Stock Price vs. Share Price: Understanding the Difference

Understanding the terms "stock price" and "share price" is crucial for anyone interested in the financial markets. While often used interchangeably in casual conversation, they technically refer to slightly different aspects of equity investment. Grasping these differences can not only enhance your market literacy but also improve your investment strategy. Let's delve into what each term means, how they relate, and why their distinctions matter.

Stock Price vs. Share Price: Definition and Basics

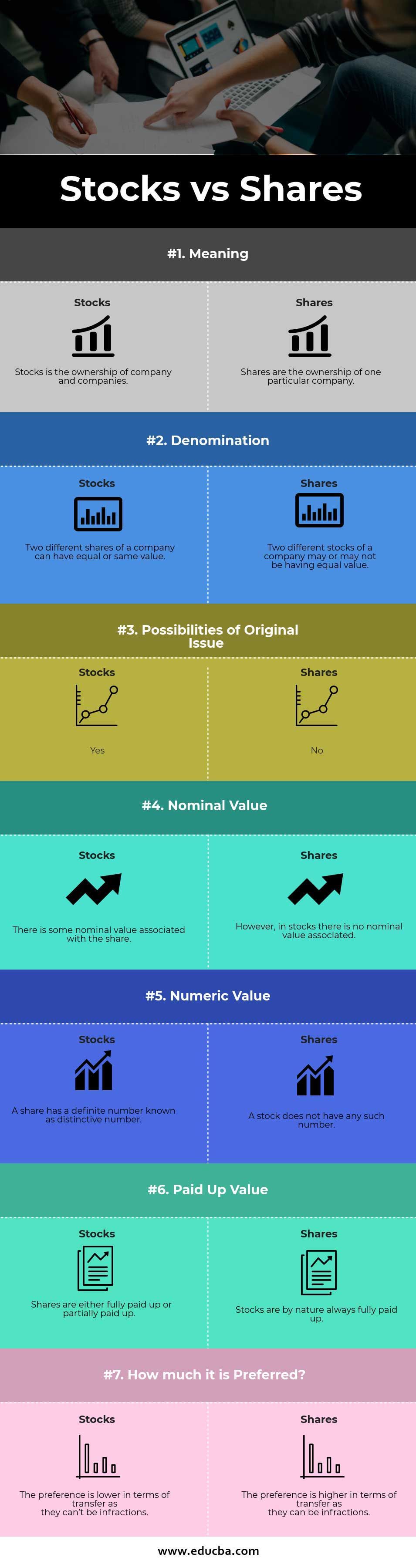

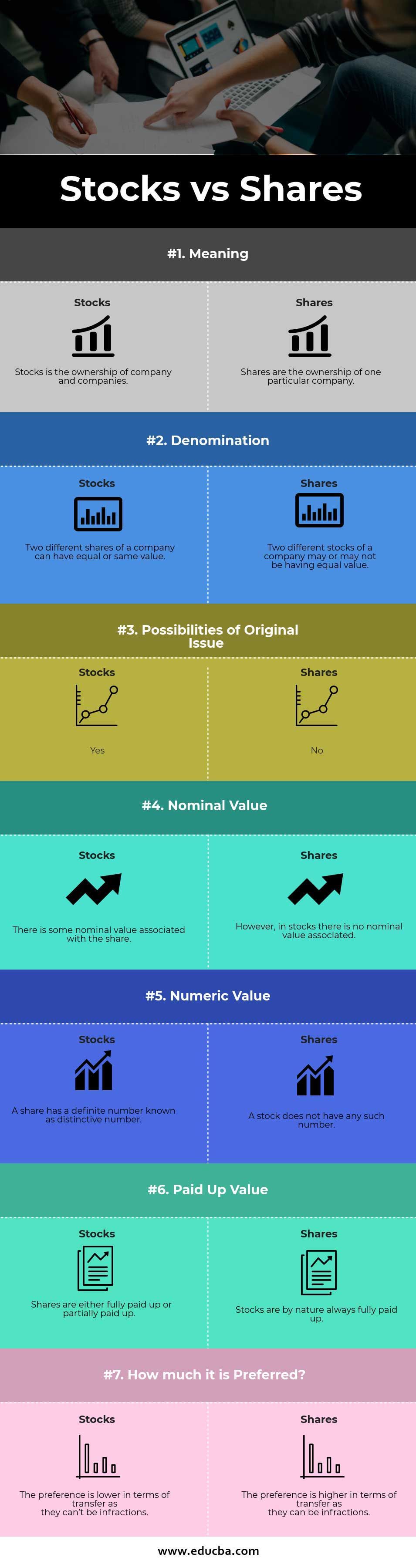

Before we explore the differences, let’s clarify what stock and share mean:

- Stock: This represents ownership in a corporation. Stocks are essentially securities that signify an ownership position in a publicly-listed company.

- Share: A share is a single unit of stock. When you purchase a share, you're buying a piece of the company.

Stock Price

The term “stock price” often refers to the market value of one share of a company’s stock at a particular point in time. Here’s a breakdown:

- Current Stock Price: The price at which the stock is trading at the current moment. This value fluctuates throughout the trading day due to market demand and supply.

- Opening Price: The price at which the stock began trading at the opening of the market.

- Closing Price: The final price at which the stock trades for the day.

- Intraday Price: Prices between the opening and closing that show how the stock price has moved throughout the day.

Share Price

While “share price” might seem synonymous with “stock price,” there’s a nuanced difference:

- Share Price: This refers specifically to the price of one share of a company's stock. It's what you pay to purchase or sell one share.

Key Differences

Here are the primary differences between stock price and share price:

- Terminology Use: While stock price is a general term, share price tends to be used in more specific contexts, like when discussing how many shares you want to buy or the price per share.

- Application in Trading: When trading, share price is more commonly used to denote the cost of each share being bought or sold.

- Context: Stock price might be used when discussing the overall value of a company or in broader market analysis, whereas share price is often about the cost of acquiring a particular portion of the company.

Importance in Investment

Understanding these terms can significantly impact your approach to investing:

- Pricing Decisions: Knowing the current share price helps investors make decisions about buying or selling at the right time.

- Portfolio Valuation: When tracking the value of your investments, stock price movements will directly affect your portfolio's worth.

- Market Analysis: For analysts, stock price trends provide insights into market sentiment, company performance, and economic conditions.

The Role of Market Conditions

Market conditions significantly influence both stock and share prices:

