Small Business Grants: Your Startup Funding Guide

Starting a small business can be incredibly rewarding, but the initial funding hurdle is a challenge many aspiring entrepreneurs face. While there are various funding options available, small business grants stand out because they don't require repayment, making them an attractive choice for startups with limited resources. This guide will walk you through the intricacies of navigating and securing small business grants.

Understanding Small Business Grants

Before diving into the process of obtaining grants, it’s essential to understand what they entail. Unlike loans, grants are non-repayable funds or products disbursed by one party, often a government department, corporation, foundation or trust. Here are some key features:

- Non-repayable: Unlike loans, you don’t have to return the money.

- Targeted Funding: Grants often aim to support specific demographics, sectors, or initiatives.

- Competitive: Due to their advantageous terms, grant applications can be highly competitive.

- Conditions Apply: There might be specific conditions on how the funds can be used.

Types of Small Business Grants

Not all grants are the same; they vary based on their origin, purpose, and conditions:

- Federal Grants: Offered by government departments at the national level.

- State/Local Grants: Available from states or local governments, often aimed at community development.

- Private Grants: Provided by corporations, private foundations, or trusts.

- Innovation Grants: Aimed at supporting groundbreaking research or product development.

- Industry-specific Grants: Tailored to specific industries like technology, manufacturing, or agriculture.

🔍 Note: Always check the eligibility criteria carefully as these can vary significantly between different grants.

Steps to Secure a Small Business Grant

Finding and securing grants might seem daunting, but with a systematic approach, it can be manageable:

1. Research Available Grants

- Use online grant directories or databases to find potential grants.

- Check federal, state, and local government websites, as well as private sector offerings.

2. Assess Eligibility

Each grant has its unique set of eligibility criteria:

- Review the purpose of the grant.

- Consider your business location, size, industry, and the demographics of your owners or employees.

3. Understand the Application Process

Each grant has a different application process:

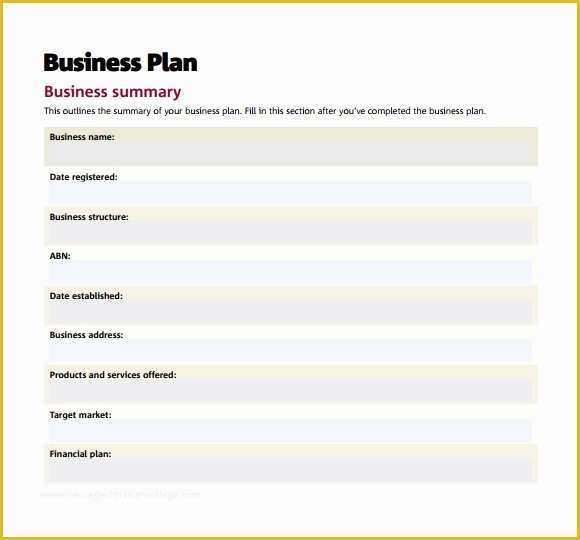

- Gather required documents, which might include business plans, financial statements, and proof of eligibility.

- Prepare to write compelling narratives explaining why your business deserves the grant.

| Grant | Documents Required |

|---|---|

| Small Business Innovation Research (SBIR) | Project proposal, company info, financial statements |

| Women-Owned Small Business (WOSB) Certification | Ownership details, proof of majority women-ownership |

| Local Community Development Block Grants (CDBG) | Community impact statement, income eligibility |

4. Apply Strategically

- Customize Applications: Tailor each application to the grant’s criteria.

- Proofread and Perfect: Ensure all documents are thoroughly reviewed.

- Follow Up: Keep track of deadlines and follow up if necessary.

Tips for Successful Grant Applications

Success in securing grants often depends on how well your application stands out:

- Know the Goals: Understand the grantor’s objectives and show how your business aligns.

- Tell a Story: Make your proposal narrative compelling with clear goals, strategies, and expected outcomes.

- Professional Presentation: Ensure your documents are well-formatted, professional, and free of errors.

- Track Record: If applicable, showcase past successes or case studies.

- Use Resources: Don’t hesitate to seek help from grant writing professionals or organizations.

📚 Note: Many community colleges and libraries offer free or low-cost workshops on grant writing.

In conclusion, securing small business grants can significantly fuel your startup's journey by providing funds without the burden of repayment. However, the process requires meticulous research, understanding of eligibility, strategic application writing, and follow-up. By leveraging the right grants tailored to your business's needs, you not only enhance your startup’s financial stability but also potentially create opportunities for growth, innovation, and sustainability. This guide has outlined the key steps and provided insights to streamline your grant acquisition process, setting you on the path to success.

What are the benefits of small business grants?

+

Grants provide non-repayable funds, potentially helping with startup costs, business expansion, and innovation without adding to your financial burden.

How do I find small business grants?

+

Utilize grant directories, government websites, industry-specific resources, and local community boards to find grants relevant to your business.

What should I include in a grant application?

+

Include a detailed business plan, financial statements, proof of eligibility, a compelling narrative explaining your project’s objectives, and outcomes.