7 Ways to Master Very Finance Techniques Today

Understanding the complexities of modern finance can be a daunting task, but with the right techniques, it's not only possible to manage your personal finances better but also to make informed investment decisions. Here, we'll explore seven very finance techniques that can pave the way to financial mastery in today's fast-paced economic environment.

1. Budgeting Beyond the Basics

The cornerstone of financial discipline is budgeting. However, basic budgeting often isn’t enough. Here are advanced techniques for budgeting:

- Zero-Based Budgeting: Assign every dollar of income to a specific expense, investment, or savings goal, ensuring nothing is left unaccounted.

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Incremental Budgeting: Gradually increase the amount set aside for savings and investments by a small percentage each month.

2. Understanding Investment Diversification

The adage “Don’t put all your eggs in one basket” holds true in finance. Here’s how to diversify:

- Asset Allocation: Spread investments across different asset classes like stocks, bonds, and real estate.

- Geographic Diversification: Invest in markets across different countries to mitigate country-specific risks.

- Sector Diversification: Distribute your investments across various industries to reduce sector-specific risks.

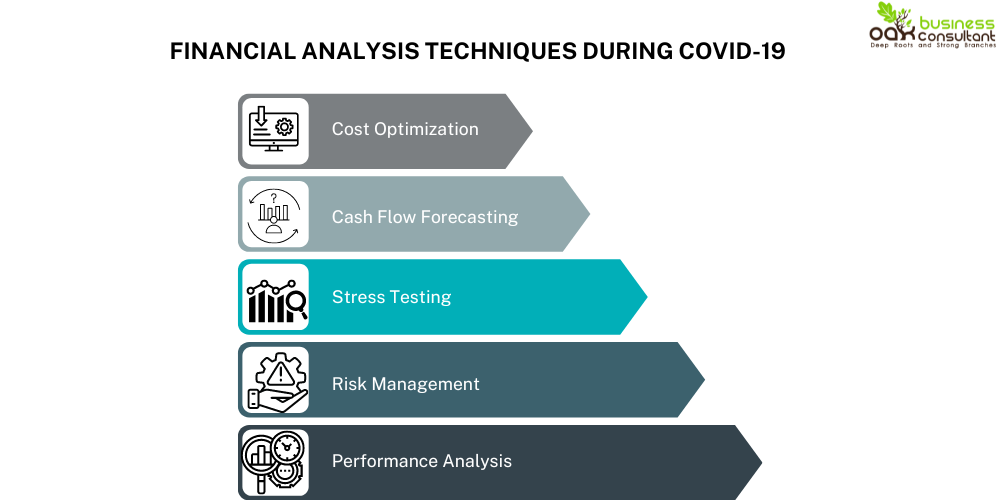

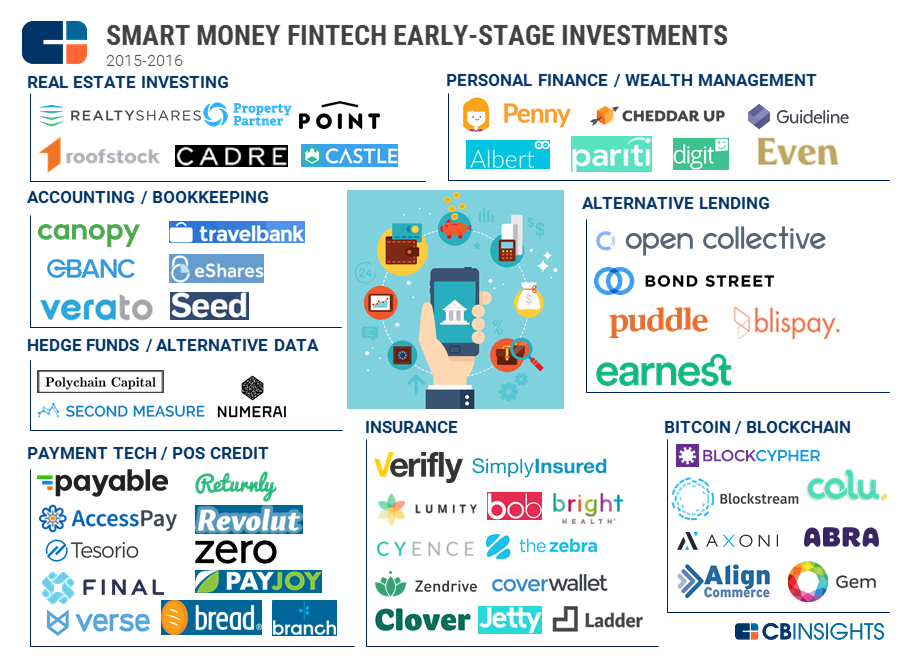

3. Leveraging Financial Technology

Fintech has transformed the financial landscape. Use these tools:

- Robo-Advisors: These automate investment decisions based on your risk tolerance and goals.

- Mobile Banking Apps: For real-time budget tracking, instant transfers, and immediate financial decision-making.

- Budgeting Software: Tools like Mint, YNAB, or PocketGuard help you visualize and manage your finances more effectively.

💡 Note: Ensure the security of your data when using fintech tools by choosing reputable providers with strong privacy policies.

4. Embracing the Debt Snowball Method

The Debt Snowball method involves paying off debts from smallest to largest, regardless of interest rate, to gain psychological momentum:

- List all debts in order of balance size.

- Pay the minimum on all but the smallest debt.

- Focus extra payments on the smallest debt until it’s paid off.

- Use the money from the paid-off debt to accelerate the next smallest debt’s payoff.

Although not always the most mathematically optimal, the psychological wins can boost motivation.

5. Mastering Retirement Planning

