Vauxhall Finance Calculator: Find Your Perfect Payment Plan

The cost of buying a new or used Vauxhall vehicle often involves several elements, one of which is financing. Understanding the financial aspect of car ownership is crucial for making an informed decision. A Vauxhall finance calculator can be your ally in finding the most suitable payment plan tailored to your financial situation.

Understanding the Vauxhall Finance Calculator

The Vauxhall finance calculator is an online tool designed to help potential car buyers calculate their monthly payments based on their desired vehicle and chosen financing options. Here's how it can assist you:

- Customization: You can input the price of the car, the down payment, interest rate, loan term, and even trade-in values to tailor your plan.

- Transparency: It provides clear information about the total cost of financing, including interest over time.

- Comparison: This tool allows you to compare different financing scenarios quickly, helping you choose the best deal.

Key Components of Vauxhall Car Finance

When you're considering financing your Vauxhall, here are the key components you need to understand:

- Vehicle Price: This is the agreed-upon purchase price of the car.

- Down Payment: The initial payment you make, which reduces the amount you need to finance.

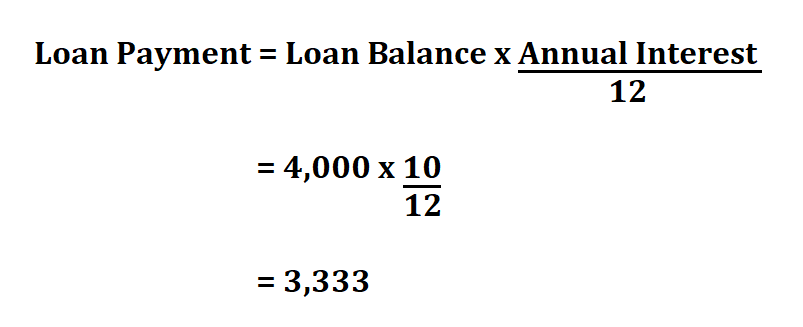

- Interest Rate: The rate at which interest is charged on the loan balance.

- Loan Term: How long you have to repay the loan, affecting both monthly payments and total interest.

- Monthly Payments: The amount you'll pay monthly, which includes both principal and interest.

- Residual Value: In some finance agreements, particularly Personal Contract Purchase (PCP), this is the estimated future value of the car at the end of the finance term.

How to Use the Vauxhall Finance Calculator

Here is a step-by-step guide to help you navigate the Vauxhall finance calculator:

Step 1: Select the Car

Choose your desired Vauxhall model from the list available. This selection will help determine the car's base price, which you'll use as the starting point for your calculations.

Step 2: Enter Loan Details

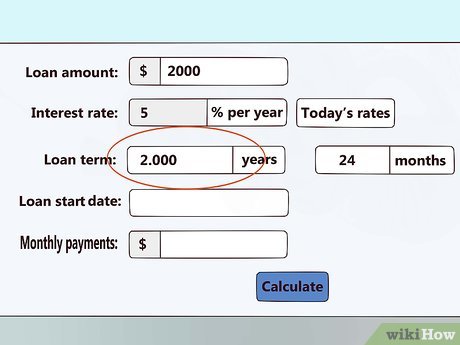

Input the following details into the calculator:

- Vehicle price

- Down payment

- Interest rate

- Loan term (e.g., 36, 48, or 60 months)

- Annual mileage (for PCP or hire purchase with balloon payments)

