Stock Market Today Live: Latest Updates and Insights

Opening Market Overview

As we delve into the heart of today's market trends, it's clear that the Stock Market remains a complex and dynamic arena where fortunes can be made or lost in a matter of minutes. With an array of international economic events influencing global markets, understanding the nuances of daily trading activities is crucial. Today's live updates provide insights into major indices, individual stock movements, and overarching market sentiments shaped by economic indicators, policy announcements, and investor reactions.

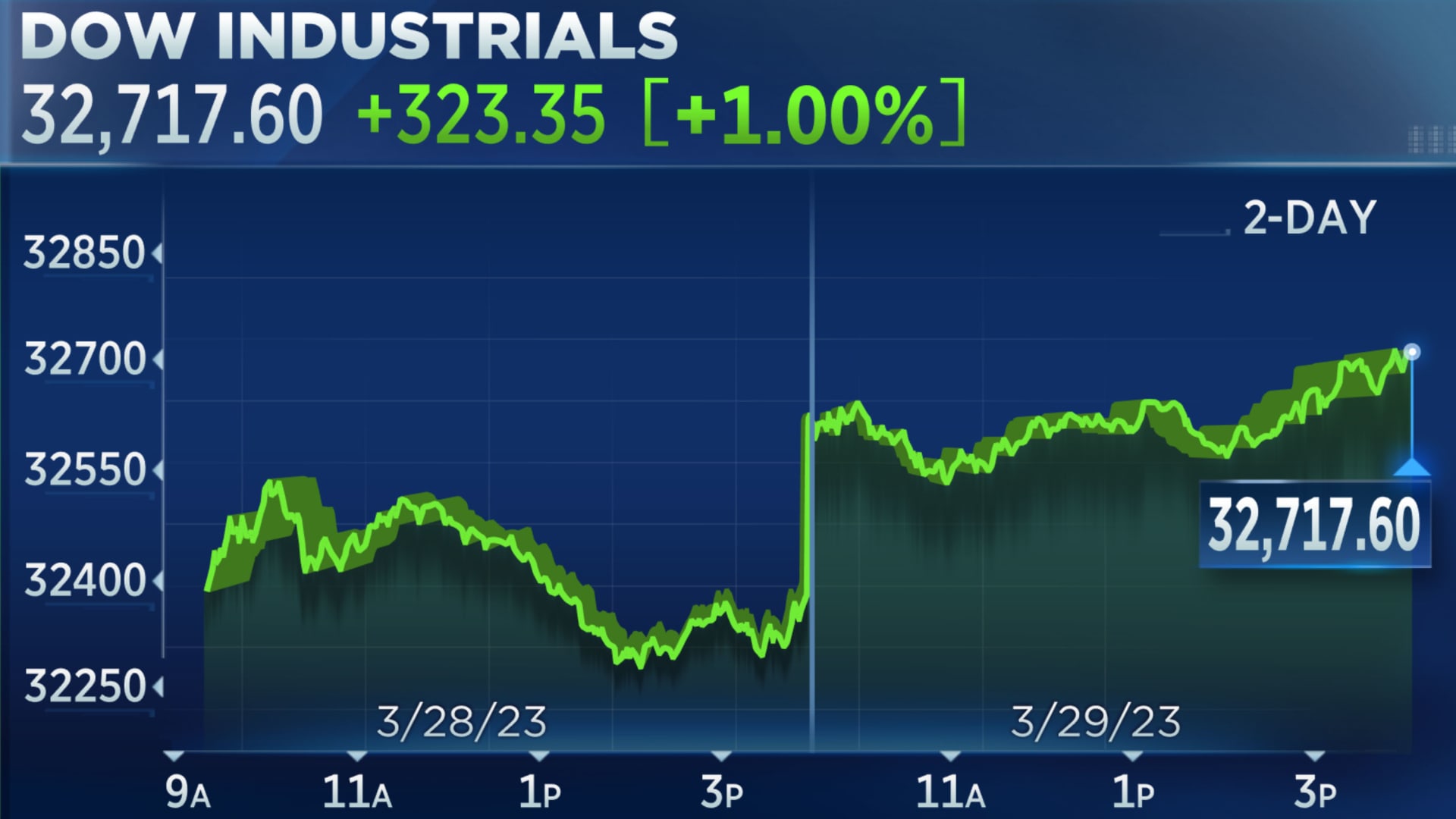

Major Indices Performance

The major indices are often the bellwethers of market health. Here's a quick look at how they are performing today:

- Dow Jones Industrial Average: Up by 0.5%, driven primarily by gains in tech stocks.