Retirement isn’t just for the elderly. Here are key strategies:

- Start Early: The earlier you start saving, the more time your money has to grow through compound interest.

- 401(k) Matching: Utilize employer matching programs to maximize your retirement contributions.

- IRA Contributions: Understand the differences between traditional and Roth IRAs to make the best choice for tax benefits.

6. Efficient Tax Planning

Tax planning can significantly reduce your tax liabilities. Here’s what you need to know:

- Tax Harvesting: Selling investments at a loss to offset capital gains tax.

- Contribute to Retirement Accounts: Contributions can often be deducted from your taxable income.

- Charitable Giving: Donate to qualified charities to reduce taxable income.

⚠️ Note: Always consult with a tax professional to ensure your strategies align with current tax laws.

7. Engaging with Financial Education

Constant learning is essential in finance:

- Online Courses: Platforms like Coursera and Udemy offer finance and investment courses.

- Podcasts: Listen to financial podcasts like “Planet Money” or “The Money Girl” to stay updated.

- Books: Books like “The Intelligent Investor” by Benjamin Graham provide timeless financial wisdom.

Summing up, mastering very finance techniques involves a mix of budgeting, investment diversification, embracing technology, debt management, retirement planning, tax optimization, and continuous learning. By integrating these techniques into your financial routine, you set the stage for not only securing your financial future but also navigating the complexities of today's financial markets with confidence. The journey to financial mastery is ongoing, but with the right knowledge and tools, you can achieve a financially secure and prosperous life.

What is the difference between traditional and Roth IRAs?

+

A traditional IRA allows you to contribute pre-tax earnings, reducing your taxable income now, with taxes paid upon withdrawal. Conversely, a Roth IRA uses after-tax contributions, so qualified withdrawals in retirement are tax-free.

Can budgeting help in reducing financial stress?

+

Absolutely. Budgeting provides clarity on your financial situation, allowing you to plan for expenses, save, and avoid unexpected financial shocks, thereby reducing stress.

How does financial technology impact personal finance?

+

Fintech simplifies managing finances by offering tools for real-time tracking, automated investment advice, and faster, more secure transactions, all of which can enhance your financial decision-making process.