Essential Tips for Securing Car Finance Easily

Securing car finance can often seem like a daunting task, especially in today's economic climate where interest rates can fluctuate, and lenders have stricter criteria. However, with the right strategies and an understanding of the car financing landscape, you can navigate through this process smoothly and secure the loan that best fits your needs and financial situation.

Understanding Car Finance Options

Car finance isn’t one-size-fits-all. There are several avenues to explore, each with its own set of benefits and drawbacks:

- Car Loans: Traditional loans where you borrow money from a bank or lender, repay it over a period, and use the car as collateral.

- Leasing: You make monthly payments to use a vehicle for a set period without owning it outright. This option often comes with lower monthly payments.

- Personal Loans: Unsecured loans where no collateral is needed, offering flexibility but usually at higher interest rates.

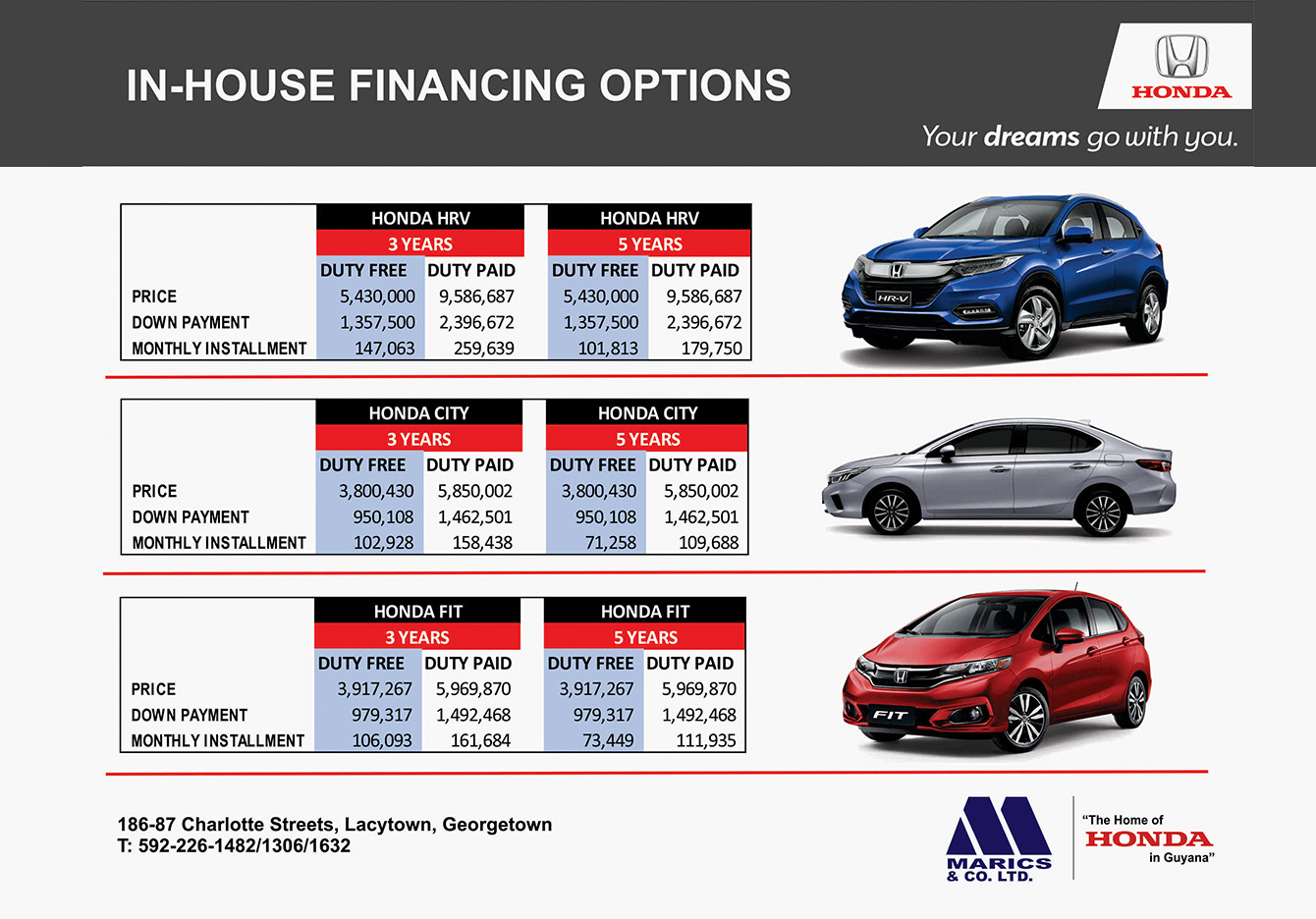

- Dealer Financing: Dealerships often have relationships with lenders, providing loans directly to customers, sometimes with incentives.

Choosing the right option depends on your long-term car ownership plans, financial health, and how you handle monthly payments.

Preparing Your Finances

Before you dive into applications, ensure you’re in a strong financial position:

- Check your Credit Score: A high credit score can unlock better rates. If it’s not where you’d like it to be, consider paying down debts or correcting any inaccuracies on your credit report.

- Save for a Down Payment: A larger down payment reduces the loan amount, your monthly payments, and shows lenders you’re serious about buying a car.

- Review Your Budget: Calculate how much you can afford to pay monthly after all expenses. A general rule is to not spend more than 10-15% of your take-home pay on car expenses.

Navigating the Application Process

Once you’ve prepared financially, here’s how to proceed:

- Shop Around: Don’t settle on the first offer. Compare rates, terms, and conditions from different lenders or credit unions.

- Pre-Approvals: Get pre-approved for a car loan. This not only shows dealerships you’re a serious buyer but also gives you a budget to work within when selecting a car.

- Understand All Fees: Be aware of all costs involved, from loan origination fees to prepayment penalties. Ask lenders for a complete breakdown.

- Negotiate: Just like buying the car itself, the loan terms are negotiable. If you have good credit or a substantial down payment, you might get a better rate.