Step 3: Review the Results

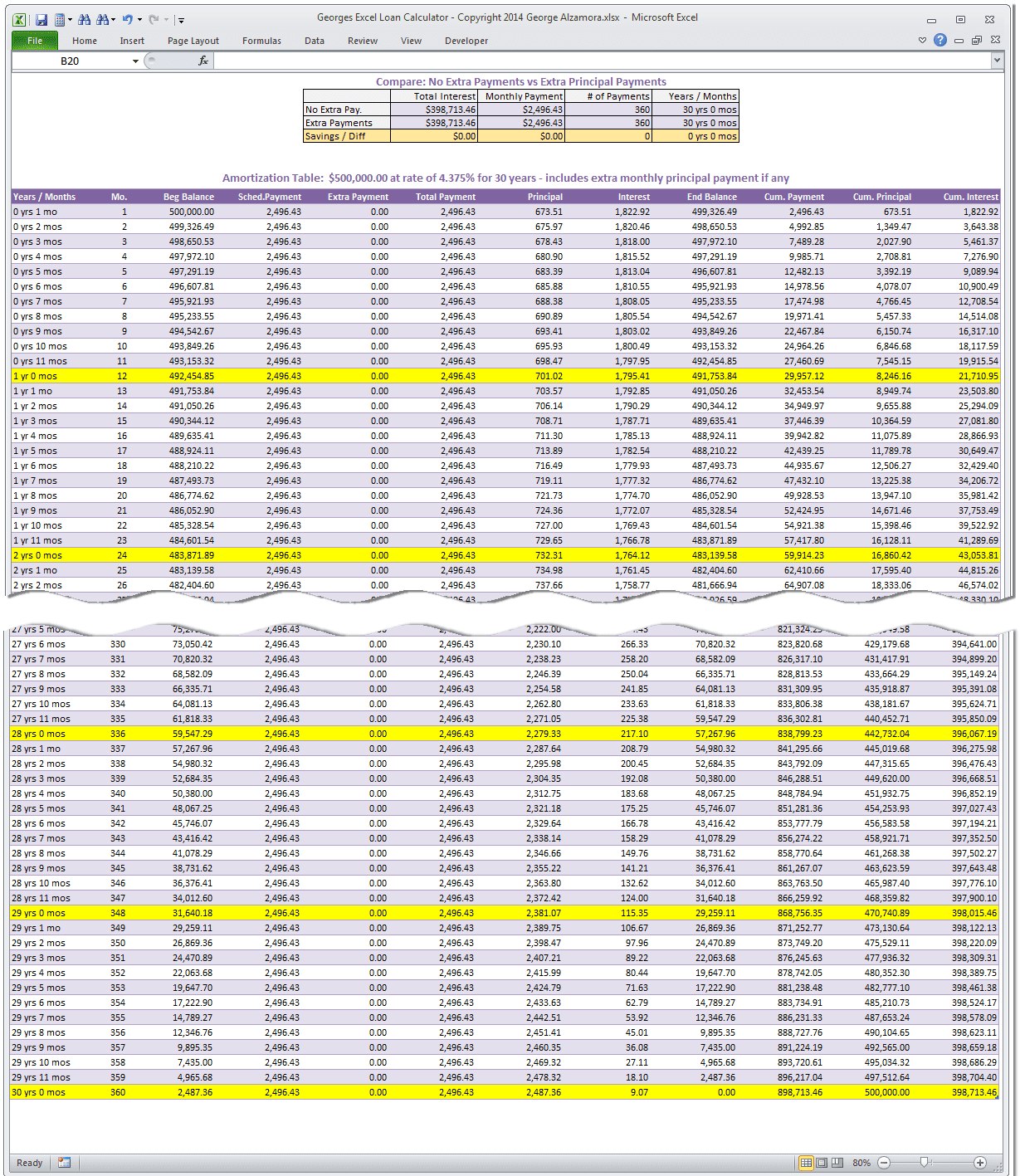

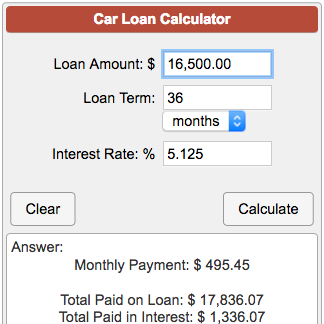

Once you've entered all your information, the calculator will show:

- Monthly Payment

- Total Interest

- Total Cost of Ownership

Step 4: Adjust Parameters

You might want to:

- Change the loan term

- Increase or decrease the down payment

- Consider different interest rates

This will help you understand how these changes affect your monthly payments and overall financial commitment.

Step 5: Finalize Your Finance Plan

After experimenting with different scenarios, you can choose the finance plan that best fits your budget and lifestyle. Remember, the calculator only provides estimates, and actual terms will be determined by the finance company.

💡 Note: Always consider your full financial picture, including insurance, maintenance, and potential future depreciation when planning your car finance.

Types of Vauxhall Car Finance

Here are the different finance options available:

- Personal Contract Purchase (PCP): Lower monthly payments with a balloon payment at the end to either purchase the car or return it.

- Hire Purchase (HP): You pay a fixed amount monthly until the vehicle is fully paid off.

- Personal Loan: Borrow money from a bank or lender and buy the car outright, which you then own.

- Leasing: Essentially long-term car rental, with no option to own the car at the end.

Choosing the Right Financing Option

When deciding on finance, consider:

- Ownership: Do you want to own the car at the end, or is flexibility more important?

- Mileage: Higher annual mileage might push you towards HP or a personal loan, as PCP has mileage restrictions.

- Upfront Costs: Down payments can be significant with some plans.

- Future Flexibility: PCP offers the flexibility to change cars every few years.

What Impacts Your Finance Deal?

Several factors can influence the finance deal you receive:

- Credit Score: A higher score might get you better rates.

- Deposit: A larger deposit can lower monthly payments.

- Term Length: Shorter terms mean higher monthly payments but less interest over time.

- Market Value: Depreciation affects the car's residual value in PCP deals.

- Additional Costs: Remember additional charges like maintenance plans or extra warranty.

🚗 Note: Don't forget to account for potential fees like arrangement fees or early settlement fees when planning your finance.

The Importance of Planning for Car Finance

Planning for your Vauxhall financing involves:

- Assessing your credit rating and financial health

- Setting a realistic monthly payment you can afford

- Understanding the total cost of ownership

- Exploring all finance options

Proper planning ensures you not only find a good finance deal but also that you're prepared for the full scope of car ownership.

Understanding and utilizing a Vauxhall finance calculator can simplify the process of securing your dream car. By taking control of your finance options, you ensure that your payment plan is aligned with your long-term financial stability. This tool is your gateway to making an informed, calculated decision on your Vauxhall purchase, providing peace of mind for your road ahead.

How accurate is the Vauxhall finance calculator?

+

The calculator provides estimates based on the data you input. The accuracy can vary, but it gives a good baseline. For precise figures, consult with finance experts or dealers.

Can I use the finance calculator for used cars?

+

Yes, the Vauxhall finance calculator can be used for both new and used cars as long as you input the correct vehicle price and other relevant details.

What if I can’t afford the recommended down payment?

+

Adjust the terms on the finance calculator to see how lowering the down payment affects your monthly payments. However, remember that a lower down payment might mean higher interest payments over time.

Is the interest rate shown in the calculator fixed?

+

The interest rate in the calculator is often an example rate. Actual rates vary based on your credit score, the finance company, and market conditions at the time of finance.