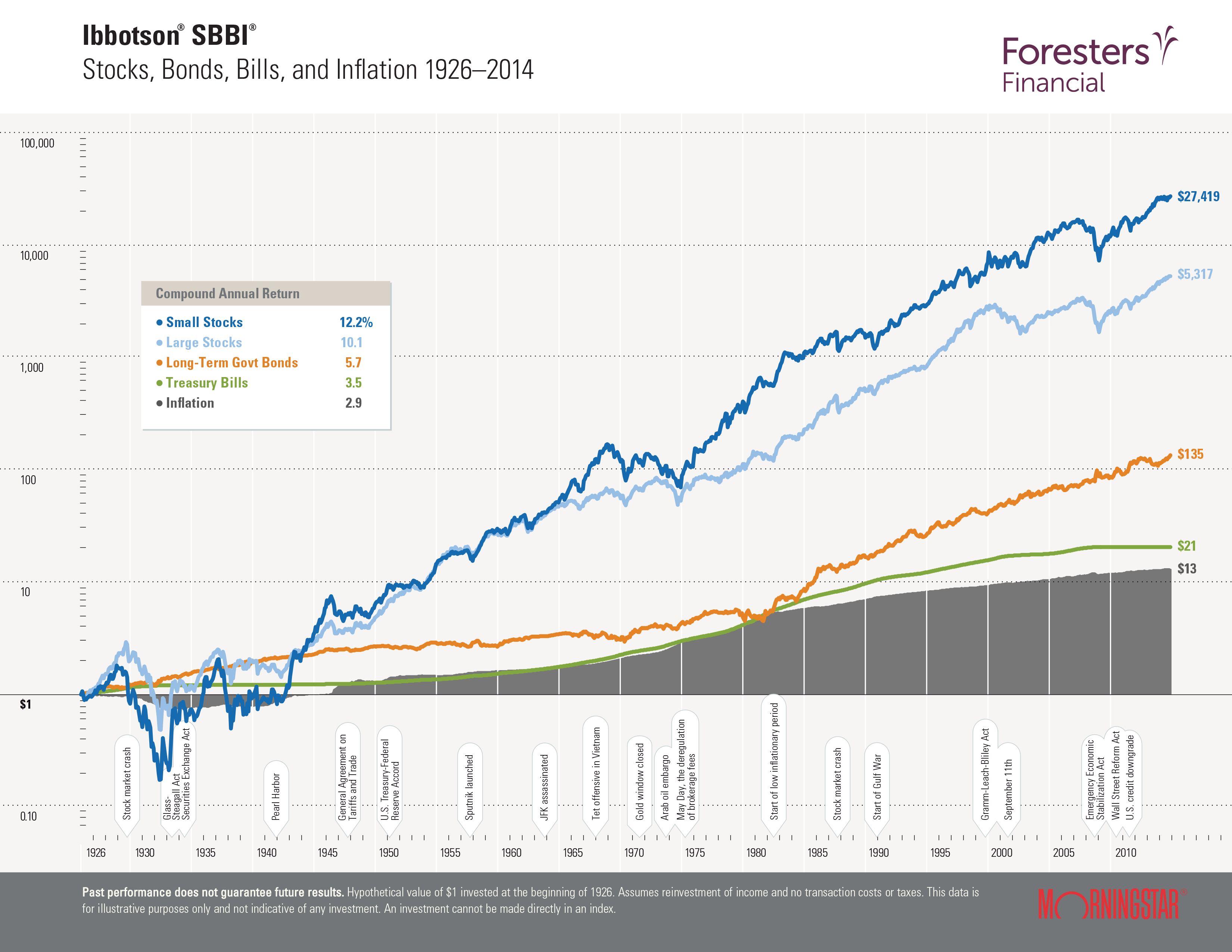

- Market Sentiment: General investor sentiment can drive stock prices up or down, often irrespective of individual company performance.

- Economic Indicators: Interest rates, inflation rates, and employment data can all affect stock market trends, thereby impacting share prices.

