Open University Student Finance: A Comprehensive Guide

Embarking on the journey of studying at an open university can be incredibly rewarding, but navigating the financial aspects can often feel like navigating a maze. Understanding student finance, from application to repayment, is crucial for students aiming to make informed decisions and manage their finances effectively. This comprehensive guide will walk you through everything you need to know about financing your open university education.

Understanding Open University Financial Aid

Open universities offer a variety of financial aid options tailored to support students from diverse backgrounds:

- Scholarships: Often merit-based or needs-based, scholarships can cover tuition, books, and sometimes living expenses.

- Grants: Unlike loans, these do not require repayment. They might be awarded for specific programs or circumstances.

- Loans: These need to be paid back, but they come with benefits like deferred repayment until after graduation and income-based repayment plans.

- Bursaries: Similar to grants, they are often provided by the institution or external organizations and do not need to be repaid.

Eligibility for Financial Aid

Eligibility for financial aid varies based on several criteria:

- Enrollment Status: Typically, you must be enrolled in a degree-granting program or at least half-time.

- Citizenship or Residency: Most financial aid programs require U.S. citizenship or eligible non-citizen status, although some scholarships might not have this requirement.

- Income and Assets: Many forms of financial aid, especially need-based, depend on your financial background, which you’ll disclose on the Free Application for Federal Student Aid (FAFSA).

Application Process for Financial Aid

The process of applying for financial aid involves several steps:

1. FAFSA

Fill out the FAFSA form, which is the gateway to federal aid and many state and institutional aid programs:

- Go to studentaid.gov to apply.

- Gather necessary documents like tax returns, W-2s, records of untaxed income, and your Social Security Number.

- Complete the form as accurately as possible, as errors can delay your aid.

💡 Note: Remember that the FAFSA opens on October 1st each year for the following academic year. Submitting your FAFSA early can increase your chances of securing more funds.

2. Institutional Aid

Many universities, including open universities, have their own financial aid applications:

- Check your university’s financial aid website for their specific application requirements.

- Some might require additional essays or letters of recommendation.

3. Scholarships

Search and apply for external scholarships:

- Use scholarship databases like Fastweb, Chegg, or Scholarships.com.

- Contact local community organizations or your employer for scholarship opportunities.

Managing Your Student Loans

Once you’ve secured your student loans, managing them effectively is crucial:

