5 Shocking Revelations in Close Brothers Finance Complaints

Exploring the world of financial services, we often find stories filled with surprise, intrigue, and sometimes, utter disbelief. The sector is inherently intricate, with a myriad of products and services tailored to meet varied financial needs. Close Brothers Finance, a prominent name in the UK's financial services landscape, has been at the center of some revelations that have left many customers, observers, and industry professionals taken aback. Here are five shocking revelations from customer complaints against Close Brothers Finance.

Unexpected High-Interest Rates

Many customers have reported encountering surprisingly high interest rates on their finance agreements. These rates, often much higher than what was initially promised or implied, have led to:

- Extended repayment periods

- Financial strain for borrowers

- A feeling of deception

⚠️ Note: Always check the terms of your finance agreement before signing. Interest rates can often be found in the fine print or be subject to change.

Hallmark of Poor Communication

Communication, or the lack thereof, has been another major issue. Here’s what customers have experienced:

- Delays in resolving issues

- Unresponsive customer service

- Miscommunication regarding terms and conditions

Customer Experiences with Hidden Charges

Another area of contention has been the emergence of hidden charges. These fees might include:

- Administrative fees

- Early termination charges

- Variable rate charges not previously disclosed

Lengthy Complaint Resolution Times

The journey to resolve complaints has been arduous for many:

- Lengthy back and forth

- Failure to follow up

- Long wait times for redress or refunds

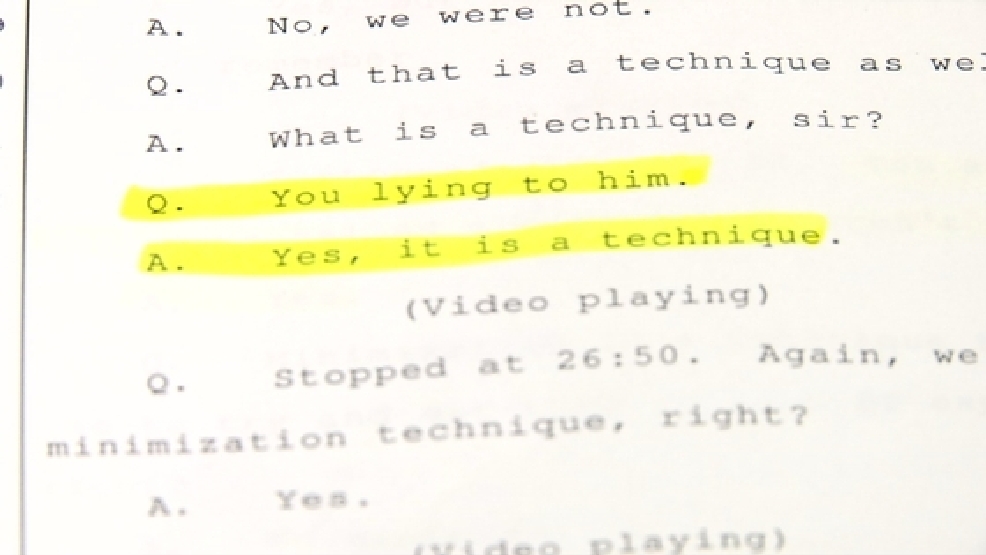

Misrepresentation of Finance Products

There have been instances where customers felt the finance products were:

- Misrepresented in terms of cost, repayment, or benefits

- Not as favorable or flexible as initially described

In summary, these revelations from Close Brothers Finance complaints have shed light on the complexities of financial products and the importance of transparency in the finance industry. Customers' stories serve as a reminder to always scrutinize the fine print, ask questions, and ensure that all charges, terms, and conditions are fully understood before entering any finance agreement. Understanding the full scope of one's financial commitment is crucial to avoid unpleasant surprises down the line.

What should I do if I notice unexpected charges on my finance agreement?

+

If you encounter unexpected charges, contact the finance provider immediately. Review your contract for any mention of such charges. If the charges are indeed unlisted, escalate the issue through the company’s complaints procedure or seek external financial advice.

How can I ensure I’m not a victim of poor communication?

+

Keep records of all your communications. If something is not clear, ask for written clarification. Remember, understanding your agreement is your responsibility, so take the time to ensure you fully comprehend it before proceeding.

What are my rights if I’m affected by high interest rates?

+

You have the right to seek full disclosure of your agreement’s terms, including interest rates. If the rates were not disclosed or misrepresented, you can escalate the complaint through the company’s channels or seek legal advice.