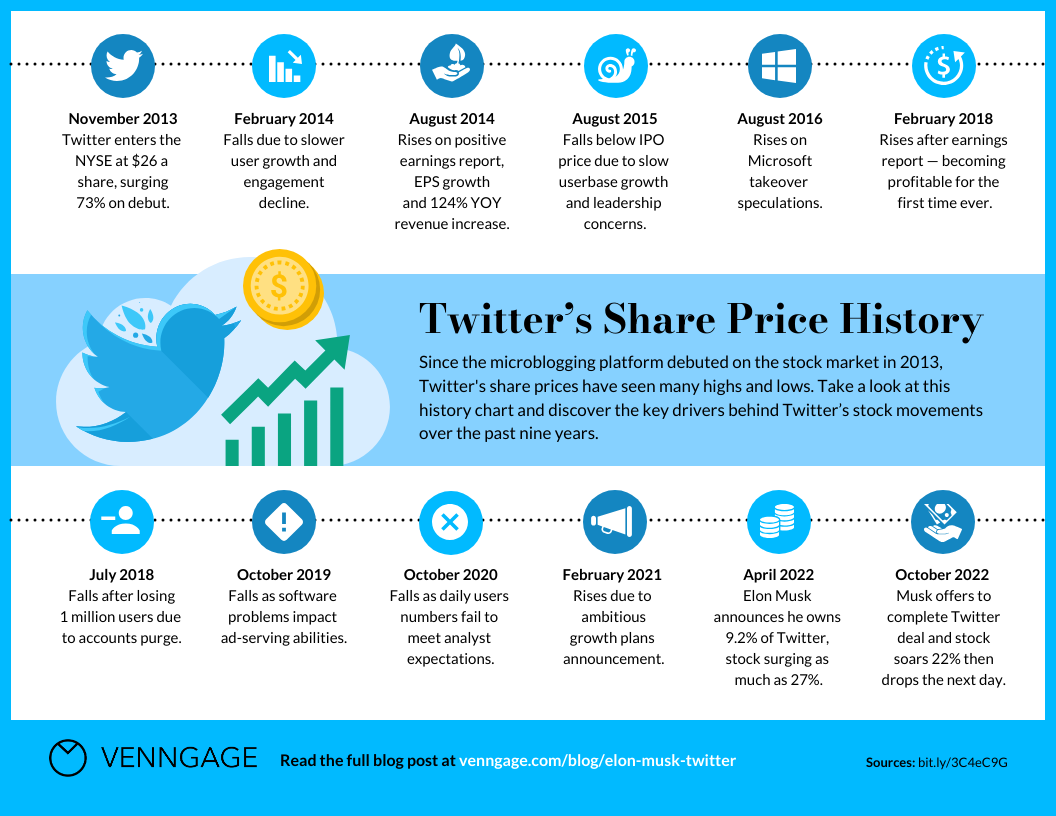

- Company News: Earnings reports, executive changes, product launches, or even scandals can lead to dramatic share price fluctuations.

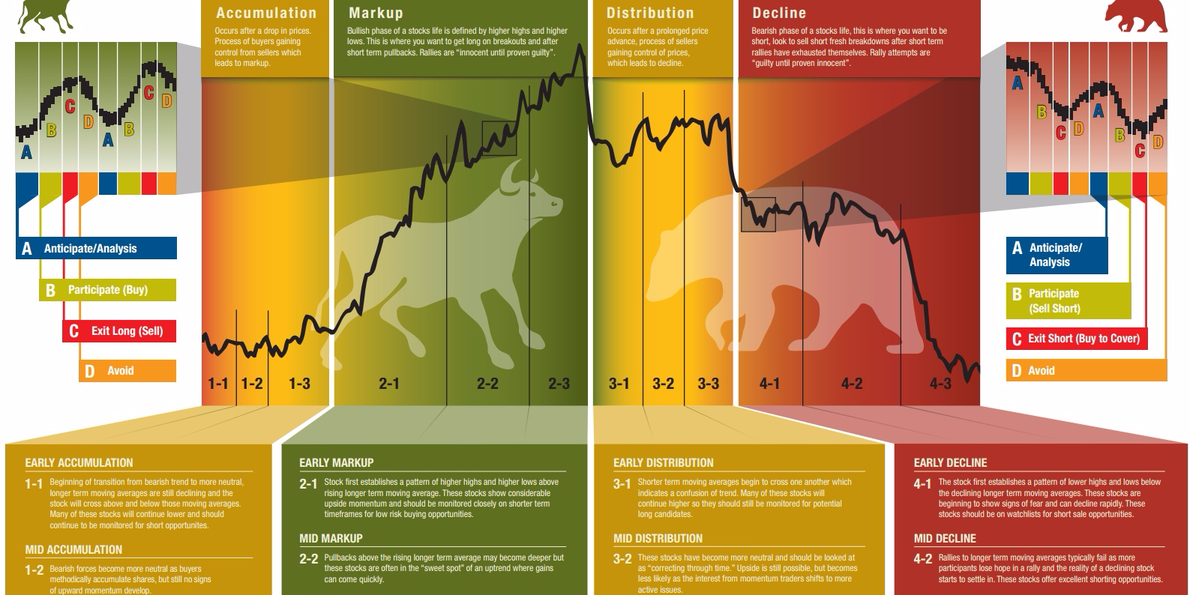

Stock Price Movements

Stock prices move for various reasons, here are some:

