Maximize Your Student Finance: Smart Budgeting Tips

Embarking on your educational journey, whether it's at university, college, or any tertiary institution, comes with its fair share of financial challenges. Student finance, while a vital lifeline for many, often leaves students puzzled on how best to manage their limited resources. Maximizing student finance isn't just about stretching your budget to the last penny; it's about smart budgeting, saving for the future, and making choices that align with your long-term goals. Here, we delve into Smart Budgeting Tips that can help you make the most of your student finance.

Budgeting Basics

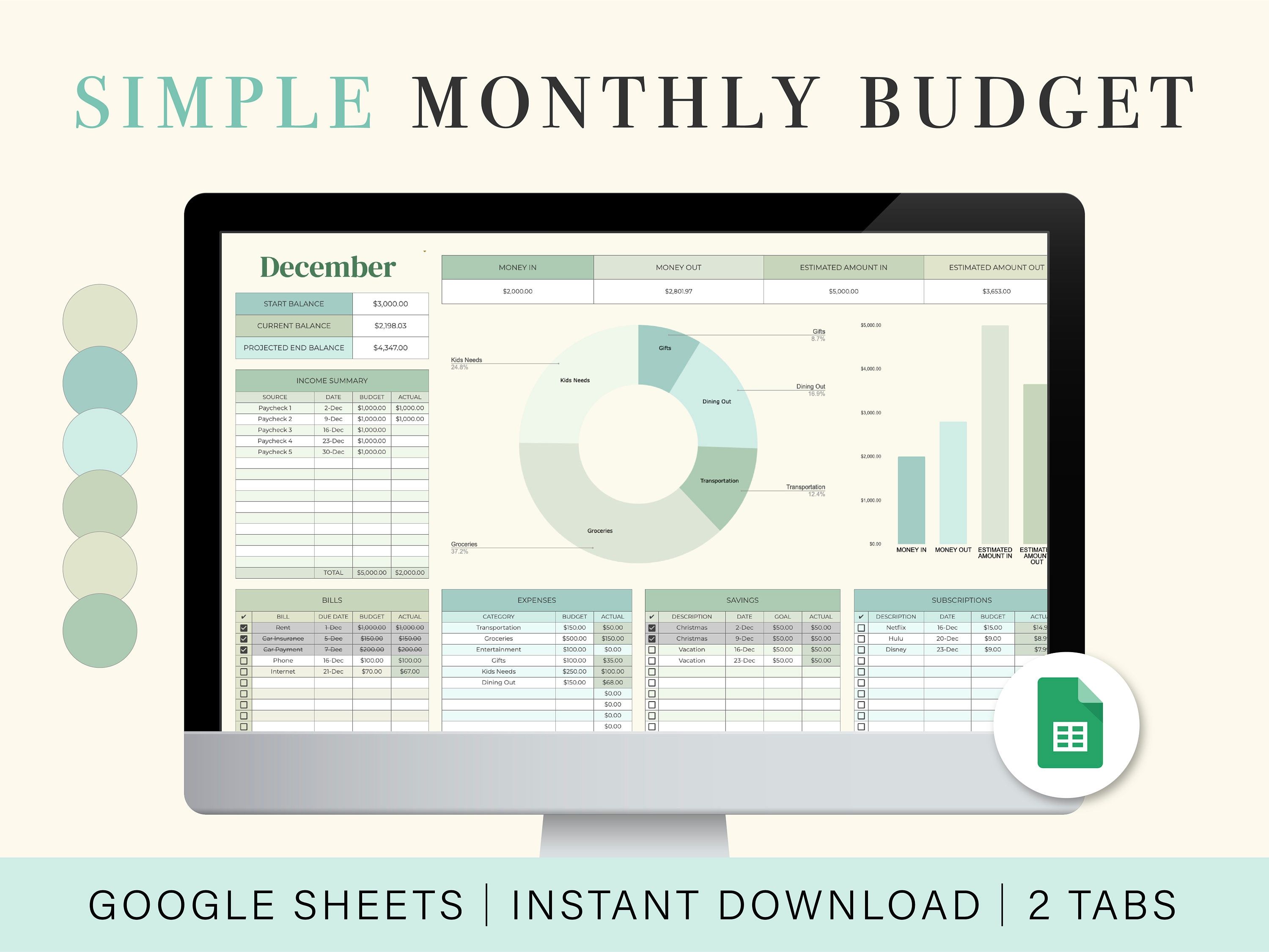

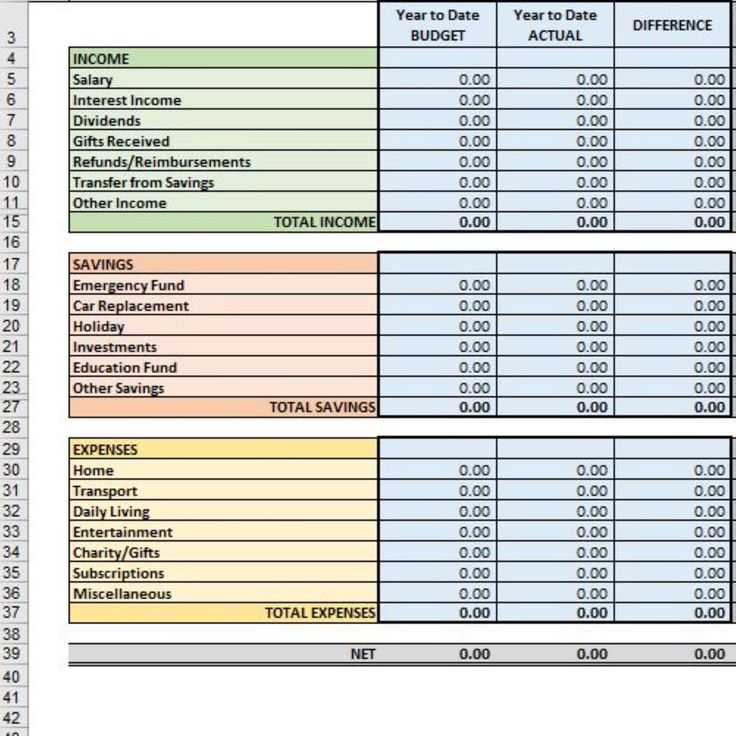

Budgeting is the cornerstone of financial stability. Understanding where your money goes is the first step to mastering your finances.

- Track Your Spending: Use apps, spreadsheets, or even a simple notebook to record every expenditure. This gives you an overview of your financial habits.

- Set Realistic Goals: Define what you want to achieve financially—be it saving for a new laptop, travel, or simply avoiding overdraft fees.

- Establish a Budget Plan: Utilize the 50/30/20 rule where 50% of your income goes to needs, 30% to wants, and 20% to savings or debt repayment.

Cutting Expenses

One effective way to maximize your student finance is by reducing unnecessary expenses.

| Area | Tips for Saving |

|---|---|

| Rent | Consider sharing accommodation or look for student housing discounts. |

| Food | Buy in bulk, cook at home, and limit dining out. Explore campus food pantries. |

| Entertainment | Leverage student discounts, free events, and on-campus entertainment. |

| Travel | Use a bike or public transportation, carpool with friends, or walk when possible. |

Smart Saving Techniques

Saving while on a student budget can seem daunting, but here are some actionable tips:

- Automate Savings: Set up automatic transfers to a savings account to ensure you save regularly.

- Use High-Interest Accounts: Look for student-friendly banks offering higher interest on savings accounts.

- Micro Savings: Apps like Digit or Acorns can round up your purchases and save the change.

Investing for the Future

Even with limited funds, investing can be a part of your financial strategy.

- Education Funds: Use a portion of your finance for education-related investments like stocks or mutual funds, which could grow over time.

