Smart Tips for Financing Your Car Purchase

Buying a car is one of the most significant financial decisions many of us make, requiring careful planning and consideration, especially when it comes to financing. Whether you're eyeing a brand new model with all the bells and whistles or considering a reliable used vehicle, navigating through financing options can be as crucial as choosing the right make and model. Here, we'll explore various strategies, tips, and considerations to help you finance your car purchase smartly.

Understanding Your Financing Options

Before diving into specific financing tips, understanding the different ways you can finance your car purchase is crucial. Here are the primary methods:

- Car Loans from Banks: Traditional loans from banks or credit unions with potentially lower interest rates, especially if you have good credit.

- Car Dealership Financing: Offers often include manufacturer incentives but might come with higher rates compared to banks.

- Leasing: An option where you pay for the depreciation of the car during the lease period rather than ownership, often including a lower monthly payment.

- Home Equity Loans or Lines of Credit: These can provide lower rates but tie your vehicle purchase to your home, which increases risk.

- Personal Loans: Unsecured loans, which might have higher interest rates but offer flexibility.

Strategies for Securing the Best Financing

Know Your Credit Score

Your credit score plays a pivotal role in determining the interest rate you’ll qualify for. Here’s what to do:

- Check your credit score from all three major credit bureaus.

- Dispute any errors or inaccuracies found on your credit report.

- If your score needs improvement, consider taking steps like reducing debt or paying down credit card balances before applying for a loan.

🌟 Note: A higher credit score can save you thousands in interest over the life of your loan.

Shop Around for Loans

Don’t settle for the first loan offer you receive:

- Compare rates from banks, credit unions, and online lenders.

- Use pre-approval options which typically won’t affect your credit score significantly.

- Consider using a car loan calculator to see how different terms and rates affect your monthly payments.

Negotiate at the Dealership

When negotiating at the dealership:

- Have pre-approvals from multiple sources to leverage for better dealership financing.

- Focus on the total cost, not just the monthly payment. Extended terms can seem more affordable but will increase the overall cost.

| Negotiation Strategy | Benefits |

|---|---|

| Pre-Approval from Multiple Lenders | More bargaining power for lower rates and terms |

| Focusing on Total Cost | Prevents overpaying due to hidden fees or extended terms |

What to Consider Before Finalizing Your Decision

Loan Term Length

The length of your loan term impacts your monthly payments and total interest paid:

- Short-term loans result in higher monthly payments but less interest over time.

- Long-term loans reduce monthly payments but significantly increase total interest paid.

Down Payment

A significant down payment can:

- Reduce your loan amount, lowering monthly payments and total interest.

- Make you look like a better credit risk, potentially securing better loan terms.