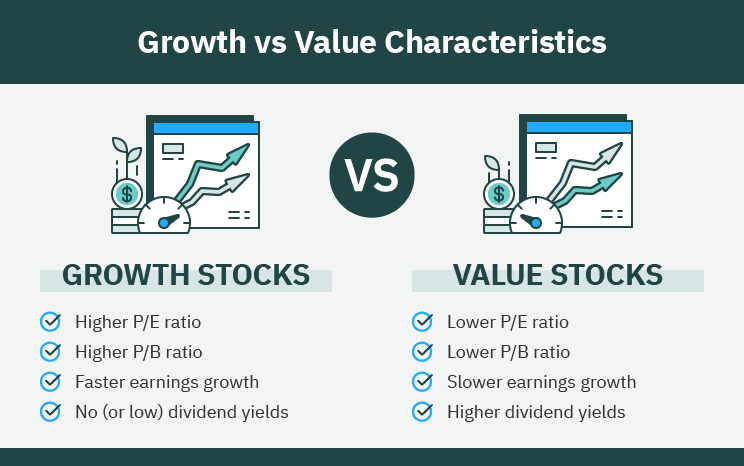

Fundamental Analysis

- Company Earnings and Revenue: If a company outperforms expectations, its stock price typically rises; underperformance can lead to a drop.

- Industry Performance: Sector-specific trends can influence stock prices, like tech stocks reacting to news on data privacy or renewable energy stocks responding to policy changes.

Technical Analysis

- Stock Charts and Patterns: Investors use technical indicators to predict future price movements based on past performance.

- Volume Trading: High trading volumes can indicate significant investor interest or sell-off, affecting price direction.

External Factors

- Global Economic Trends: Economic cycles, currency exchange rates, and geopolitical events can move stock markets.

- Policy and Regulation Changes: Government regulations, trade tariffs, or financial policies can alter industry landscapes.

💡 Note: While fundamental and technical analysis are key tools for investors, stock price movements are never entirely predictable due to the complexity of market dynamics.

Share Price and Market Liquidity

Share price also relates to market liquidity:

- Liquidity: A high number of shares traded daily indicates better liquidity, making it easier to buy or sell without significantly affecting the price.

- Bid-Ask Spread: Lower share prices often result in a narrower bid-ask spread, which benefits investors by reducing trading costs.

Stock Splits and Reverse Splits

A company can alter its share price through:

- Stock Split: Increases the number of shares while reducing the price per share, making the stock more accessible to small investors.

- Reverse Stock Split: Consolidates shares to increase the price per share, often used to meet listing requirements or improve investor perception.

📝 Note: Stock splits don't add value to the company, but they can increase market liquidity and potentially make the stock more attractive to investors.

Investor Sentiment and Share Price

Investor sentiment can be a powerful force:

- Panic Selling: Rapid declines in share prices can occur during market downturns due to fear and uncertainty.

- Bull Market: In a bull market, share prices rise as investors are generally optimistic about future growth.

Here's a summary table:

| Aspect | Stock Price | Share Price |

|---|---|---|

| Definition | The market value of a company's equity | The price of one share of a company's stock |

| Use in Trading | General discussions about company valuation | Specific to transactions involving single shares |

| Market Analysis | Can reflect overall market trends | More focused on the cost of shares |

Summarizing our journey through the world of stock and share prices, we've highlighted the nuanced differences between these terms, explored how they relate to various aspects of investing, and provided insights into what influences their movements. Whether you're a seasoned investor or just starting, understanding these concepts is crucial for making informed investment decisions, tracking your portfolio, and interpreting market behavior.

What’s the difference between stock price and share price?

+

Stock price refers to the market value of the company’s equity, while share price is the cost of one share. Essentially, stock price can be used to discuss the overall valuation of a company, whereas share price is specific to the cost of an individual share.

Can a stock have different prices?

+

Yes, during trading hours, a stock’s price can change multiple times due to market dynamics. There’s an opening price, intraday price, and closing price, among others. Additionally, prices can vary slightly between different markets and exchanges.

How do I know when to buy or sell a stock?

+

Deciding when to buy or sell involves a combination of fundamental analysis (like earnings, industry trends, and economic indicators) and technical analysis (such as stock price patterns and volume). Also, consider your investment goals, risk tolerance, and market conditions.