- S&P 500: A modest increase of 0.3%, reflecting a mixed bag of sector performances.

- Nasdaq Composite: Leading the pack with a 1.2% rise, as tech giants continue their upward trend.

🔍 Note: Indices movements are influenced by not just individual stocks but also by broader market sentiments and economic news.

Stock Spotlights

Tech Titans

Tech stocks have been the talk of the town for years, and today is no different. Here are some notable performances:

- Apple (AAPL): 2.5% increase after announcing a significant update to their product line.

- Microsoft (MSFT): 1.8% rise following positive earnings guidance.

- Amazon (AMZN): Slight dip by 0.2%, attributed to antitrust concerns.

Healthcare and Biotech

While tech continues to dominate headlines, healthcare and biotech companies are also making significant moves:

- Pfizer (PFE): Up by 1.1% after promising developments in their vaccine trials.

- Biogen (BIIB): 2% jump due to a positive FDA update regarding Alzheimer's treatment.

Economic Reports and Influences

Today's market is not only shaped by stock performances but also by several economic reports and international events:

- FOMC Minutes: The release of these minutes has caused minor fluctuations as investors analyze the Fed's stance on interest rates.

- Jobless Claims: Initial jobless claims decreased more than expected, boosting consumer confidence.

- Geopolitical Tensions: Ongoing issues, like trade talks between the US and China, continue to sway market moods.

Market Sentiment

Investor sentiment today is cautiously optimistic. Despite some positive economic indicators, there's an underlying wariness due to the unpredictable nature of international politics and economic policies. Here's how sentiment is reflected:

| Indicator | Current Reading |

|---|---|

| Volatility Index (VIX) | 16.5 (Slightly Increased) |

| Bullish-Bearish Sentiment | 55% Bullish |

| Investor Fear Gauge | Neutral |

Key Takeaways

Understanding today's market involves piecing together various economic indicators, stock performances, and broader market sentiments. Here are the crucial points to take away:

- The stock market today shows growth in tech stocks, particularly in Nasdaq, with Apple and Microsoft leading.

- Healthcare sectors, especially biotech, are gaining ground due to promising medical advancements.

- Economic reports like jobless claims are more favorable than anticipated, lifting market morale.

- Geopolitical and policy announcements are introducing uncertainty, causing fluctuations in investor confidence.

While the market shows resilience and growth in certain areas, investors are recommended to stay vigilant, keep abreast of news, and consider a diversified investment strategy to mitigate risks associated with market volatility.

Final Thoughts

Today's stock market landscape offers both opportunities and challenges. By keeping a pulse on economic indicators, sector performance, and global events, investors can better navigate this ever-evolving environment. Whether you're a seasoned trader or a novice, staying informed is key to making strategic investment decisions.

What drives stock market movements?

+

Stock market movements are influenced by a myriad of factors including economic indicators, company earnings, global economic trends, geopolitical events, and even investor sentiment.

How often should I check market updates?

+

If you’re an active trader, daily updates might be necessary. However, for long-term investors, weekly or even monthly reviews might suffice, depending on their investment strategy.

Are there any reliable sources for market analysis?

+

Yes, sources like Bloomberg, Reuters, and CNBC provide comprehensive market analyses. Financial blogs, stock newsletters, and investment podcasts can also offer valuable insights.

How can I better understand economic reports?

+

Subscribing to financial news services, reading up on economics, or even taking courses in finance can help decode economic reports. Understanding terms like GDP, inflation, and unemployment rates is crucial.