Empower Your Financial Decisions with Agency in Finance

Embarking on a journey to achieve financial empowerment requires a deep understanding and strategic application of financial principles. In today's dynamic economic landscape, mastering the art of making informed financial decisions is not just an advantage—it's a necessity. Whether you're managing personal finances or leading a corporation, the ability to wield financial agency can shape your future in profound ways. This blog post aims to provide you with insights into how you can harness this power to enhance your financial decision-making capabilities.

The Importance of Financial Literacy

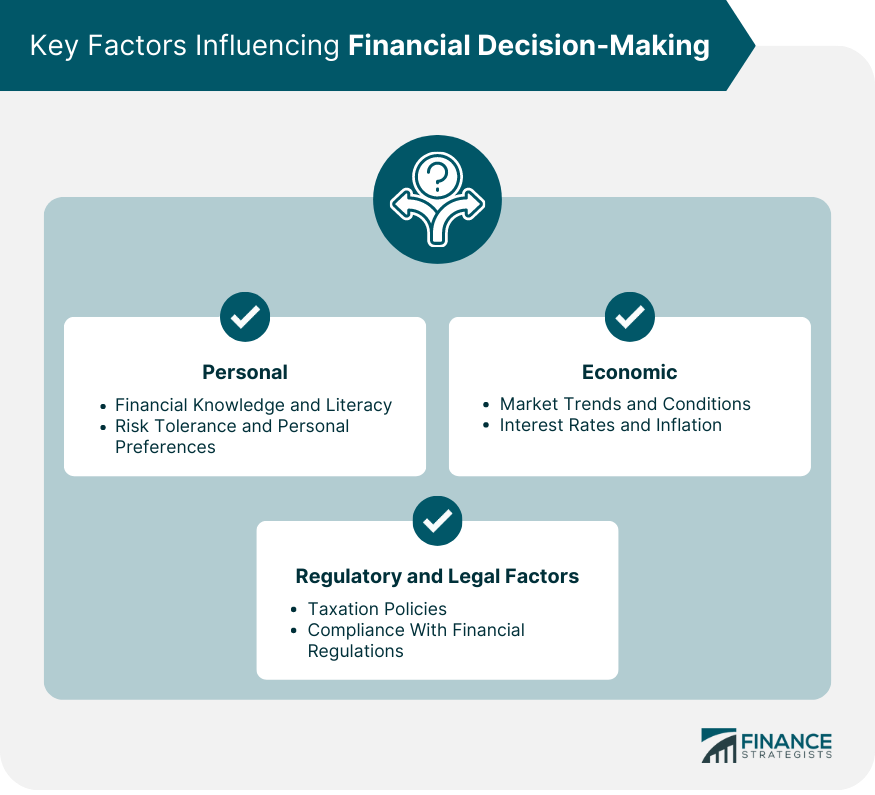

Financial literacy forms the bedrock of making empowered financial decisions. It's not just about understanding how money works; it's about gaining the knowledge to apply this understanding effectively. Here are key aspects where financial literacy impacts your life:

- Budgeting and Forecasting: Knowing how to budget allows you to allocate resources wisely, predict future financial scenarios, and prepare accordingly.

- Debt Management: Understanding different types of debts, their implications, and how to manage them can prevent financial pitfalls like bankruptcy.

- Investing: Financial literacy enables you to make informed investment decisions, from stocks to real estate, optimizing your returns.

- Retirement Planning: With the right financial know-how, you can plan your retirement to ensure a comfortable and secure future.

Developing Your Financial Agency

Agency in finance isn't just about having financial literacy; it's also about taking control of your financial destiny. Here's how you can develop and exercise your financial agency:

1. Set Clear Financial Goals

Define what financial success looks like for you. These goals can be short-term (like saving for a vacation) or long-term (like buying a home). Having clear objectives provides a roadmap for your financial actions.

2. Establish a Robust Financial Strategy

Your strategy should cover:

- Investment diversification to mitigate risks.

- Adaptable budgeting to adjust to income fluctuations.

- An emergency fund to cushion against unexpected expenses.

- Continuous financial education to stay abreast of market changes.

3. Engage in Active Decision-Making

Be an active participant in your financial life:

- Regularly review and adjust your financial plans.

- Consult with financial advisors but make the final decisions yourself.

- Learn from past financial decisions to refine your strategies.

📝 Note: Financial agency is about making your financial decisions in line with your values and long-term vision, rather than just following advice.

Tools and Resources for Empowering Financial Decisions

To aid in your financial empowerment, here are some tools and resources:

Financial Apps and Software

- Personal Finance Management (PFM): Apps like Mint, YNAB (You Need A Budget), or PocketGuard help track expenses and manage budgets.

- Investment Platforms: Platforms like Robinhood, E*TRADE, or Betterment make investing accessible for beginners and seasoned investors alike.

| App/Software | Primary Use |

|---|---|

| Mint | Budget tracking, bill reminders |

| YNAB | Zero-based budgeting, future forecasting |

| Betterment | Automated investment management, robo-advisor |

Financial Education Platforms

- Websites like Investopedia offer comprehensive articles and tutorials.

- Courses on platforms like Coursera or Udemy can provide in-depth learning.

Navigating Common Financial Pitfalls

Making empowered financial decisions involves navigating several potential pitfalls:

1. Emotional Decisions

Market volatility or personal pressures can lead to emotionally driven financial decisions. Techniques like:

- Mindful investing: Take time to reflect on your decisions.

- Automated investing: Set up regular contributions to remove emotion from the equation.

2. Over-Analysis

Analysis paralysis can stall your financial progress. Learn to:

- Set a time limit for research before making a decision.

- Develop a decision-making framework to streamline choices.

3. Lack of Diversification

Not spreading your investments across different asset classes can increase risk. Ensure you:

- Assess your risk tolerance and diversify accordingly.

- Regularly rebalance your portfolio.

💡 Note: Diversification isn't just about asset allocation; it's also about choosing investments with different economic cycles, locations, and sectors to mitigate risk.

Your financial journey is not just about accumulating wealth but mastering the art of making decisions that lead to financial well-being. By embracing financial literacy, setting clear goals, engaging in active financial planning, and utilizing the right tools, you can exert true agency over your finances. Remember, the key to financial empowerment lies in the choices you make daily, the knowledge you acquire, and the strategies you implement. As you navigate through economic uncertainties, let this guide empower you to make decisions that align with your financial values and goals, ensuring a prosperous future where you are at the helm of your financial destiny.

What is financial agency?

+

Financial agency refers to the power and control an individual or entity has over their financial decisions. It’s about actively choosing how to manage, invest, and grow one’s wealth.

Why is financial literacy important?

+

Financial literacy equips you with the knowledge needed to understand and manage financial resources effectively, leading to better decision-making and financial stability.

How can one avoid common financial pitfalls?

+

Avoiding financial pitfalls involves emotional discipline, setting decision-making time limits, and diversification to reduce risk exposure. Implementing these strategies helps mitigate common mistakes.

What tools can I use to enhance my financial decisions?

+

Personal Finance Management (PFM) apps, investment platforms, and educational resources like Investopedia or online courses can help you make informed financial choices.

What are the steps to setting financial goals?

+

To set financial goals, follow these steps: define your objectives clearly, assess your current financial status, prioritize goals, quantify them with specific amounts and timelines, and regularly review and adjust your plan.