Equity vs. Debt Financing: Which is Better for Your Business?

Exploring the Foundations of Equity and Debt Financing

The growth journey of every business hinges on how effectively it can secure capital to fuel its aspirations. At the heart of every financial decision for business owners lies the choice between equity financing and debt financing. Each method presents unique advantages, drawbacks, and considerations that shape the trajectory of your venture. This guide will elucidate the nuances of these financing options, offering a comprehensive comparison to aid you in making an informed decision.

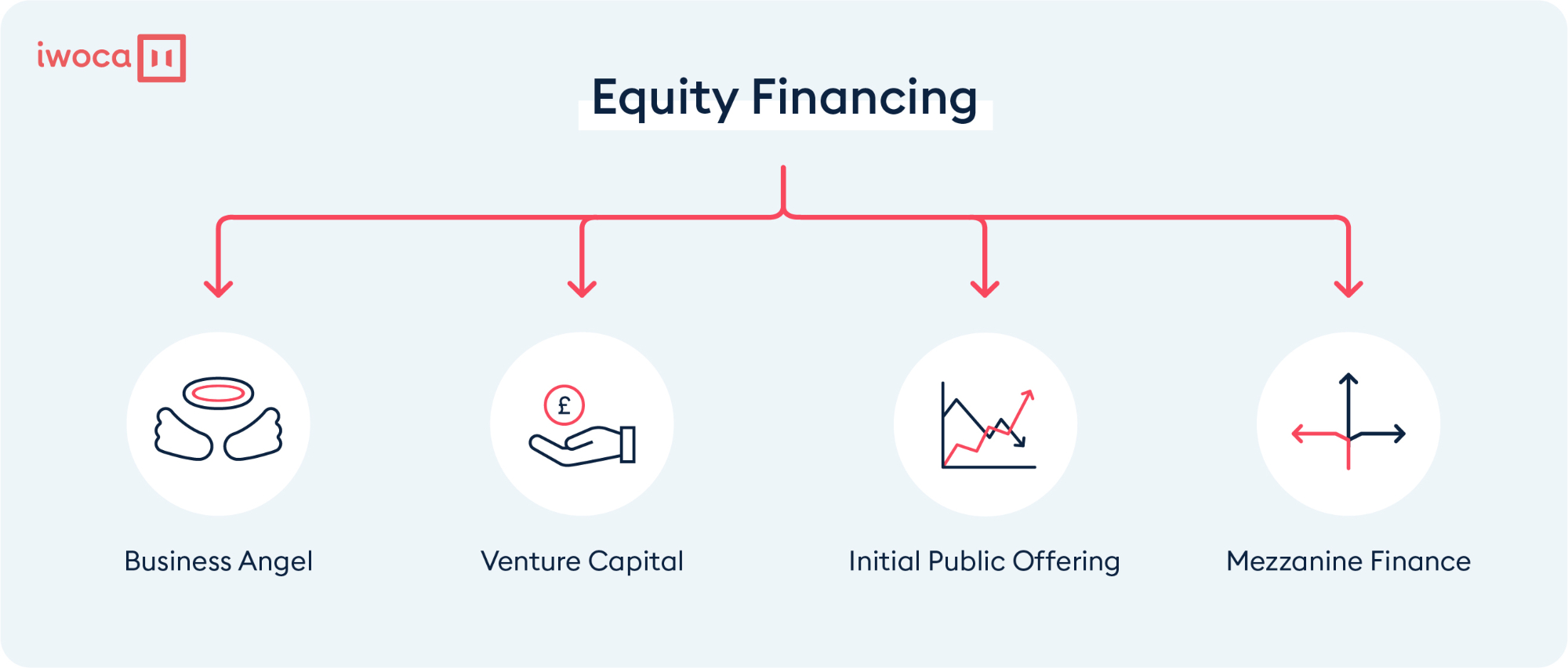

Understanding Equity Financing

Equity financing involves raising capital by selling shares of your company to investors. Here's what you need to know:

- Equity Dilution: Each time new shares are issued, existing shareholders see their percentage ownership decrease, a process known as dilution. This can impact control and future earnings distribution.

