5 Ways Robotic Process Automation Transforms Finance

Business finance is a field steeped in the meticulous handling of numbers, records, and compliance. With the advent of Robotic Process Automation (RPA), finance professionals can now harness technology to streamline tasks, reduce errors, and focus on strategic activities. Here are five ways RPA is revolutionizing finance:

1. Automated Data Entry and Reconciliation

Data entry and reconciliation are often the most time-consuming tasks in finance. RPA bots can seamlessly:

- Extract data from invoices, receipts, and bank statements.

- Perform validation checks on entered data.

- Reconcile figures between different financial records.

By automating these processes, finance departments can:

- Reduce human error.

- Increase efficiency by eliminating manual, repetitive tasks.

- Ensure consistency and accuracy in financial reporting.

🔗 Note: It’s critical to ensure RPA solutions are compliant with data protection regulations like GDPR or CCPA to maintain the integrity of financial data.

2. Fraud Detection and Prevention

Finance teams employ various strategies to mitigate the risk of fraud. RPA enhances these efforts by:

- Analyzing transaction patterns to detect anomalies in real-time.

- Monitoring user behavior to identify suspicious activities.

- Implementing automated checks for duplicate or suspicious payments.

These benefits include:

- Proactive fraud prevention.

- Real-time alerts to potential fraud.

- Reduced risk exposure through automated checks.

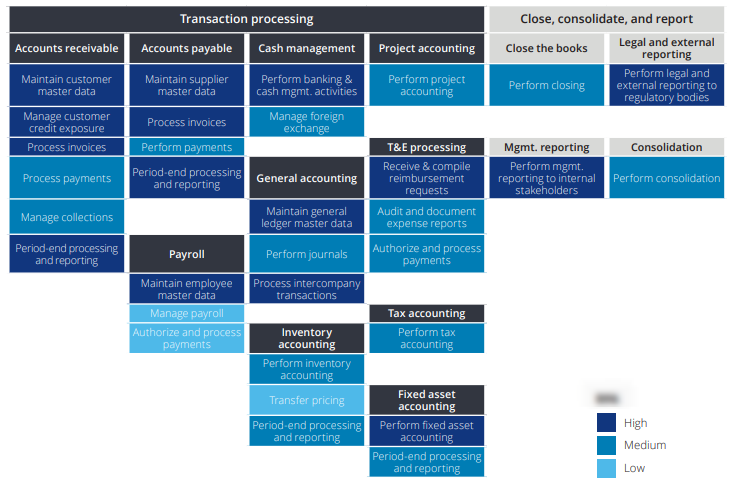

3. Streamlined Accounts Payable and Receivable

The processes of managing accounts payable (AP) and accounts receivable (AR) can be immensely labor-intensive. RPA can:

- Automate invoice processing, reducing manual input.

- Automatically flag for discrepancies or approval if conditions are met.

- Expedite the collections process by automating reminder emails for outstanding invoices.

Here’s how it helps:

- Accelerates payment cycles for better cash flow management.

- Reduces days sales outstanding (DSO) in AR.

- Minimizes late payments and overdue accounts.

4. Compliance and Audit Management

Regulatory compliance is a cornerstone of finance. RPA tools can:

- Ensure timely and accurate reporting.

- Automate the creation of compliance documentation.

- Assist in internal and external audits by providing data on-demand.

This results in:

- Reduced risk of non-compliance.

- Streamlined audit processes.

- Enhanced transparency and traceability in financial transactions.

Here is a sample table showing how RPA can assist in compliance:

| Regulation | RPA Capability |

|---|---|

| Sarbanes-Oxley Act | Automates the creation and tracking of necessary documentation. |

| IFRS | Standardizes and validates data entries according to IFRS standards. |

| GDP | Monitors and logs financial transactions for audit trails. |

5. Strategic Decision-Making

While RPA handles mundane tasks, finance teams can focus on:

- Analyzing big data for strategic insights.

- Creating predictive models for financial forecasting.

- Conducting scenario analysis for better risk management.

The automation of routine tasks allows for:

- More time dedicated to analysis and strategy.

- Agile response to market changes through enhanced data-driven decisions.

- Proactive identification of opportunities and threats.

To conclude, Robotic Process Automation isn't just about replacing human effort with bots; it's about enabling finance professionals to operate at their highest potential. By automating routine tasks, organizations can foster innovation, accuracy, and strategic agility in their finance departments. With RPA, finance transforms from a reactive, record-keeping function to a proactive, strategic partner in business growth and governance.

Can RPA be integrated with existing financial systems?

+

Yes, RPA can be seamlessly integrated with existing financial systems such as ERP, CRM, and accounting software, enhancing their capabilities without replacing them.

How does RPA impact job roles in finance?

+

RPA shifts finance professionals’ roles from administrative tasks to more analytical, strategic, and decision-making responsibilities, creating more value-driven positions.

What are the common concerns when implementing RPA in finance?

+

Common concerns include data security, compliance with regulations, initial setup costs, and the need for continual updates as systems and processes evolve.