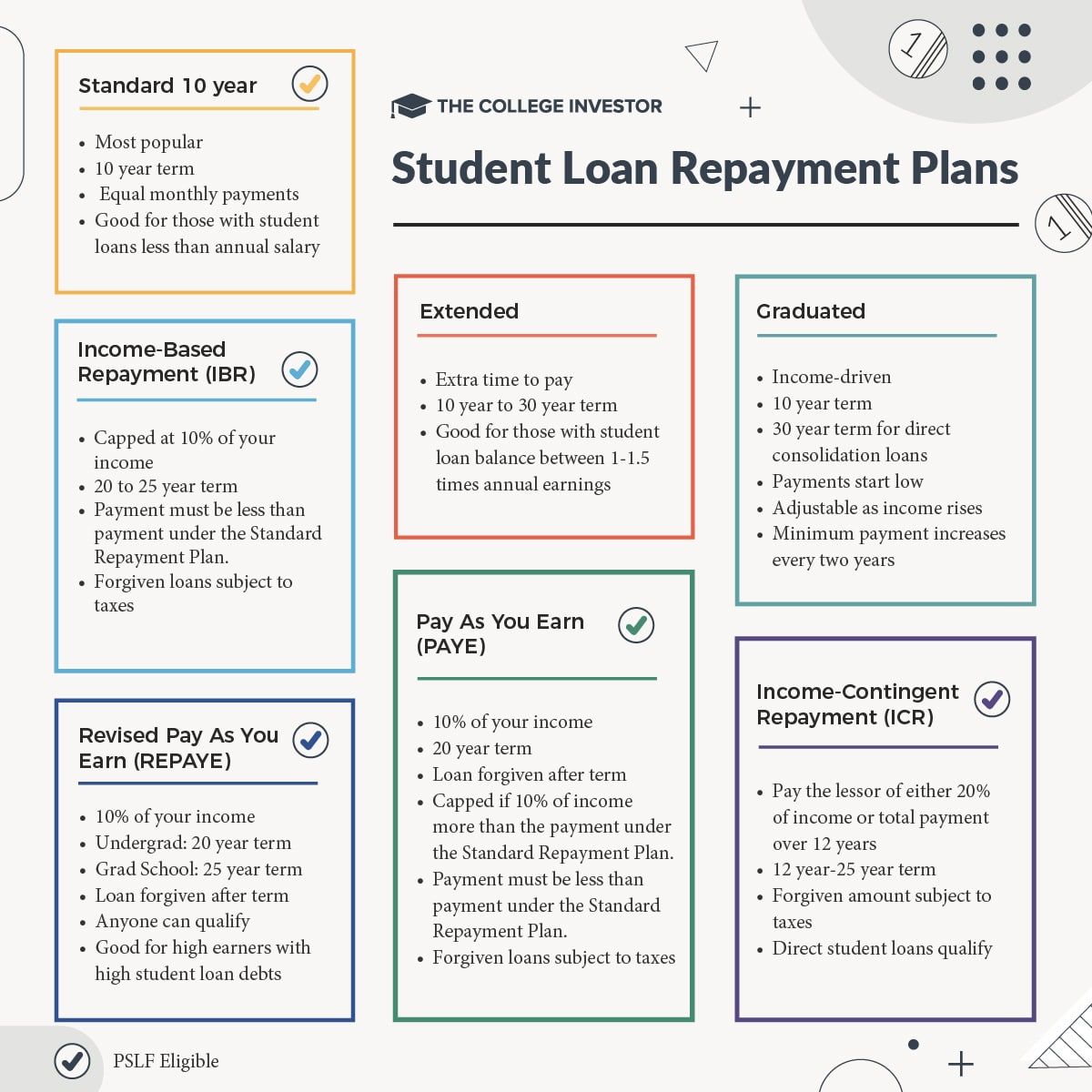

Repayment Plans

Understand your repayment options:

- Standard Repayment: Fixed payments over a set period (usually 10 years).

- Income-Driven Repayment Plans: Payments adjust based on your income, extending the loan term if needed.

- Deferment or Forbearance: Options to pause or reduce payments in times of financial hardship.

Strategies for Repayment

Here are some strategies to manage your loan repayment:

- Make Extra Payments: If possible, pay more than the minimum to reduce interest.

- Automatic Payments: Set up automatic debit to ensure payments are never missed.

- Refinance or Consolidate: Sometimes, refinancing or consolidating your loans can lower your interest rate or simplify payments.

Financial Tips for Open University Students

Here are some financial management tips tailored for open university students:

- Create a Budget: Track your income, expenses, and student loan disbursements to stay on top of your finances.

- Use Student Discounts: Leverage student discounts on software, books, and travel.

- Part-time Work: Consider part-time jobs that offer flexibility for your study schedule.

- Take Advantage of Free Resources: Use your university’s libraries, online resources, and tutoring services to reduce out-of-pocket expenses.

As we wrap up this guide, let's highlight the key points. Navigating student finance at an open university involves understanding the various types of financial aid available, the application processes, and how to manage your loans effectively. Remember, financial aid is not a one-size-fits-all solution. Tailor your approach to your personal circumstances, apply early, and keep informed about your loan repayment options. With this knowledge, you're well on your way to financing your education wisely and reducing the burden of student debt.

What happens if I can’t pay back my student loan?

+

If you’re unable to repay your student loan, explore options like deferment, forbearance, or income-driven repayment plans. Failure to repay can lead to default, which has severe credit implications.

Can I still get financial aid if I’m studying part-time?

+

Yes, many open universities offer financial aid for part-time students, though the aid might be pro-rated based on your enrollment status. Always check with your institution for specific policies.

Are there scholarships specifically for open university students?

+

Absolutely, many organizations offer scholarships tailored for online, distance, or open university students. Look for scholarships from professional associations, online education advocates, or those specifically for non-traditional students.

Related Terms:

