Skyrocket Your Portfolio: Mastering Stock Value Analysis

Investing in the stock market can be both exhilarating and daunting. For seasoned investors and newcomers alike, understanding how to effectively analyze stock value is crucial for building a robust portfolio. This comprehensive guide will walk you through the essentials of stock value analysis, equipping you with the tools and knowledge to make informed investment decisions.

Understanding Stock Value Analysis

At its core, stock value analysis involves determining the intrinsic value of a company’s stock, comparing it to its current market price, and making investment decisions based on that assessment. Here are the fundamental approaches to stock valuation:

- Fundamental Analysis: Focuses on the financial health, industry conditions, and macroeconomic factors affecting a company.

- Technical Analysis: Looks at price movements and trading volumes to predict future price changes.

- Quantitative Analysis: Utilizes mathematical and statistical models to value stocks.

Steps to Analyze Stock Value

1. Define Your Investment Criteria

Before diving into detailed analysis, it’s important to establish:

- Your risk tolerance

- Investment horizon

- Expected returns

- Sector preferences

2. Collect and Analyze Financial Statements

To perform fundamental analysis, you’ll need:

- Income Statement: Check revenue growth, profitability, and earnings per share (EPS).

- Balance Sheet: Assess assets, liabilities, and equity to evaluate financial stability.

- Cash Flow Statement: Understand how cash is generated and used within the company.

3. Evaluate Company’s Economic Moat

An economic moat refers to the competitive advantages that protect a company from competitors. Consider:

- Cost advantages

- Network effect

- Brand recognition

- Switching costs for customers

4. Use Valuation Models

Popular methods include:

- Discounted Cash Flow (DCF): Forecasts future cash flows and discounts them back to the present value.

- Comparable Company Analysis (CCA): Compares the stock with similar companies in terms of size, industry, and growth potential.

- Price-to-Earnings Ratio (P/E): Compares the current market price with the company’s per-share earnings.

5. Consider Technical Indicators

If you’re incorporating technical analysis:

- Moving Averages: Help in identifying trends by smoothing price data over a specified period.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Support and Resistance Levels: Predict potential price movement barriers.

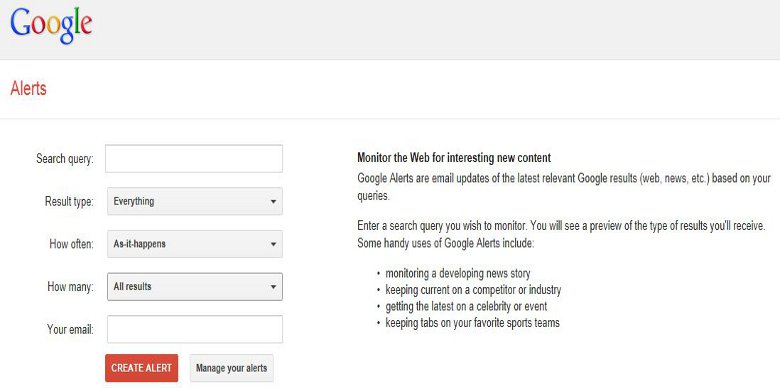

6. Stay Informed on Market Conditions

Keep abreast of:

- Economic reports like GDP, inflation rates, and employment figures.

- Industry news and trends that could impact your investment.

- Global events that might affect international markets.

🌟 Note: Always consider the broader economic environment alongside your stock analysis for a comprehensive view.

Utilizing Analysis Tools

Here are some tools and software that can aid in your stock value analysis:

| Tool | Function | Best For |

|---|---|---|

| Excel | Financial modeling, data analysis | DIY Investors |

| FactSet | Data on stocks, analysis tools | Professionals |

| Yahoo Finance | Basic analysis and company profiles | All Investors |

| Bloomberg Terminal | In-depth market data, real-time updates | Institutional Investors |

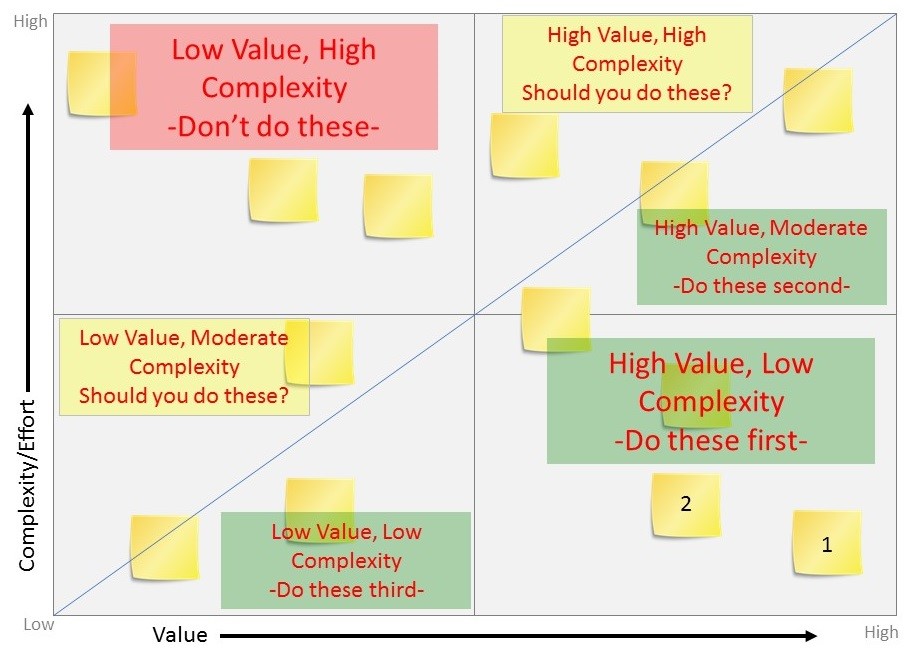

Combining Analysis Methods

Many investors find success by combining both fundamental and technical analysis to get a well-rounded view:

- Use fundamental analysis to identify undervalued stocks with strong fundamentals.

- Then, employ technical analysis to time your entry and exit points in the market.

🔍 Note: Combining analysis methods can provide insights that might not be apparent when using a single approach.

Your Investment Journey

With these steps and tools, you’re now equipped to begin a more nuanced and informed investment strategy. Remember, stock value analysis is not a one-size-fits-all process. It requires continuous learning, adaptation to market changes, and a clear understanding of your own investment goals and risk profile.

What is the difference between fundamental and technical analysis?

+

Fundamental analysis focuses on the financial health and prospects of a company through financial statements and economic factors. Technical analysis, on the other hand, predicts stock price movements based on historical market data, like price and volume.

How can I tell if a stock is undervalued?

+

A stock can be considered undervalued if its intrinsic value, as calculated by methods like DCF, is significantly higher than its current market price. Also, comparing it with its peers via ratios like P/E or P/B can give a sense of relative value.

Is it necessary to use both fundamental and technical analysis?

+

While not strictly necessary, many investors find combining both methods provides a more comprehensive investment strategy, allowing for better timing and identification of undervalued stocks.