- Matching Schemes: If your university or a scholarship program matches student contributions, take full advantage.

- Low-Risk Options: Explore ETFs, index funds, or even peer-to-peer lending platforms designed for cautious investors.

Note: Before investing, understand the risks involved, and consider consulting a financial advisor if necessary.

📈 Note: Investing requires research and understanding your risk tolerance. Always start with what you can afford to lose.

Income Boosting Strategies

Beyond cutting expenses, here are ways to augment your student finance:

- Scholarships and Grants: Continue searching for scholarships; even small ones can add up.

- Part-Time Work: Balance study with a part-time job or work-study program. Choose roles related to your field for added value.

- Freelancing: Use skills you possess to freelance—writing, coding, design, etc., can generate extra income.

- Reselling: Items bought at student discounts or thrift shops can be resold online for profit.

Maximizing student finance is not a one-time task but an ongoing practice. By adopting these budgeting tips, you cultivate habits that will serve you well beyond your student years. Balancing frugality with the necessary indulgences, investing wisely, and continually seeking ways to increase income can ensure you not only survive financially during your studies but thrive, setting a solid foundation for your future.

How can I find scholarships as a student?

+

Look for scholarships through your university’s financial aid office, scholarship databases like Fastweb, community organizations, and national scholarship programs related to your field of study.

Is it worth it to work part-time during my studies?

+

Yes, if you can manage the workload. Part-time work not only provides financial support but also enhances your resume and can offer networking opportunities.

What should I do if I’m struggling financially despite budgeting?

+

Consider speaking to your university’s financial aid office for additional support, explore emergency funds or loans, and reassess your budget to find potential savings.

Can investing as a student actually benefit me?

+

If approached with caution, yes. Investing can teach you about finance, grow your money over time, and prepare you for future financial planning.

How often should I review my budget?

+

At least once a month to ensure you’re on track with your financial goals. Life changes, and so should your budget to reflect these changes.