Provident Finance

Financial management can be a daunting task, whether you're managing personal finances or those of a business. Enter Provident Finance, a concept that focuses on using available resources to secure financial stability, growth, and prosperity. It emphasizes foresight, planning, and the wise use of financial tools and strategies to ensure that you're not only meeting your current needs but also setting the stage for future financial health.

Understanding Provident Finance

Provident Finance revolves around several key principles:

- Proactive Financial Planning: Anticipating future financial needs and ensuring that funds are available when required.

- Prudence: Avoiding unnecessary risks and managing money with caution.

- Savings and Investment: Encouraging regular saving and smart investing to grow wealth over time.

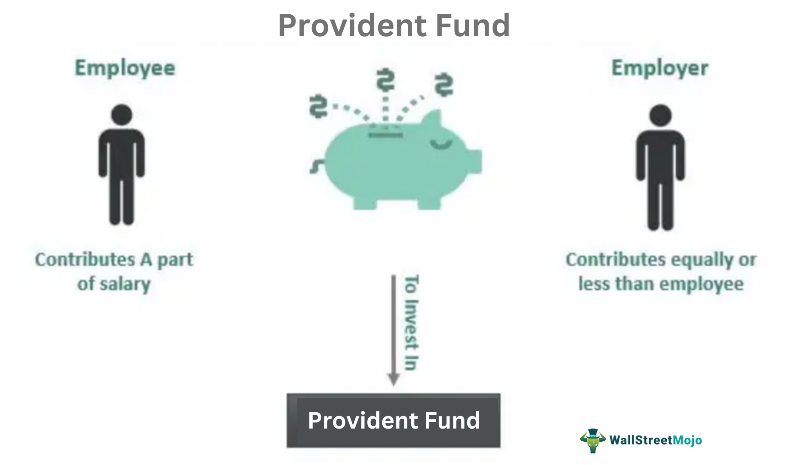

The Role of Provident Funds

Provident funds are a crucial part of provident finance. They are often seen in employee benefit packages, where:

- Employees contribute a portion of their salary to the fund.

- Employers may match the contribution or provide a lump sum at the time of retirement.

- The funds are invested, usually in low-risk options, to grow over time.

🔄 Note: Provident funds are not to be confused with pensions, though they might serve similar purposes in providing retirement income.

Steps to Implement Provident Finance in Personal Life

Here’s how you can incorporate provident finance into your personal financial planning:

- Budgeting: Start with a clear budget to understand your cash flow.

- Emergency Fund: Set aside funds for unexpected expenses, ideally 3-6 months of living expenses.

- Saving Goals: Establish short-term, medium-term, and long-term financial goals.

- Debt Management: Plan to pay off high-interest debts to free up income for savings and investments.

- Investment: Choose investments that align with your risk tolerance and financial objectives.

Advantages of Provident Finance

| Benefit | Description |

|---|---|

| Financial Stability | Provides a buffer against financial shocks, leading to greater peace of mind. |

| Future Security | Ensures funds are available for retirement, education, or other long-term objectives. |

| Better Decision Making | Encourages careful consideration of financial decisions for long-term benefits. |

Challenges in Adopting Provident Finance

Despite its benefits, adopting provident finance practices can face several challenges:

- Initial Investment: It might require setting aside funds which could otherwise be used for immediate gratification.

- Discipline: Maintaining a long-term financial discipline can be challenging when faced with short-term financial temptations.

- Economic Conditions: Inflation, market volatility, and economic downturns can impact savings and investments.

Strategies to Overcome Financial Challenges

Here are some strategies to navigate through the challenges of provident finance:

- Automate Savings: Set up automatic transfers to your savings or investment accounts to avoid the temptation to spend.

- Educate Yourself: Stay informed about financial markets, economic conditions, and personal finance strategies.

- Diversify Investments: Spread your investments across different asset classes to mitigate risk.

- Professional Advice: Consult financial advisors to tailor your financial strategy to your unique situation.

Provident Finance for Business

For businesses, provident finance can mean:

- Cash Flow Management: Ensuring liquidity for operations while planning for expansion.

- Retirement Plans: Offering employees retirement plans can improve retention and morale.

- Investment for Growth: Reinvesting profits or seeking investment for scaling operations.

Implementing these strategies can help a business maintain financial health and ensure continuity.

⚠️ Note: While provident finance can be highly beneficial, it's not a one-size-fits-all solution. Tailoring strategies to fit the business's operational model, market conditions, and long-term vision is crucial.

In the journey towards financial security and prosperity, adopting the principles of provident finance stands out as a wise strategy. Whether on an individual level or in managing a business, the focus on prudent savings, investments, and long-term planning helps to not just survive but thrive. By being proactive about finances, one can mitigate risks, plan for the future, and secure a foundation of wealth that supports both current and future endeavors. This approach not only fosters financial resilience but also provides peace of mind, knowing that one is well-prepared for whatever life might bring.

What is the difference between a provident fund and a pension?

+

While both provide retirement income, a provident fund is often an accumulation of contributions from both the employee and employer that can be withdrawn as a lump sum upon retirement. In contrast, a pension provides a regular income stream throughout retirement.

How can I start practicing provident finance?

+

Begin with creating a budget, setting financial goals, and automating your savings. Review your investments and diversify to match your risk tolerance, and seek professional financial advice to optimize your financial strategy.

Are there tax benefits to contributing to a provident fund?

+

Yes, many countries offer tax benefits for contributing to provident funds. The contributions might reduce your taxable income, and in some cases, the growth on investments is also tax-deferred or tax-exempt until withdrawal.