5 Best Deals on Used Tesla Financing

Exploring the Best Deals on Used Tesla Financing

Financing a used Tesla can be an exhilarating yet intricate process. With electric vehicles becoming increasingly popular, it’s wise to explore your financing options for these sustainable, high-performance vehicles. In this blog, we’ll take a comprehensive look at the five best deals available when financing a used Tesla, allowing you to make an informed decision about how to finance your dream car.

1. Low-Interest Rates through Tesla Financing

Tesla offers competitive financing options even on used cars, which can be an attractive deal for potential buyers:

- Low-Interest Rates: Tesla often provides some of the lowest interest rates in the market, sometimes even 0% APR for well-qualified buyers.

- Pre-approval Online: Potential buyers can get pre-approved online, making the financing process quick and convenient.

- Flexible Terms: Choose from various loan terms to fit your financial situation.

💡 Note: Checking your eligibility online does not affect your credit score, making it risk-free to explore your options.

2. Bank and Credit Union Loans

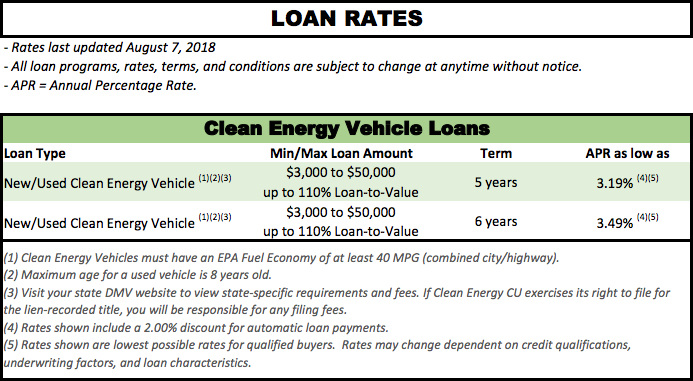

Traditional financial institutions can offer favorable terms for used Tesla financing:

- Negotiable Rates: You might secure a lower rate by negotiating with your bank or credit union.

- Premium and Rewards: Some banks offer loyalty programs or premium accounts that give you access to better rates or exclusive deals.

- Physical Presence: Unlike online-only options, dealing with banks allows for in-person discussions and potentially more personalized service.

3. Credit Card Financing

Although unconventional for vehicle financing, credit cards can be used for:

- 0% Introductory APR: If you have a good credit score, credit cards might offer introductory 0% APR periods which you could use to pay off your Tesla over time.

- Rewards: Earn rewards or cash back on your purchase, effectively reducing the cost of your car.

💡 Note: Be cautious with credit card financing as balances can accrue high interest if not paid off during the introductory period.

4. Online Auto Lenders

Online lending platforms specialize in auto loans, offering convenience and often competitive rates:

- Quick Approvals: Online lenders often provide quick pre-approvals, which is perfect for expediting the purchase process.

- Comparison Shopping: Easily compare loan terms, rates, and lenders in one place.

- Innovative Financing: Some platforms even offer lease-to-own or subscription models for used electric vehicles.

5. Leasing a Used Tesla

Although it’s less common to lease a used car, here's what you might find:

- Lower Monthly Payments: Leases typically have lower monthly payments than loans.

- Warranty Coverage: You might still benefit from some warranty protection that often comes with Tesla vehicles.

- Future Flexibility: At the end of the lease, you can decide whether to buy, return, or trade-in the vehicle.

💡 Note: Ensure you understand the terms of a lease, particularly the residual value and mileage limits, to avoid unexpected charges.

In this rapidly evolving automotive landscape, securing the best deal on financing a used Tesla requires a keen eye for detail, understanding of market trends, and leveraging the best available options. From Tesla's own financing perks to exploring traditional loans, innovative credit card strategies, or embracing the convenience of online lenders, there’s a path for every potential Tesla owner. Remember, the right financing deal not only makes your Tesla more affordable but can also pave the way for a greener and more financially sound future.

To recap, the five best deals on used Tesla financing include:

- Tesla’s attractive in-house financing

- Bank and credit union loans

- Credit card financing

- Online auto lenders

- Leasing options

Is financing a used Tesla a good idea?

+

Financing a used Tesla can be a great idea, especially if you can secure low interest rates or unique financing terms. Electric vehicles tend to have lower operating costs, and with Tesla’s ongoing software updates, your car can improve over time, making it a wise long-term investment.

What are the benefits of using Tesla’s own financing?

+

Tesla’s financing often includes lower interest rates, no dealer fees, easy online pre-approvals, and customizable loan terms. Plus, they have a vested interest in ensuring their customers are satisfied, potentially leading to better customer service.

Can I finance a used Tesla with bad credit?

+

While it can be more challenging, some lenders specialize in subprime auto loans. You might face higher interest rates, but with a healthy down payment or a co-signer, you could still finance a used Tesla even with less than perfect credit.

What should I consider when deciding to lease or buy a used Tesla?

+

Consider your financial situation, driving habits, and future plans. If you enjoy driving new models every few years, leasing might be better. However, if you plan to keep the car for a long time, buying might be more financially sound due to the potential for resale value and overall cost of ownership.