5 Hunter Finance Tips for Maximizing Returns

In an ever-evolving financial landscape, maximizing returns from investments isn't just about picking the right stocks or assets; it's also about adopting the mindset and strategies that seasoned hunters in the realm of finance use to outsmart the market. These tips aren't just for professional investors; anyone looking to enhance their financial gains can benefit. Here are five crucial strategies to help you become a more astute financial hunter:

1. Know Your Prey: Research and Understand Investments

The foundation of successful investing is knowledge. Whether you’re investing in stocks, bonds, real estate, or cryptocurrencies, understanding the market dynamics, historical trends, and future outlook is vital.

- Stay Informed: Keep up with market news, subscribe to newsletters, and utilize financial analysis platforms.

- Research Companies: Understand the business models, financial health, management quality, and industry positioning of companies you consider for investment.

- Learn Fundamentals: Grasp the basics of financial statements, valuation metrics, and sector-specific factors that influence investment returns.

2. Use the Right Tools: Financial Instruments and Software

Today’s investor has access to an array of tools that can provide an edge:

- Trading Platforms: Choose platforms with real-time data, analytical tools, and low transaction fees.

- Portfolio Management Tools: Use software to track your investments, calculate returns, and analyze risk.

- Apps for Market Simulation: Practice trading strategies without risking real capital, helping you to hone your skills.

📝 Note: Remember that tools are aids, not substitutes for your own judgment.

3. Track Your Prey: Regular Portfolio Monitoring

Investing isn’t a “set it and forget it” scenario. Regular portfolio monitoring allows you to:

- Assess Performance: Understand how your investments are performing against benchmarks.

- Reallocate Assets: Adjust your portfolio based on changes in your investment goals, market conditions, or personal circumstances.

- Detect Risk: Monitor signs of increased volatility or risk within your holdings.

4. Timing Your Hunt: Market Timing Strategies

Market timing involves predicting market movements to buy low and sell high:

- Technical Analysis: Use chart patterns, technical indicators, and trends to forecast market behavior.

- Fundamental Timing: Base your timing on economic cycles, company earnings reports, and macroeconomic indicators.

- Seasonal and Cyclical Trends: Some assets have seasonal patterns; understanding these can help in timing investments.

5. Diversify Your Hunting Grounds: Risk Management

The age-old adage ‘don’t put all your eggs in one basket’ holds true:

- Diversify: Spread investments across various asset classes, sectors, and geographies.

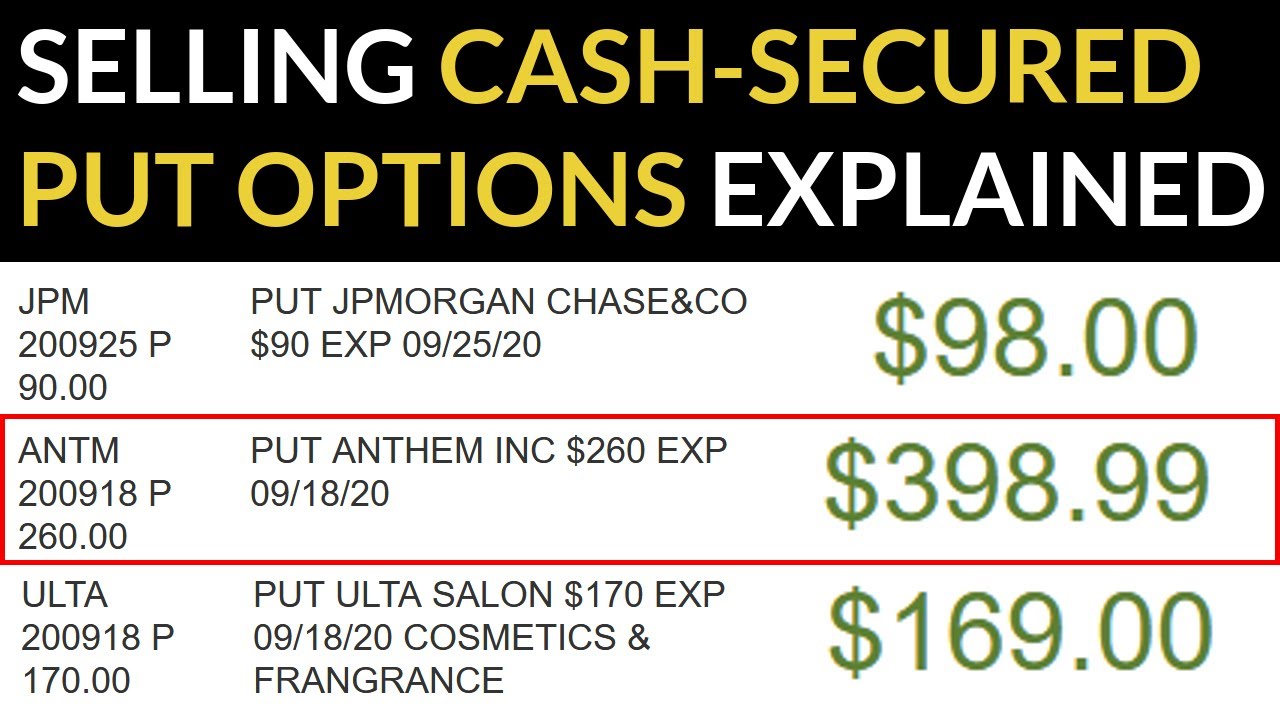

- Hedge: Use financial instruments like options or futures to mitigate risk.

- Stop-Loss Orders: Implement stop-losses to limit potential losses on investments.

These strategies are not just about maximizing returns; they are about creating a disciplined approach to finance that can help you navigate the unpredictable nature of markets. By understanding your investments deeply, utilizing tools effectively, keeping a close eye on your portfolio, timing the market strategically, and managing risk through diversification, you are equipping yourself with the skills to hunt for financial gains in the best possible way.

In summary, effective financial hunting involves preparation, patience, and persistent observation. Just as hunters scout for the best hunting grounds, investors should scout for the best investment opportunities through research, tools, and strategic timing. Risk management ensures that while you aim for the prize, you also protect yourself from unexpected downturns. This holistic approach to investing not only offers the potential for higher returns but also fosters a deeper understanding of your financial landscape, ultimately leading to more informed and confident investment decisions.

What is the best investment for beginners?

+

Many financial experts suggest starting with low-risk investments like index funds or mutual funds, which provide diversification and require less hands-on management.

How important is diversification in a portfolio?

+

Diversification is critical as it helps mitigate risk. By spreading your investments, you can potentially reduce the impact of poor performance in any single asset or sector.

Can timing the market really work?

+

Market timing is highly debated. While some investors have seen success, it requires deep market knowledge and experience, and carries significant risk due to market unpredictability.