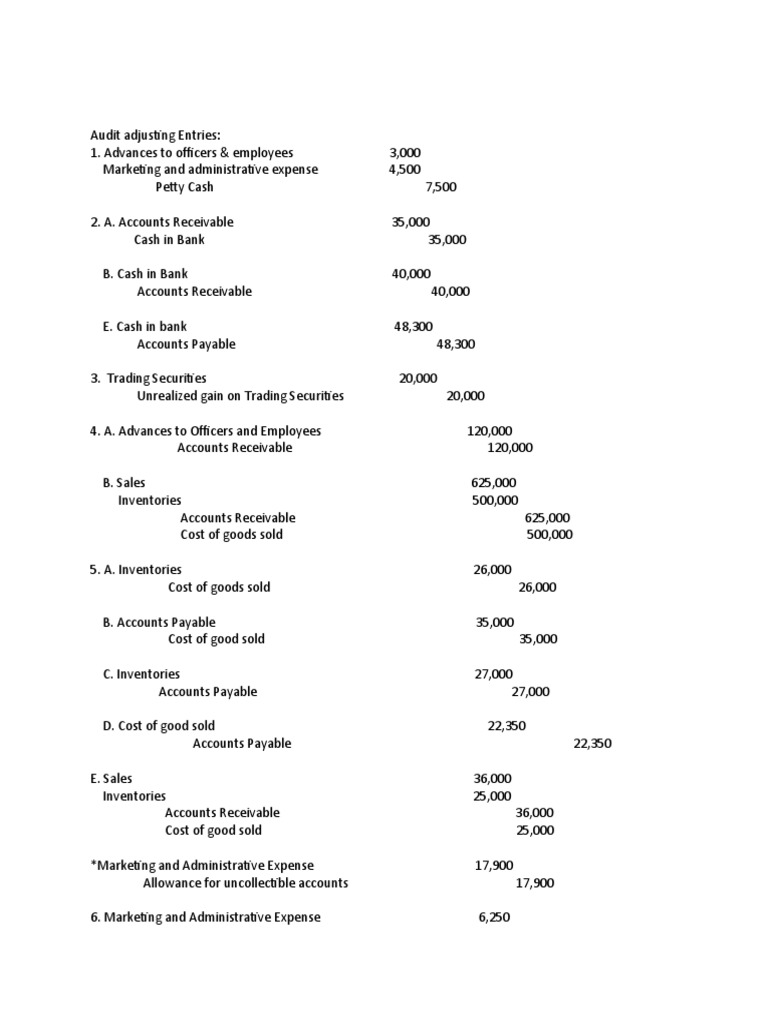

2. Analyze Financial Strength

Ensure the company is financially stable:

- Financial Ratings: Companies like Standard & Poor’s or Moody’s provide ratings on the financial health of finance companies.

- Balance Sheets: Review annual reports if available for a deeper understanding of their financial status.

3. Examine the Range of Services

Different finance companies specialize in various services:

- Personal Loans: For unsecured loans, consolidation, or major purchases.

- Home Loans: Mortgage financing or home equity lines of credit.

- Auto Loans: For buying new or used vehicles.

- Business Financing: If you’re a business owner, this could be critical.

4. Consider Interest Rates and Fees

Interest rates can drastically affect the overall cost of borrowing:

| Type of Rate | Description |

|---|---|

| Fixed Rates | These remain unchanged throughout the loan period. |

| Variable Rates | These can fluctuate with market rates, potentially lowering or increasing your costs. |

Fees to consider include:

- Origination fees

- Application fees

- Early repayment penalties

5. Review Customer Service

Good customer service can make all the difference:

- Accessibility: Check how easy it is to reach customer support.

- Response Time: Quick responses are a sign of respect for your time.

- Resolution Quality: How well does the company resolve customer issues?

6. Understand Loan Terms and Flexibility

The flexibility in loan terms can impact your financial planning:

- Repayment Flexibility: Can you make additional payments without penalty?

- Loan Modification: Are there options for adjusting loan terms if your situation changes?

7. Regulatory Compliance

Verify that the finance company adheres to financial regulations:

- Licenses: Ensure the company holds necessary licenses in your state.

- Consumer Protection: Compliance with laws like the Truth in Lending Act (TILA) ensures you receive full disclosure of loan terms.

🔍 Note: Compliance with regulations indicates the company's legitimacy and commitment to ethical practices.

In this comprehensive selection process, you aim to choose a finance company that not only meets your current needs but also supports your long-term financial goals. By evaluating reputation, financial stability, service offerings, interest rates, customer service, loan terms, and regulatory compliance, you can confidently make a decision that aligns with your financial well-being.

What are the consequences of choosing a finance company with poor customer service?

+

Poor customer service can lead to delays in resolving issues, misunderstandings about loan terms, and a generally negative experience that might affect your financial planning or peace of mind.

How important is it to review the financial strength of a finance company?

+

Financial stability is crucial as it ensures that the company can fulfill its obligations to you, like providing loans or managing your investments without going bankrupt.

Can I negotiate interest rates with a finance company?

+

While some finance companies allow for rate negotiations, this largely depends on the company’s policies and your creditworthiness. It’s always worth asking, but be prepared with alternative options.