Lowest Rate Car Finance: Your Ultimate Savings Guide

Securing the lowest rate car finance can mean the difference between a manageable monthly payment and one that stretches your budget too thin. For many, financing a car is the only way to drive away in a new vehicle, and thus, finding the most competitive interest rates is of utmost importance. In this comprehensive guide, we delve into the strategies that will help you lock in the lowest rate car finance, ensuring you save money over the life of your auto loan.

Understanding Car Finance Basics

Before we dive into finding the best rates, it’s crucial to understand the fundamentals of car finance. Car finance isn’t just about securing the keys to your new ride; it’s about the terms of your loan:

- Interest Rate: The cost of borrowing money, expressed as a percentage of the loan amount.

- Loan Term: The length of time you have to repay the loan, which can greatly influence your monthly payments and total interest paid.

- Down Payment: The upfront amount you pay, which reduces the amount financed and potentially your interest rate.

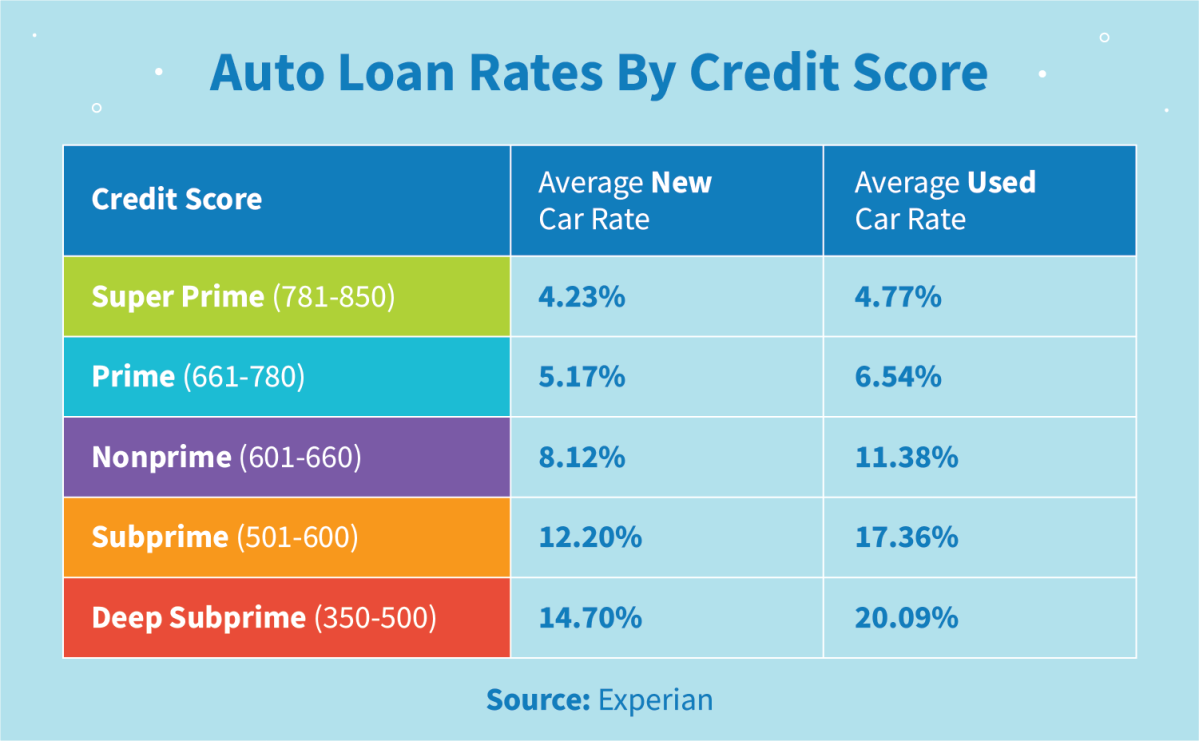

- Credit Score: A key determinant in the interest rate you’ll receive, with better scores typically leading to lower rates.

How to Prepare for Car Finance

Preparation is key to securing the best finance deal. Here’s what you should do:

- Check Your Credit Report: Obtain a free credit report and check for errors. Addressing discrepancies can improve your credit score before applying for finance.

