5 Essential Tips for Student Finance in England

Handling finances as a student can be daunting, especially when balancing academic pursuits with everyday living expenses. The increasing cost of living in the UK further compounds these challenges. However, with strategic planning and smart management, you can ensure your financial stability throughout your academic journey. Here are 5 Essential Tips for Student Finance in England to guide you through this critical aspect of your student life.

1. Understand Your Student Finance Package

The foundation of good student finance management begins with understanding what's available to you.

- Student Loans: This is the primary source of funding for most students. Ensure you know the differences between Maintenance Loans, Tuition Fee Loans, and any potential grants or bursaries.

- Repayments: Understand when and how you'll start repaying your loans. Repayments usually start when you earn above a certain threshold.

- Overdrafts and Credit: Many banks offer student accounts with interest-free overdrafts and sometimes credit cards. Know the terms to avoid over-reliance and potential debt traps.

💡 Note: Make sure to apply for student finance before the deadlines to avoid any hiccups in your funding.

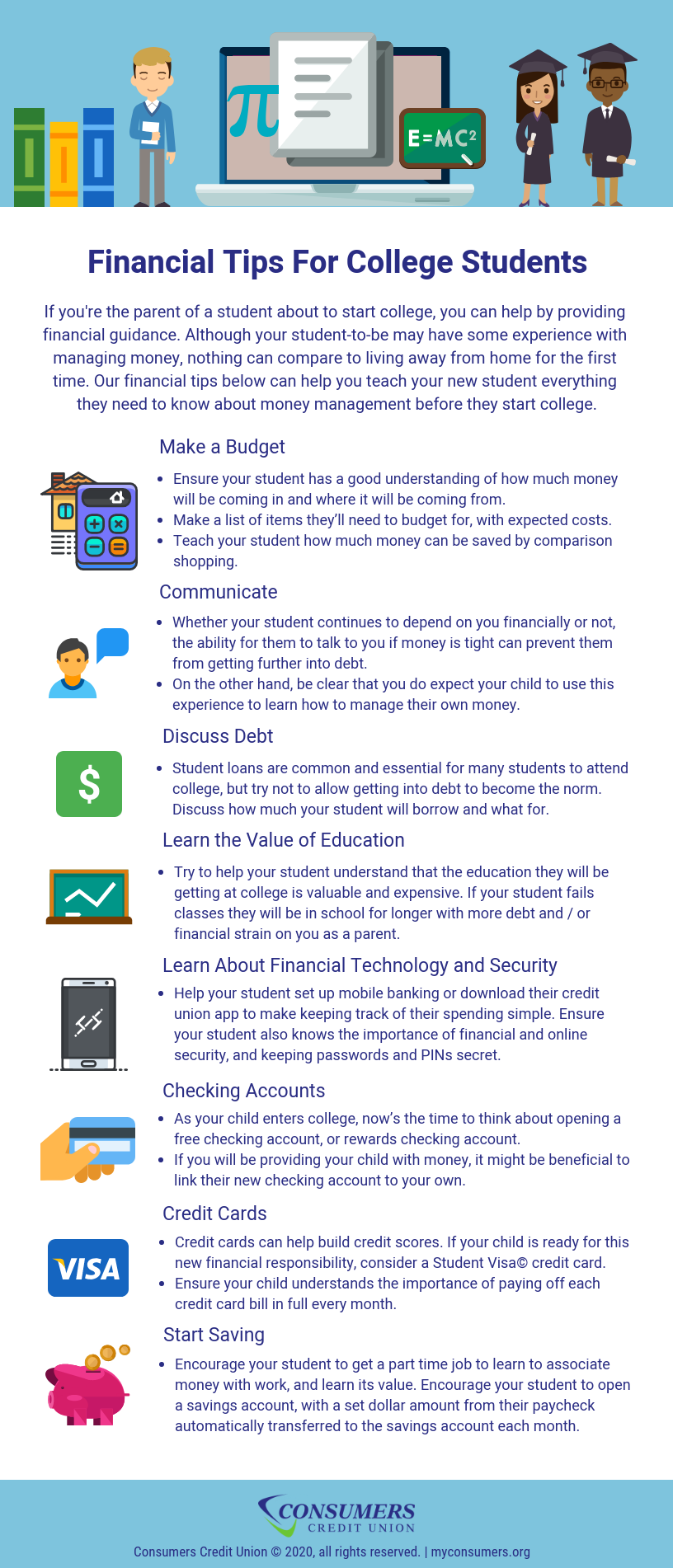

2. Budget Like Your Life Depends on It

The key to avoiding unnecessary spending and financial stress is effective budgeting. Here are some steps:

- Track Your Income: Include student loans, part-time job earnings, savings, or any grants.

- Track Your Expenses: Utilize budgeting apps or simple spreadsheets to monitor where your money goes.

- Allocate Funds Wisely: Divide your money into categories like rent, utilities, food, entertainment, and savings.

- Stick to Your Budget: Discipline is crucial. If you're overspending in one area, adjust your budget or find ways to cut back.

🛑 Note: Regularly review and adjust your budget to accommodate any changes in your financial situation.

3. Explore Multiple Income Streams

Supplementing your student loan with additional income can ease financial pressure:

- Part-time Work: Look for jobs on campus or nearby that fit your study schedule.

- Freelancing: Utilize any skills you have to offer freelance services, like writing, editing, tutoring, or design.

- Scholarships & Bursaries: Seek out external funding sources that might offer scholarships or bursaries.

- Entrepreneurial Ventures: If you have a business idea, consider starting something small.

4. Master the Art of Saving

Developing a habit of saving can significantly benefit your financial health:

- Save Before You Spend: Treat savings like a fixed expense and allocate it first.

