Car Finance Payment Calculator: Your Best Deal Finder

Are you in the market for a new car but feel overwhelmed by the financing options available? Understanding how much you can afford to pay each month for a car loan is crucial not only to manage your finances effectively but also to find the best deal available. This article will guide you through the intricacies of using a Car Finance Payment Calculator to find your ideal car financing terms and help you make an informed decision.

What is a Car Finance Payment Calculator?

A car finance payment calculator is a tool designed to estimate your monthly payments for a car loan based on variables like the loan amount, interest rate, term of the loan, and any down payment you might make. Here's why you should consider using one:

- Financial Planning: Helps you determine how much car you can afford.

- Comparison: Allows you to compare different loan scenarios to find the best deal.

- Time-Saving: Reduces the time needed to analyze loan options manually.

- Transparency: Offers a clear picture of your total repayment amount, including interest.

💡 Note: Regularly revisiting your financial situation before using the calculator can help adjust your calculations for changes in income, expenses, or interest rates.

How to Use a Car Finance Payment Calculator

Here's a step-by-step guide on using a car finance payment calculator effectively:

1. Gather Essential Information

- Car Price: The total cost of the vehicle you’re considering.

- Down Payment: The upfront amount you can afford to pay.

- Loan Term: How long you wish to take the loan for (e.g., 36, 48, or 60 months).

- Interest Rate: The rate at which the loan will accrue interest.

- Trade-In Value: If applicable, the value of any vehicle you’re trading in.