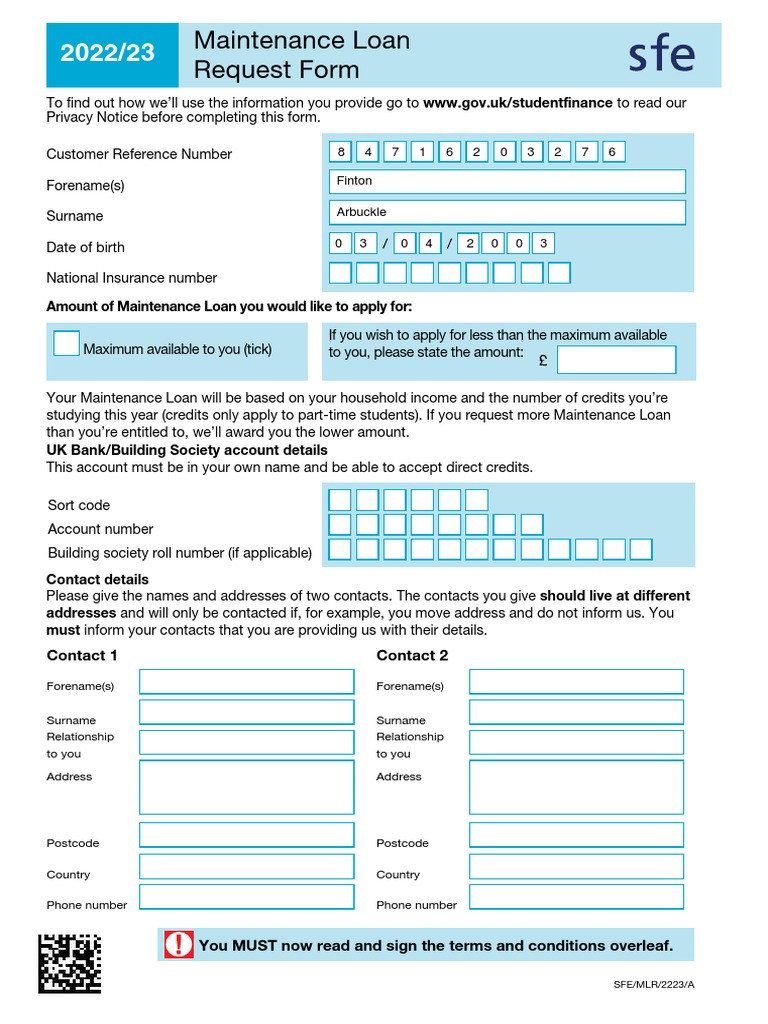

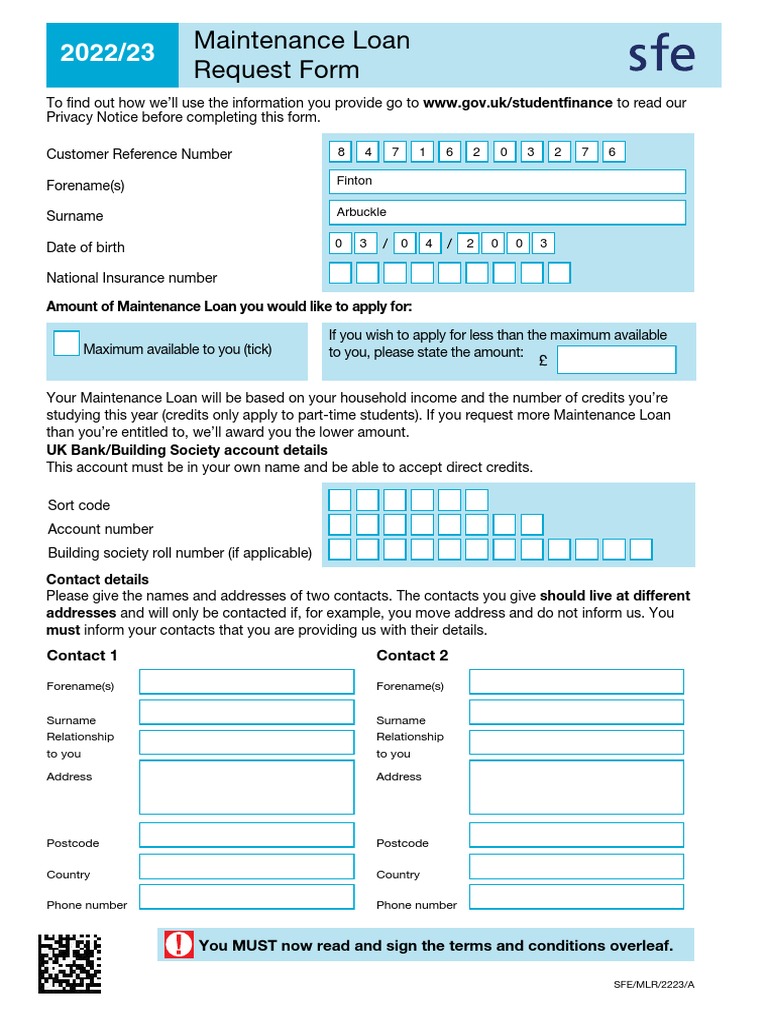

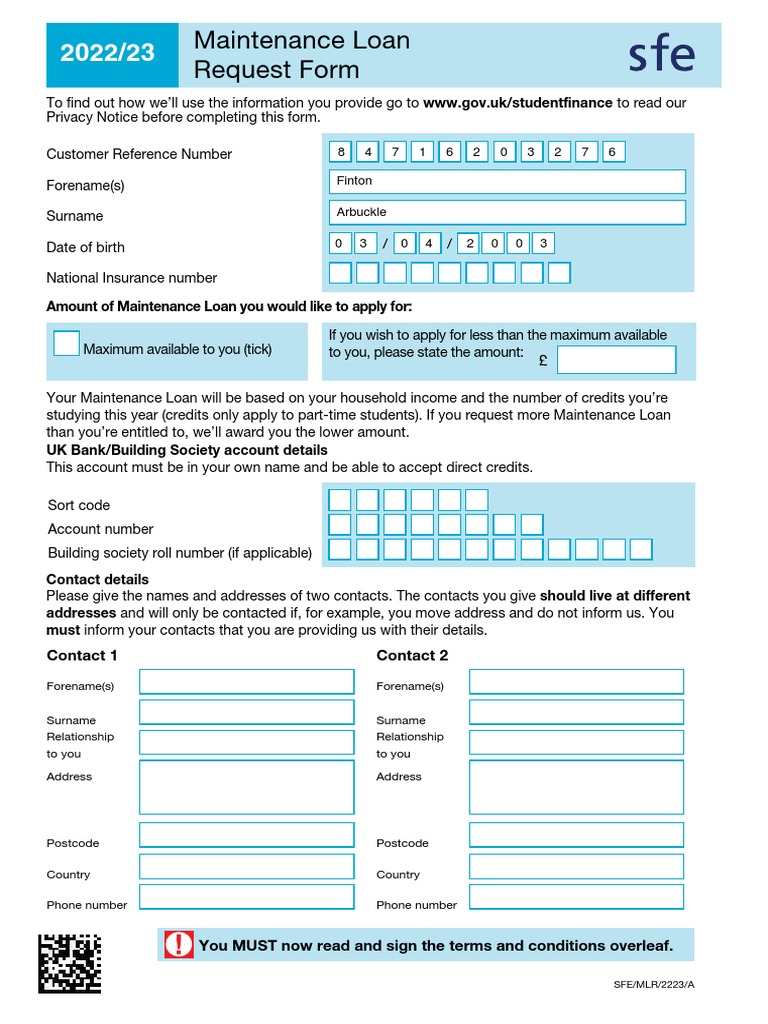

- Open University maintenance loan

