5 Ways to Secure Car Finance with 0% APR

When it comes to purchasing a vehicle, securing the best possible financing deal is crucial. One particularly attractive offer in the automotive finance industry is a 0% APR (Annual Percentage Rate) car loan. This rate means you pay zero interest over the term of your loan, saving a significant amount on what would otherwise be added to the cost of your car. Here are five strategic ways to secure car finance with 0% APR, ensuring you drive off the lot with the best deal possible.

1. Understanding 0% APR Offers

Before diving into the methods, it’s worth understanding what 0% APR car finance entails:

- What it means: A 0% APR deal implies that the dealership or lender is essentially lending you the money at no interest cost. This can be a promotional tool to entice buyers.

- Benefits: You only pay for the vehicle itself, with no additional interest, making your monthly payments lower.

- Catch: There might be conditions, like paying the loan off within a shorter period or forfeiting certain rebates.

Understanding this can guide you towards the best possible deals when negotiating with lenders.

2. Research Current Offers

The auto finance market is dynamic, with various manufacturers and dealerships constantly rolling out special financing deals:

- Online Tools: Use online car financing calculators and sites that aggregate current deals from various manufacturers.

- Manufacturer Websites: Many times, special financing offers are listed on car manufacturer websites or are announced during sales events.

- Local Dealerships: Visit local dealerships or contact them to inquire about current promotions. Often, these aren’t advertised online.

3. Leverage Multiple Offers

Securing a 0% APR deal can be like a bidding war; having multiple offers gives you leverage:

- Get Pre-Approved Loans: Apply to several lenders or credit unions for pre-approval. This gives you a baseline to compare with dealership offers.

- Dealer Financing vs. Bank Financing: Compare deals not just on the APR but also on the total cost, fees, and conditions.

- Show Willingness to Walk Away:** If a dealership doesn’t offer a 0% APR when you have a better offer, be prepared to go elsewhere. This willingness can sometimes push dealers to match or better the deal.