- No Repayment Obligation: Unlike loans, equity financing does not require your business to repay the capital, only potentially to share profits if the company is profitable.

- Attracting Investors: Equity investors bring not only funds but also valuable insights, connections, and credibility. They have a vested interest in your success and often bring industry knowledge or growth strategies.

- Risk Sharing: By taking on investors, the risk of the business is shared. If the company fails, the financial loss is borne by investors, not as a personal debt.

The Mechanics of Debt Financing

Debt financing, on the other hand, refers to taking on financial obligations with the promise of repayment. Here are key aspects:

- Fixed Repayment Schedule: Businesses must repay the borrowed amount plus interest over a predetermined period. This can provide predictable cash flow but might strain finances if profits are inconsistent.

- Tax Deductibility: Interest paid on loans can often be deducted from taxable income, effectively lowering the cost of borrowing.

- Maintaining Ownership: Debt financing does not dilute ownership. You retain full control, but lenders might impose covenants or restrictions.

- Collateral Requirement: Lenders often require collateral or personal guarantees, putting your business assets or even personal property at risk if you default on the loan.

⚠️ Note: Assess your ability to service debt before committing to loans. Late or missed payments can harm your credit score and may lead to asset seizure.

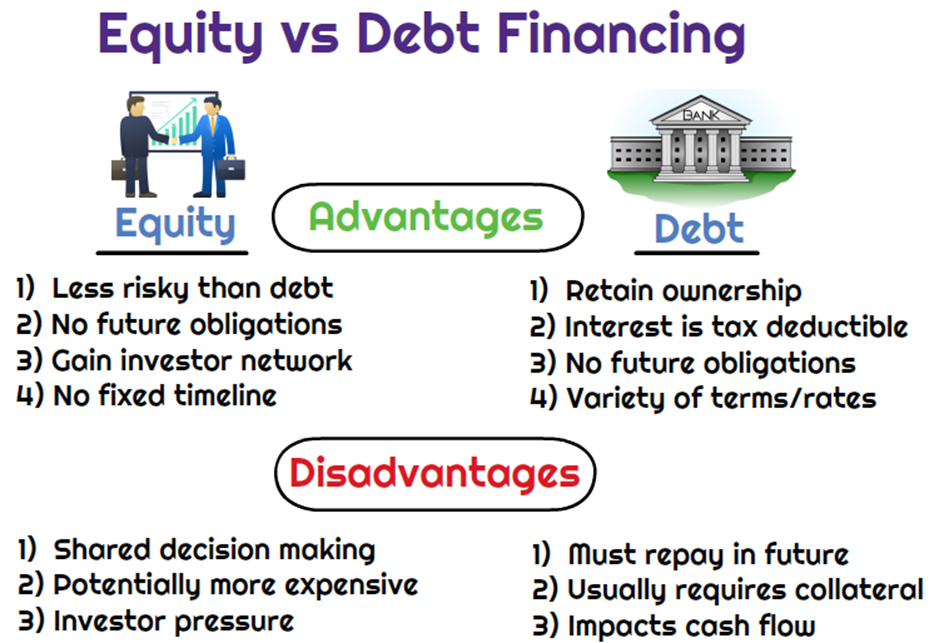

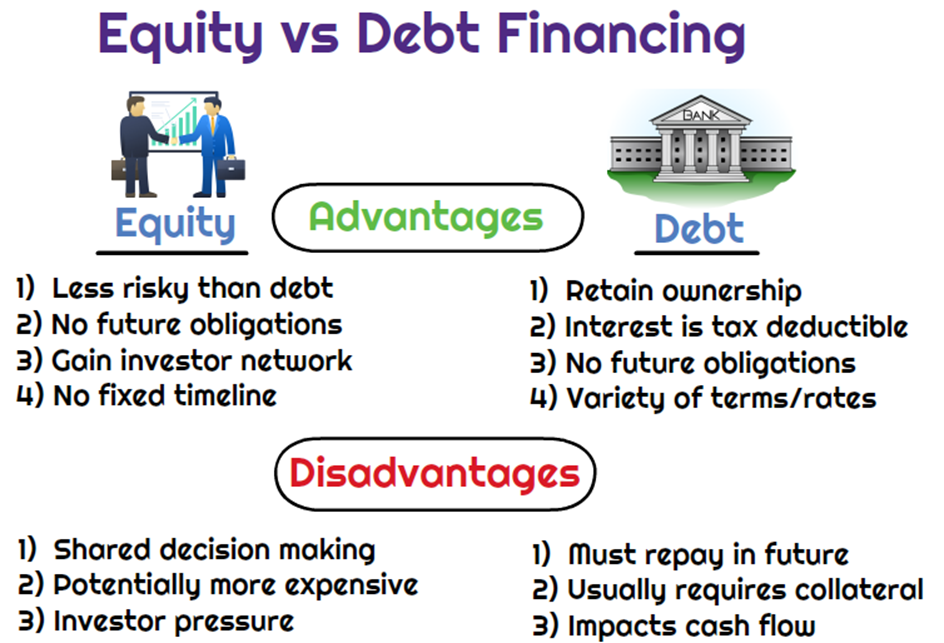

Pros and Cons: A Side-by-Side Comparison

| Aspect | Equity Financing | Debt Financing |

|---|---|---|

| Ownership Dilution | Yes | No |

| Repayment Obligation | No Repayment of Capital | Regular Payments Required |

| Interest and Tax | No Interest Payments, no Tax Deduction | Interest Payments, with Tax Deduction |

| Risk Sharing | Investors Bear Risk | Borrower Bears Risk |

| Credit Impact | No Direct Impact | Can Affect Credit |

Choosing the Right Path for Your Business

Your choice between equity and debt financing should consider the following:

- Control and Ownership: If maintaining control is paramount, debt might be the better choice, though it comes with repayment obligations.

- Business Life Cycle: Equity financing is often more suitable for early-stage companies with high growth potential but limited cash flow to service debt.

- Future Cash Flow: Companies with stable, predictable cash flows can handle debt better than those with uncertain revenues.

- Interest Rates and Cost of Capital: Compare the cost of borrowing with the potential cost of dilution or the higher interest rates of a loan.