- Open university maintenance loan disability

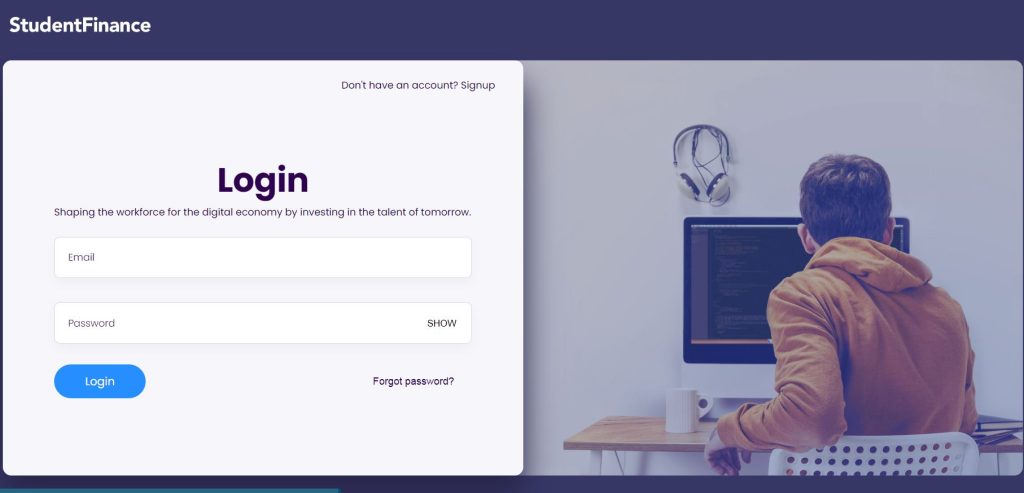

- Student finance login

- Open University maintenance loan reddit

- Apply for student loan