- Save on Energy: Use energy-efficient appliances, turn off lights, and reduce heating costs.

- Bulk Buying: Purchase items in bulk like cleaning supplies, toiletries, or even non-perishable food items when they're on sale.

- Student Discounts: Make use of student discounts for shopping, dining, and entertainment.

| Saving Strategy | Description |

|---|---|

| No Spend Days | Designate days where you'll not spend any money except on essentials like food or utilities. |

| Second-Hand Shopping | Opt for second-hand goods for books, clothes, or electronics. You'll save significantly on these items. |

| Shared Expenses | Share accommodation, utilities, or even subscriptions like Netflix to reduce individual costs. |

5. Prepare for Financial Emergencies

Life is unpredictable, and having an emergency fund can prevent small issues from becoming financial crises:

- Contingency Fund: Try to set aside a small amount regularly to create a buffer for unexpected expenses.

- Insurance: Consider basic insurance for items like laptops or bikes, which are crucial for your studies.

- Financial Aid: Understand the processes for requesting additional financial help or hardship funds from your university if needed.

In closing, mastering student finance in England is about being proactive, informed, and disciplined. By grasping the nuances of student finance, creating and adhering to a budget, exploring various income streams, saving where possible, and preparing for unforeseen events, you'll lay a solid foundation for financial well-being during your university years and beyond.

What if I exceed my student loan amount?

+

If you find yourself short on funds, look into part-time work, scholarships, or speak with your university’s financial aid office for potential hardship funds.

How can I budget effectively as a student?

+

Utilize budgeting tools or apps, categorize your expenses, and allocate a portion of your income to savings and emergency funds before you spend on other things.

Are there any tips for saving on accommodation?

+

Consider shared housing, explore student halls that are less expensive, and stay away from the university to save on rent. Look for housemate deals or council tax exemptions for full-time students.

What should I do if I struggle to repay my student loan?

+

Student loans in the UK are income-contingent, meaning repayment starts only when you earn above a specific income threshold. Contact the Student Loans Company if you have difficulties with the repayment process.

Can I study and work part-time?

+

Yes, many students do manage to work part-time alongside their studies. However, balance is key. Choose jobs that fit your study schedule, and ensure you’re not sacrificing sleep or study time excessively.