The Importance of Documentation

Having the right documents at hand can expedite the car finance process:

- Proof of income (pay stubs or tax returns)

- Proof of residence (utility bill or rental agreement)

- Proof of insurance (vehicle insurance details)

- Personal details (ID or passport)

Considerations for Used vs. New Cars

When it comes to financing:

- New Cars: Generally, new cars come with better financing options like zero percent APR or manufacturer incentives. However, they depreciate rapidly.

- Used Cars: You might face higher interest rates due to the increased risk for lenders. However, the overall cost can be lower, and they come with warranties or certified pre-owned programs.

The Role of Negotiating the Car Price

Negotiating the car’s price can impact your loan amount:

- Always negotiate the car’s selling price before discussing financing.

- Use competitive quotes from other dealerships as leverage.

- Be ready to walk away if the deal isn’t right. There are always other cars and financing options available.

📝 Note: Remember, car finance isn't just about securing a loan, but securing the right loan for your situation. Patience and preparation can lead to better terms and a more affordable vehicle.

In closing, securing car finance isn't merely a financial transaction; it's an important step in achieving personal and financial independence. By understanding the various car finance options, preparing your finances meticulously, navigating the application process wisely, and understanding the implications of your choices, you can drive off the lot with confidence. Whether you're opting for a brand new vehicle or a reliable used car, the key is to align your finance choice with your long-term goals, ensuring it's a decision that supports rather than strains your financial health.

What’s the difference between leasing and buying with a loan?

+

Leasing involves lower monthly payments, and you never own the vehicle, whereas buying with a loan results in ownership after the loan is paid off, but usually with higher monthly payments.

Can I refinance my car loan?

+

Yes, you can refinance your car loan if you find a better rate or terms elsewhere, which could potentially reduce your monthly payments or the total interest paid.

How does my credit score impact car finance?

+

A higher credit score generally leads to lower interest rates because lenders see you as less of a risk, while a lower score might mean higher rates or difficulty securing a loan.