5 Financial Tips for ao com Financing

In the ever-evolving world of ecommerce, securing the right financing can make all the difference in your ao com business growth and success. Whether you're looking to expand your operations, upgrade technology, or simply keep the lights on during tough economic times, understanding financial strategies is paramount. Let's explore five actionable financial tips to help finance your ao com venture.

1. Understand Your Cash Flow

Before making any financial decisions, it’s crucial to have a clear understanding of your business’s cash flow. This includes:

- Accounts Receivable: Monitor how quickly customers pay you.

- Accounts Payable: Manage payments to suppliers wisely to leverage cash flow.

- Inventory Turnover: Keep an eye on how fast inventory sells and turns into cash.

💡 Note: Cash flow analysis tools can provide real-time insights into your financial health, helping with proactive decision-making.

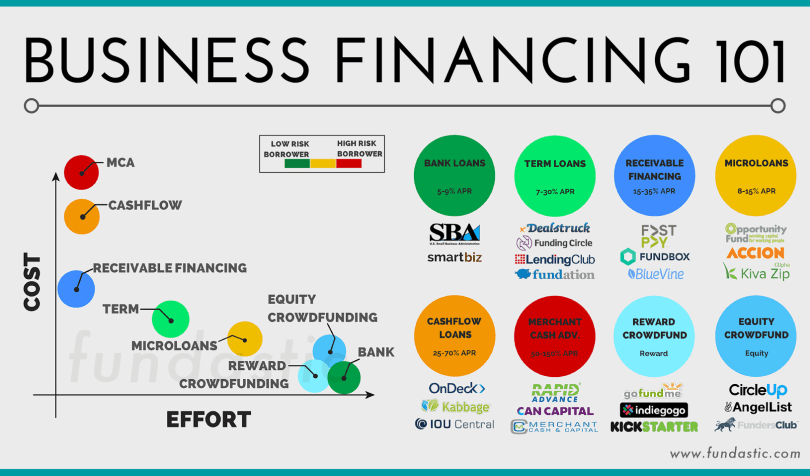

2. Explore Different Funding Options

Traditional loans might not always be the best fit for an ao com business:

- SBA Loans: Small Business Administration loans can offer lower interest rates and longer repayment terms.

- Lines of Credit: For short-term cash flow management, these can be very useful.

- Crowdfunding: Engage your community to fund specific projects or expansions.

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| SBA Loans | Lower interest rates, longer terms | Extensive paperwork, approval time |

| Line of Credit | Flexible, only pay for what you use | Higher interest rates, requires good credit |

| Crowdfunding | Engages community, no debt | Need a compelling pitch, not guaranteed success |

3. Optimize Your Pricing Strategy

Your pricing not only affects your cash flow but also your competitive positioning in the market. Consider:

- Cost-Plus Pricing: Add a margin to your cost of goods sold.

- Competitive Pricing: Align prices with what competitors offer.

- Value-Based Pricing: Charge based on the perceived value to the customer.

⚠️ Note: Your pricing strategy should be dynamic; regularly review and adjust to market changes.

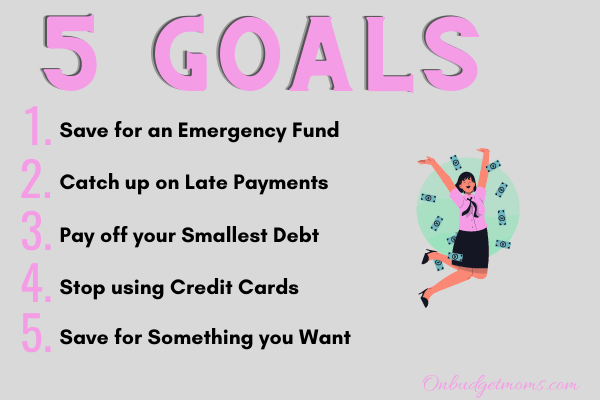

4. Use Financial Leverage Wisely

While debt can fuel growth, it comes with risks:

- Interest Rates: Look for financing with the lowest possible rates.

- Repayment Flexibility: Choose options that offer flexible repayment terms.

- Strategic Investments: Use debt for investments that will generate returns, not just for daily operations.

5. Embrace Technology and Automation

Technology can streamline your financial operations:

- Accounting Software: Tools like QuickBooks or Xero can save time and reduce errors.

- Automated Billing: Ensure timely payments from customers.

- Analytics Tools: Use data to make informed financial decisions.

By meticulously applying these financial tips, your ao com business can navigate through economic fluctuations, scale operations, and achieve long-term sustainability. Each step requires thoughtful analysis and strategic implementation, but the rewards can be substantial. Keep in mind that financial health is not just about numbers but about creating a robust foundation for your business's future.

🔍 Note: Regularly review these strategies against your business goals to ensure they remain relevant.

What is the importance of cash flow for an ecommerce business?

+

Cash flow is critical for ao com businesses as it determines the company’s ability to meet its financial obligations, reinvest in the business, and withstand economic downturns. Managing cash flow effectively allows for smoother operations, timely inventory replenishment, and the capacity to seize growth opportunities.

How can I determine the best funding option for my ecommerce business?

+

Assess your current financial health, understand your business growth objectives, review the terms and conditions of each funding option, and consider the sustainability of your cash flow before deciding. Consulting with a financial advisor can also provide tailored recommendations.

Why should I adjust my pricing strategy frequently?

+

The market conditions, competition, and customer perceptions are always changing. Adjusting your pricing strategy helps in staying competitive, responding to customer demands, and maximizing profits while maintaining sales volume. A dynamic pricing strategy can also help in managing inventory turnover and cash flow more effectively.