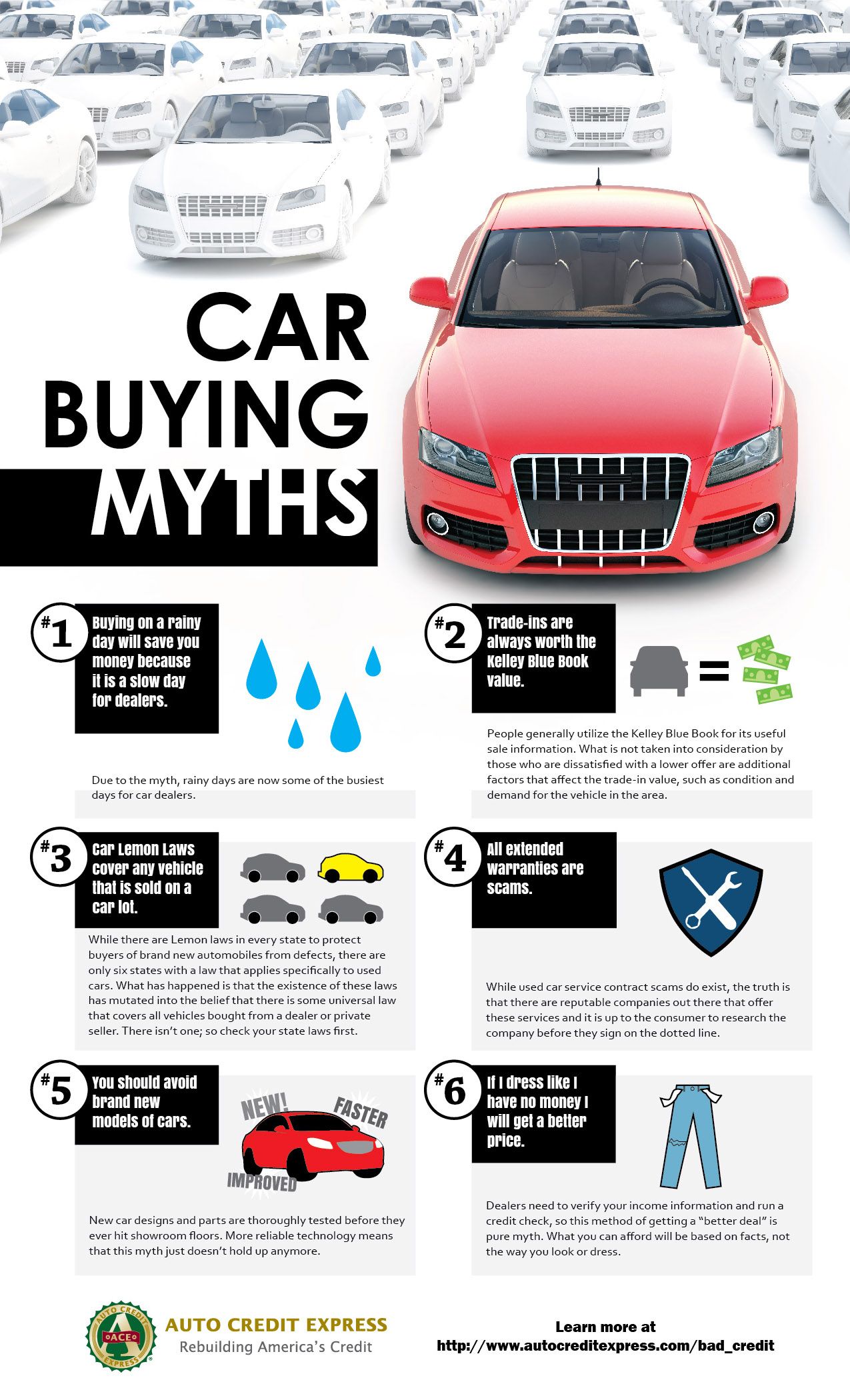

Loan Extras

Be cautious of:

- GAP insurance (Guaranteed Auto Protection) - useful if you owe more than the car’s value.

- Extended warranties, which might not be worth it if the car has a good reputation for reliability.

Smart Financing Tips

Understand All the Costs

Don’t just look at the sticker price or the monthly payment:

- Include taxes, registration, dealer fees, and any extras you might opt for.

Don’t Forget About Maintenance

Plan for:

- Regular maintenance and unexpected repairs.

Consider Future Financial Changes

Think about:

- Job security, family changes, or potential moves that might impact your ability to make payments.

In summary, financing a car involves several steps from understanding your credit worthiness, to shopping around for the best rates, to carefully negotiating at the dealership. Remember, the best financing isn’t just about getting the lowest interest rate; it’s about structuring the loan in a way that matches your long-term financial health and goals. By keeping these tips in mind, you can drive off the lot with confidence, knowing you’ve made a smart financial decision.

How important is my credit score when financing a car?

+

Your credit score significantly impacts the interest rate you’ll receive. A higher score can lead to substantial savings over the loan term.

Should I choose a short or long loan term?

+Short-term loans mean higher monthly payments but less interest over time. Long-term loans lower your monthly burden but increase the total interest paid.

Is it better to finance through a dealership or bank?

+It depends. Dealerships might offer incentives or manufacturer-backed rates, but banks can provide lower rates if you have excellent credit. Always compare offers.

What is the role of a down payment in car financing?

+A larger down payment can reduce the loan amount, lowering both the monthly payments and total interest over time, making you a better risk for lenders.

Related Terms:

- Disadvantages of financing a car

- Car finance options explained

- Financing vs leasing a car

- What is financing a car