2. Enter the Information into the Calculator

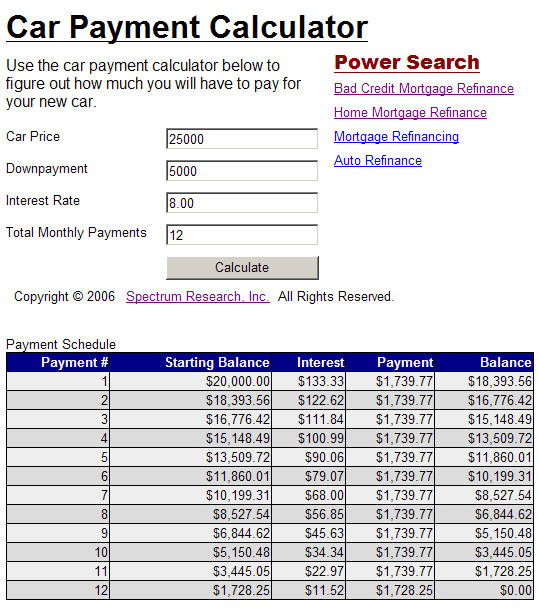

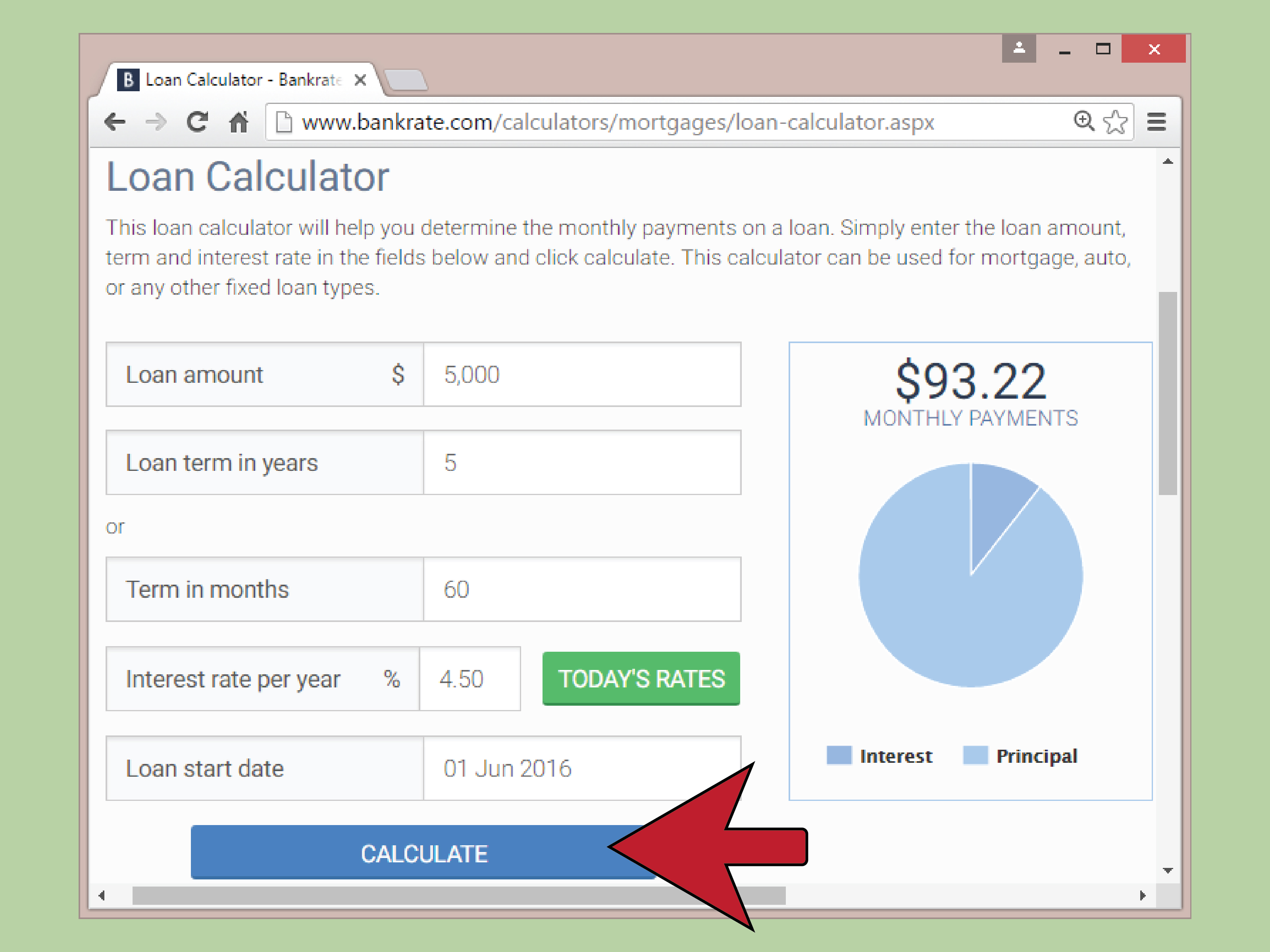

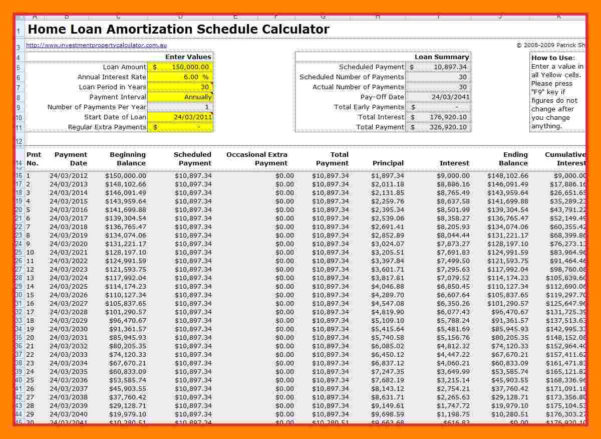

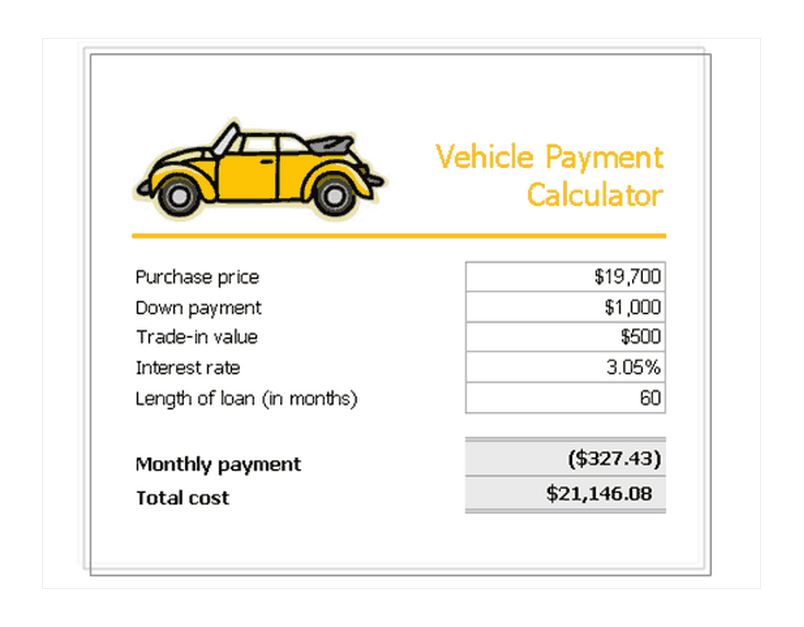

Input these details into the calculator. Here’s an example of how a basic car finance payment calculator might work:

| Item | Input |

|---|---|

| Vehicle Price | $30,000 |

| Down Payment | $5,000 |

| Loan Term (months) | 48 |

| Interest Rate | 6.5% |

| Trade-In Value | $3,000 |

3. Analyze the Results

The calculator will provide you with:

- Monthly Payment: This tells you how much you’ll need to budget each month for the car payment.

- Total Interest: How much interest you will pay over the life of the loan.

- Total Payment: The sum of all payments, including interest.

📌 Note: Remember that the calculator gives an estimate; lenders might have additional fees or require different down payments which could alter the final terms.

Additional Factors to Consider

Beyond the basic car finance calculator, there are other factors you should consider:

1. Additional Costs

- Sales Tax: This can significantly increase your monthly payments.

- Registration and Title Fees: These are one-time costs but need to be accounted for.

- Insurance: Comprehensive auto insurance is typically more than your monthly car payment.

- Fuel and Maintenance: Owning a car means ongoing expenses for gas and upkeep.

2. Type of Financing

Consider whether you want a traditional loan, lease, or even alternative financing options like peer-to-peer lending:

- Leasing: Usually has lower monthly payments but involves restrictions on mileage and wear.

- Bank Loans: Might offer better rates if you have good credit or bank with them.

- Manufacturer Financing: Special rates or promotions from carmakers can save you money.

- Peer-to-Peer Lending: An emerging option for those with less-than-stellar credit scores.

Benefits of Online Car Finance Calculators

Using an online calculator offers several advantages:

- Accessibility: You can run the calculations anytime, anywhere.