Real-World Examples

Consider these brief examples from the business world:

- Uber: Initially raised through equity investments from venture capitalists, which allowed Uber to expand rapidly without the burden of immediate debt repayment.

- Boeing: Has used both equity (stock sales) and debt (bonds) to finance its operations, often balancing its capital structure between the two to manage its financial obligations.

The Convergence of Equity and Debt: Hybrid Instruments

Some businesses opt for a hybrid approach, blending elements of both:

- Convertible Bonds: These start as debt and can convert into equity if certain conditions are met, offering flexibility for both the investor and the issuer.

- Preferred Equity: Shares with fixed dividends, akin to debt, but with potential equity benefits like voting rights or convertibility.

Ultimately, your decision will be influenced by the specifics of your business's situation, the market conditions, and your growth strategy. Weigh the long-term implications and short-term needs, and consider how each financing method aligns with your vision for the business.

As you navigate this decision, keep in mind the balance between immediate growth needs and sustainable financial health. Whether you choose equity, debt, or a mix, the key is to secure financing that supports your business’s journey from startup to flourishing enterprise.

What is equity dilution, and why should I be concerned about it?

+

Equity dilution occurs when a company issues more shares, reducing the ownership percentage of existing shareholders. This can dilute the value of shares and potentially reduce control over company decisions if too much equity is sold.

Can I use both equity and debt financing?

+

Absolutely. Many businesses employ a mix of equity and debt, known as a hybrid financing approach. Convertible bonds or preferred equity are examples where debt and equity elements coexist, providing flexibility in capital raising.

How does debt financing impact my company’s credit?

+

Taking on debt can affect your company’s credit rating. Regular, on-time payments can improve your credit, whereas missed payments or defaults can lower your credit score, making future borrowing more difficult or expensive.

Should my business’s stage influence the choice between equity and debt?

+

Yes, the stage of your business can greatly influence this choice. Startups or high-growth companies might prefer equity financing for its lack of repayment obligations, whereas established businesses with steady cash flow might leverage debt for its tax benefits and to preserve ownership.