- Improve Your Credit Score: Pay down debt, avoid new credit inquiries, and ensure timely payments to boost your creditworthiness.

- Save for a Down Payment: A larger down payment can reduce your loan amount and signal financial responsibility, which lenders favor.

💡 Note: Remember that even a small improvement in your credit score can lead to a significant reduction in interest rates.

Strategies for Finding the Lowest Rate

Finding the best deal involves research and comparison:

- Compare Lender Rates: Visit multiple lenders, including banks, credit unions, and online financiers, to compare rates and terms. Use car finance calculators to understand potential payments.

- Pre-approval: Seek pre-approval from several lenders to understand your loan options before stepping onto a dealership lot.

- Shop Around: Even after securing pre-approval, remain open to better deals from other lenders, including dealership financing.

| Lender Type | Pros | Cons |

|---|---|---|

| Banks | Wide range of products, loyalty discounts | Can be more bureaucratic |

| Credit Unions | Lower rates, member benefits | Membership requirement, often less convenient locations |

| Online Financiers | Convenience, broad reach for quotes | Potentially higher rates, no physical locations for direct service |

Negotiating the Best Deal

Negotiation is not just for the car’s sticker price but also for the finance terms:

- Use Pre-Approvals: Present your pre-approvals to the dealership to leverage a better rate or beat their offer.

- Bundle Your Deal: Sometimes, dealerships will lower finance rates when you’re also buying additional products or services from them.

- Ask About Manufacturer Incentives: Automakers often offer low or even zero percent finance deals. Utilize these if available.

💡 Note: Always negotiate separately for the car price and finance terms to avoid confusion and get the best value.

Understanding Interest Rate Types

When securing car finance, it’s important to understand the difference between:

- Fixed Rates: Your interest rate stays the same, offering predictability in your monthly payments.

- Variable Rates: The rate can fluctuate with market conditions, which might lower your payments if rates decrease but can increase them if rates rise.

Consider Alternative Car Financing Options

Beyond traditional loans, there are other financing methods to consider:

- Leasing: A lease can offer lower monthly payments, but you won’t own the car at the end of the term unless you opt to buy it.

- Peer-to-Peer Lending: P2P lending platforms might offer competitive rates, although this is more common for personal loans.

- Family and Friends: Borrowing from loved ones can be an interest-free option, but it requires careful handling to maintain good relationships.

While these alternatives can provide savings or unique advantages, be aware of the potential risks and terms involved.

After You’ve Signed

Once your car finance agreement is in place, there are still ways to ensure you’re getting the most from your deal:

- Refinance: If your credit has improved or rates have dropped, consider refinancing for a lower rate.

- Stay on Top of Payments: Timely payments improve your credit score, which could help for future loans or refinancing.

- Review Your Finance Agreement: Be sure you understand all terms, including penalties for late payments or paying off your loan early.

💡 Note: Refinancing isn't without costs; weigh the savings against any fees or potential hit to your credit score from a new inquiry.

Throughout this comprehensive guide, we've explored various facets of securing the lowest rate car finance. By understanding the basics, preparing your credit and finances, negotiating deals, considering alternative financing, and managing your loan post-signing, you'll be well-equipped to drive away with savings in your pocket.

How important is my credit score for car finance?

+

Your credit score is a crucial factor in determining the interest rate you’ll be offered for car finance. A higher score can mean lower rates, while a lower score might lead to higher rates or even loan rejections.

Can I lower my car finance rate after the loan is in place?

+

Yes, if your credit score improves or market interest rates drop, you can consider refinancing your auto loan to potentially secure a lower rate.

Should I choose a shorter or longer loan term?

+

A shorter term will usually mean higher monthly payments but less total interest paid over the life of the loan. A longer term means lower monthly payments but more interest in the long run.

Is it better to finance through a dealership or directly with a bank?

+

It depends on the deals available. Sometimes, dealerships can offer better rates, especially through manufacturer incentives. Banks might offer more competitive rates if you’re not looking to bundle additional products or services.

Can I negotiate the interest rate for my car finance?

+

Absolutely! Bringing pre-approvals and shopping around can give you leverage to negotiate lower rates or better terms at the dealership or with a lender.