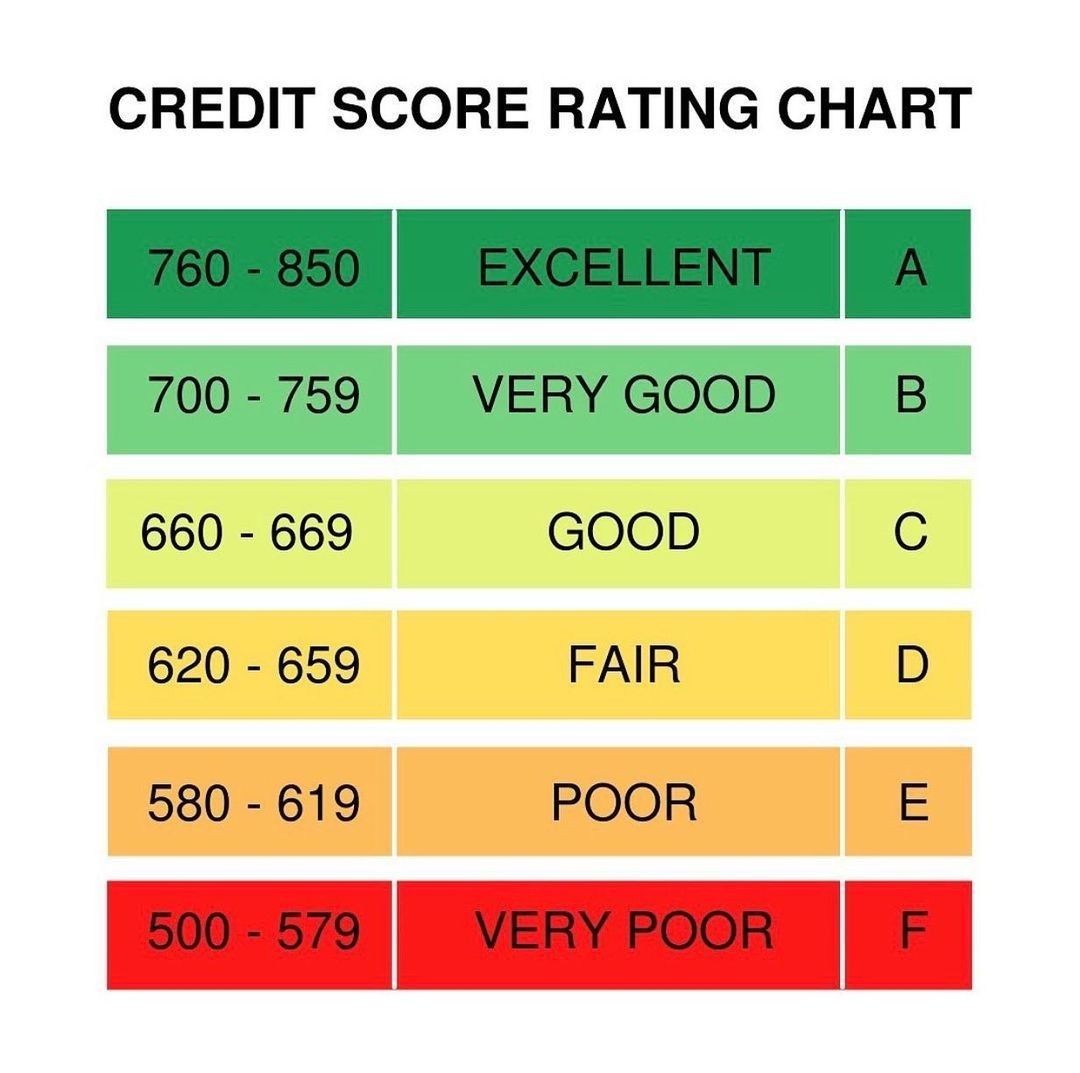

4. Perfect Your Credit Score

A 0% APR deal is typically offered to borrowers with excellent credit:

- Credit Check: Regularly check your credit score and work on improving it if necessary. Pay down debt, make payments on time, and correct any errors on your credit report.

- Build Credit: If your credit isn’t where it needs to be, consider alternatives like securing a secured credit card or becoming an authorized user on someone else’s account with good credit.

- Correct Errors: Ensure that your credit reports from all three credit bureaus (Experian, Equifax, TransUnion) are accurate.

💡 Note: Remember that each credit inquiry can temporarily lower your score, so shop wisely and in a short period.

5. Timing and Negotiation

Timing can play a critical role in securing a 0% APR deal:

- End of Month/Quarter/Year: Dealerships often need to meet sales targets, making them more flexible with financing options.

- Model Year Changeovers: When new models arrive, dealers are eager to sell off old inventory, which can include special financing deals.

- Negotiate: Even if an offer isn’t available, negotiate. Sometimes, dealers can provide 0% APR through incentives or by absorbing the interest cost into the car price.

6. Consider Buying Used

While 0% APR is more common with new cars, some manufacturers extend similar offers on certified pre-owned vehicles:

- Certified Pre-Owned Programs: These vehicles undergo thorough inspections and come with warranties, often making them nearly as reliable as new cars.

- Look for Specials: Occasionally, dealers promote 0% financing on used cars during specific periods or for certain makes and models.

In securing car finance with 0% APR, understanding the offers, researching current deals, leveraging multiple financing options, improving your credit score, and mastering the art of timing and negotiation are key. By applying these strategies, you can drive away with a vehicle that not only meets your needs but also saves you a considerable amount in interest. Remember, patience and preparation are your best allies when it comes to securing the most favorable financial terms.

What does 0% APR mean for car finance?

+

0% APR for car finance means you are not charged any interest on the loan amount you borrow to purchase the car. You only pay back the principal amount borrowed, without any additional interest over the term of the loan.

Are 0% APR deals common, and can anyone get them?

+

While 0% APR deals are less common, they are frequently used as promotional offers by manufacturers to boost sales, particularly at certain times of the year. They are often available to those with excellent credit scores, but sometimes they might be part of an end-of-month or model year changeover sales push.

How long can I finance a car with 0% APR?

+

The duration for which a 0% APR offer is available can vary. Typically, these deals last for 36 to 48 months. However, some might offer 72-month terms, depending on the promotional campaign and the dealership’s incentives.

Is it better to take a 0% APR deal or a cash rebate?

+

The choice depends on the financial calculation. If the cash rebate reduces the price significantly, it might be more beneficial than saving on interest, especially if you plan to pay off the car quickly or invest the rebate. Conversely, if you prefer lower monthly payments and have the car for the full term, 0% APR can save you money in interest over time.