Understanding PCP Finance: Is It Right for Your Car Purchase?

Understanding PCP Finance: Is It Right for Your Car Purchase?

In the quest for a new car, financing options are plentiful, and one of the most popular forms in the UK today is Personal Contract Purchase (PCP). This financing method has its allure but also comes with a set of considerations that potential buyers should not overlook. In this comprehensive guide, we'll delve into what PCP finance entails, its benefits, and potential pitfalls to help you decide if it's the best route for your next vehicle acquisition.

What is PCP Finance?

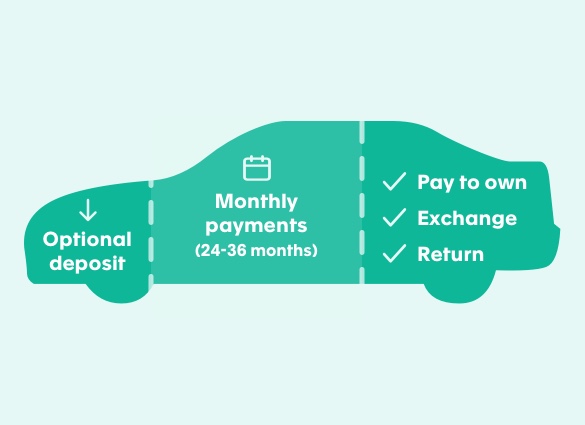

PCP, or Personal Contract Purchase, is a car finance agreement that allows you to drive a new car on a long-term lease, typically for 2 to 5 years, with the option to buy it at the end of the term. Here's how it works:

- Deposit: You start by paying a down payment.

- Monthly Payments: Throughout the agreement, you make regular payments which cover the depreciation of the car over the lease period.

- Final Payment (Balloon Payment): At the end, you have three choices:

- Pay the final balloon payment to own the car outright.

- Part exchange the car for a new vehicle under another PCP deal.

- Return the car to the dealership without further payments.

Advantages of PCP Finance

PCP finance can be attractive for several reasons:

- Lower Monthly Payments: Compared to traditional hire purchase agreements, PCP offers lower monthly payments as you're not paying off the full value of the car.

- Flexibility: You have the option at the end of the contract to either own the car, upgrade to a new model, or simply walk away.

- New Car Every Few Years: If you love the feel of driving a new car, PCP allows you to switch vehicles without the hassle of selling your current car.

- Fixed Interest Rate: The interest rate for the finance is fixed, providing predictability in your monthly budget.

Considerations Before Opting for PCP

However, there are critical factors you need to consider:

- Mileage Restrictions: PCP agreements come with annual mileage limits. Exceeding these can incur substantial penalties.

- Ownership: During the term, you don't own the car outright. This could limit modifications or affect decisions regarding repairs or maintenance.

- Equity: At the end of the term, you might find that the balloon payment is higher than the car's market value, leaving you with negative equity if you decide to buy the car.

- Depreciation Risk: The forecasted value at the end of the contract might differ from actual depreciation, potentially causing issues if you wish to purchase the car.

Steps to Secure a PCP Deal

If you decide that PCP finance is right for you, here are the steps to secure a deal:

- Research: Look into current PCP offers, interest rates, and compare deals from various dealerships.

- Calculate Affordability: Use online calculators to determine how much you can borrow based on your income, deposit, and expected monthly payments.

- Choose a Car: Decide on the make, model, and options that fit your lifestyle and budget.

- Negotiate Terms: You can negotiate not just the price of the car but also the interest rate, deposit amount, contract length, and annual mileage cap.

- Apply for Finance: Submit your application, ensuring you provide all required information accurately.

- Understand the Agreement: Read the contract thoroughly. Make sure you understand all terms, including what happens if you want to return the car early or if the car gets damaged.

💡 Note: Always get a copy of all documents for your records.

⚠️ Note: Excess mileage charges can be high. Be realistic about your driving habits.

Is PCP Finance the Right Choice for You?

Determining if PCP finance is the right option depends on several personal factors:

- If you want to drive a new car every few years.

- If you prefer lower monthly payments.

- If you don't plan on owning the car long-term.

- If you're okay with potential excess mileage charges.

Conversely, if you're looking for:

- Long-term car ownership.

- To avoid mileage restrictions.

- To build up equity in your car over time.

... then PCP might not be the most cost-effective choice. Alternatives like personal loans, hire purchase, or leasing might better suit your needs.

To summarize, PCP finance can provide you with the excitement of driving a brand new car with lower initial outlay and the flexibility to upgrade regularly. However, it's essential to weigh this against the restrictions on ownership, mileage, and the potential lack of equity at the end of your contract. Ensure you thoroughly understand the terms and conditions before committing, and consider if the benefits outweigh the constraints for your situation.

What happens if I exceed the mileage limit on my PCP agreement?

+

If you exceed the agreed mileage cap in your PCP contract, you will face excess mileage charges. These can be significant, often calculated per mile or in pence per mile. It’s crucial to realistically assess your annual mileage before signing the contract to avoid unexpected costs at the end of the term.

Can I pay off a PCP deal early?

+

Yes, you can pay off a PCP deal early. This involves calculating the settlement amount, which includes the remaining finance, less any refunds on interest, and sometimes an early settlement fee. You should check with your finance provider for the exact figures and conditions related to early settlement.

What if I want to keep the car after my PCP term?

+

If you decide to keep the car at the end of your PCP agreement, you need to make the final balloon payment. This payment can often be substantial, but remember that it’s the difference between the car’s value when you started the contract and its projected value at the end. Ensure you can afford this amount if your plan is to own the car outright.