Sip Finance: Simple Investment Plans for Your Future

In an era where financial freedom is at the forefront of personal aspirations, understanding and investing in the right financial instruments can make all the difference. 'Sip Finance', or Systematic Investment Planning, offers a structured approach to saving and investing, allowing individuals to steadily build their wealth over time. Whether you're looking to secure your retirement, fund your child's education, or simply grow your nest egg, Sip Finance is an excellent strategy to consider. This blog post delves into what Sip Finance entails, its benefits, how to get started, and answers some of the most common questions potential investors might have.

What is Sip Finance?

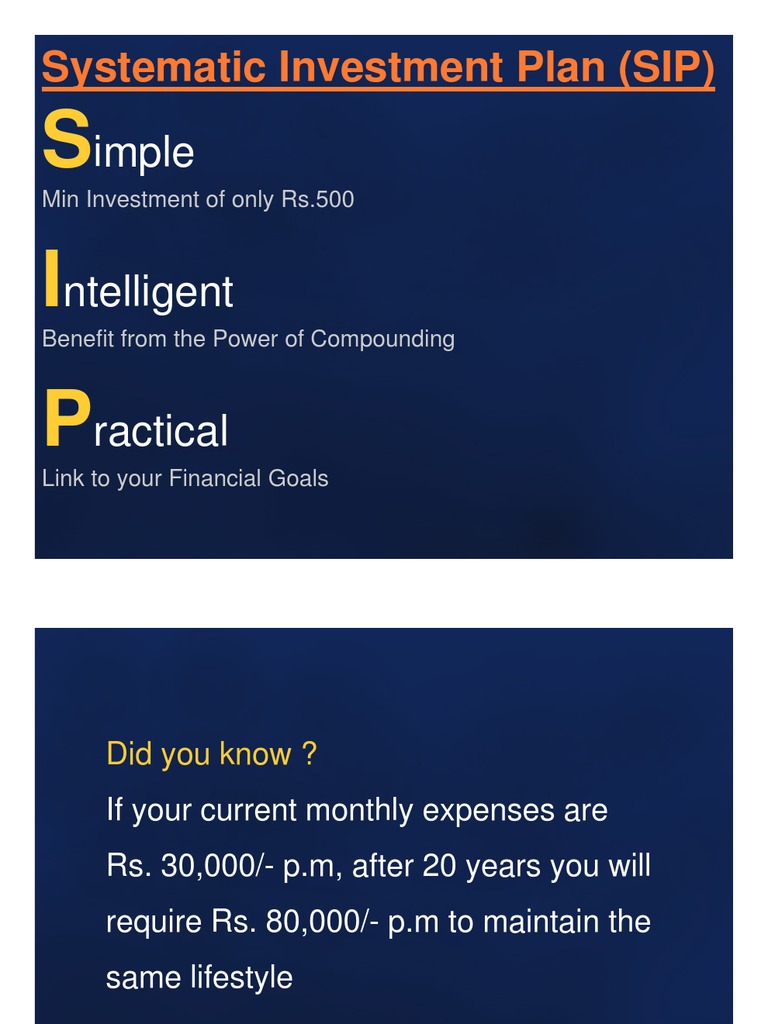

Sip Finance refers to the practice of investing a fixed sum into a mutual fund at regular intervals, typically monthly. Here's how it works:

- Rupee Cost Averaging: By investing a fixed amount regularly, investors buy more units when prices are low and fewer when prices are high, thus averaging the cost of investment over time.

- Discipline and Affordability: It promotes discipline in saving and allows individuals to start with as little as Rs. 500 a month.

- Compounding: Over time, the reinvestment of earnings leads to compounding, which can significantly increase the value of the investment.

Benefits of Sip Finance

The advantages of Sip Finance are manifold:

- Flexibility: You can increase or decrease your investment according to your financial capacity.

- Lower Risk: Since the investment is spread over time, market volatility's impact is reduced.

- Convenience: Automating investments removes the hassle of timing the market or making large lump-sum investments.

- Diversification: Sips often invest in mutual funds that are well-diversified, reducing the risk associated with single stock investments.

How to Start a Sip Finance Plan

Starting a SIP can be straightforward. Here's a step-by-step guide:

- Choose Your Investment Goal: Define what you're saving for - retirement, buying a house, etc.

- Select a Mutual Fund: Research or seek advice on mutual funds that align with your risk tolerance and goals. Funds can be equity, debt, or hybrid.

- Decide on Your Investment Amount: Start with an amount you can afford to invest regularly.

- Set the Duration: Decide how long you want to invest for, knowing that longer durations typically yield better compounding benefits.

- Open a Mutual Fund Account: Fill out the KYC forms and submit documents to your chosen fund house or through a financial advisor.

- Automate Your Investment: Set up an auto-debit from your bank account to ensure the investment is made without fail.

- Monitor and Adjust: Keep an eye on your investments and adjust your SIPs as necessary based on financial changes or fund performance.

💡 Note: Always consider speaking with a financial advisor before making substantial investment decisions to ensure the plan fits your financial profile and goals.

Considerations and Common Pitfalls

While Sip Finance has many benefits, investors should be aware of the following considerations:

- Not a One-Size-Fits-All Solution: Different investment goals might require different strategies.

- Market Fluctuations: Even with rupee cost averaging, market downturns can lead to short-term losses.

- Inflation: The returns must outpace inflation to ensure growth in real terms.

- Expense Ratio: The cost of managing the fund can eat into your returns.

After exploring the various facets of Sip Finance, it's evident that this investment strategy can be a powerful tool for building wealth. By setting a regular investment schedule, you benefit from the power of compounding, the safety of diversification, and the discipline of saving. However, success with Sip Finance also depends on choosing the right funds, maintaining a long-term perspective, and adjusting your investments as your financial situation evolves. With careful planning and perhaps some expert guidance, Sip Finance can pave the way to a secure and prosperous future.

What is the minimum amount I can start with for a SIP?

+

The minimum investment amount for a SIP can vary, but many mutual funds allow you to start with as little as Rs. 500 per month.

Can I change the SIP amount or stop it at any time?

+

Yes, you can increase, decrease, or stop your SIP at any time, although you should check with your fund provider for any associated fees or charges.

What if I miss a payment?

+

Missing a payment usually does not cancel your SIP, but consecutive missed payments might require you to reinitiate it.