- Customization: Most allow you to adjust parameters easily.

- Accuracy: With precise input, these tools provide highly accurate results.

- Ease of Use: User-friendly interfaces make it simple to compare different scenarios.

Final Thoughts

Choosing the right car finance plan involves understanding your financial health, the vehicle’s cost, and the market’s current financing options. A car finance payment calculator serves as a vital tool in this process, helping you navigate the often complex world of auto loans. By estimating your monthly payments, total interest, and total cost, you’re better equipped to find a deal that aligns with your budget and lifestyle. Remember that while calculators provide estimates, your actual payments might vary based on lender terms, additional fees, and your credit situation. Use this tool as a starting point for negotiations, ensuring that you’re not caught off-guard by unforeseen expenses or terms that don’t suit your financial strategy. With careful planning, you can drive off the lot in the vehicle of your choice, confident that you’ve secured the best possible financing terms.

What if I can’t afford the monthly payments calculated?

+

You might need to consider a larger down payment, a longer loan term, or looking at less expensive vehicles. Also, improving your credit score can result in lower interest rates, which would decrease your monthly payments.

Do car finance payment calculators account for taxes and fees?

+

Basic calculators might not. You could estimate these or use more advanced calculators that allow for customization to include these costs.

Can I use the calculator to compare different types of loans?

+

Yes, by adjusting interest rates, loan terms, and even down payments, you can compare how different loan options impact your monthly payments.

How often should I use a car finance payment calculator?

+

Use it as needed when your financial situation changes or when you’re considering a new vehicle purchase to ensure you’re making the best decision based on current circumstances.