Short-Term Methods Of Business Finance Hire

When starting or scaling a business, securing the necessary funds can often be a significant challenge. Whether you're launching a new venture or need to inject capital into an existing operation to cover operational costs or expansion plans, understanding short-term financing options can be the lifeline your business needs. This comprehensive guide will navigate you through various short-term methods of business finance available today, detailing their benefits, potential drawbacks, and how to leverage them effectively.

What Are Short-Term Financing Methods?

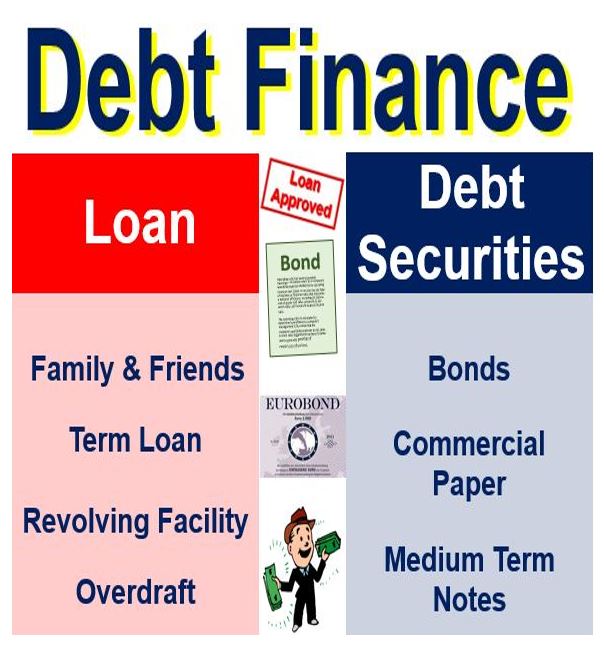

Short-term finance is essentially any funding option that needs to be repaid within one year or less. Here are some prevalent types:

- Trade Credit: This is an informal arrangement where a supplier allows you to buy goods or services on credit, with payment terms usually extending from 30 to 90 days.

- Merchant Cash Advances (MCAs): An advance on future sales where you receive funds in exchange for a percentage of your daily credit card sales.

- Invoice Financing: Where businesses sell their outstanding invoices to a third party at a discount to gain immediate cash.

- Line of Credit: A flexible loan from a bank or a financial institution that businesses can draw upon when needed.

- Short-Term Loans: These can be secured or unsecured and are designed to be paid back quickly, often with higher interest rates due to the shorter repayment period.

- Peer-to-Peer Lending: Borrowing directly from individuals through online platforms, often with competitive rates but without the need for traditional bank approval processes.

- Bridge Loans: Interim financing used to bridge the gap between immediate financial requirements and longer-term financing.

Choosing the Right Short-Term Financing Method

The choice of financing depends on various factors:

- Repayment Capacity: Assess how soon your business can afford to repay the borrowed funds.

- Use of Funds: Different loans are better suited for different needs, like covering a cash flow shortage, purchasing inventory, or bridging capital.

- Cost of Financing: Interest rates, fees, and the cost of equity must be considered to determine the total cost of the financing.

- Timeframe: Evaluate how long you’ll need the funds for.

- Business Credit Score: Some options require a good credit score, while others might be more lenient but at a higher cost.

- Collateral Availability: Some short-term financing methods might require collateral.

Trade Credit

Trade credit is one of the simplest forms of short-term financing. Here’s how it typically works:

- Suppliers provide goods or services with an invoice stating a payment term, usually ‘Net 30’, ‘Net 60’, or ‘Net 90’.

- You receive the benefit of delayed payment, allowing you to sell the product before needing to pay for it.

Merchant Cash Advances

MCAs are popular with businesses that process high volumes of credit card sales:

- Funding is provided against future sales, meaning repayments fluctuate with business performance.

- While convenient, MCAs can be costly due to the way advances and repayments are structured.

Invoice Financing

Invoice financing is beneficial if you have outstanding invoices:

- You can sell your invoices to a factor at a discount for immediate cash.

- This can help manage cash flow without the burden of debt.

💡 Note: Invoice financing can be a double-edged sword. While it provides quick cash, it also means you’re selling your invoices at a lower value.

Lines of Credit

Business lines of credit offer flexibility:

- You can draw funds as needed up to a predetermined limit.

- Interest is only charged on the amount you draw.

- This method allows for better cash flow management.

Short-Term Loans

These loans have a short repayment term, usually less than a year:

- They can come with high interest rates, but if managed well, they can provide quick capital.

- Secured short-term loans might offer better terms if you can provide collateral.

Peer-to-Peer Lending

Peer-to-Peer (P2P) lending platforms:

- Offer an alternative to traditional banking.

- Can provide competitive rates and are less focused on credit scores than banks.

Bridge Loans

Useful for businesses expecting a delay in larger financing:

- Short-term bridge loans can cover immediate needs.

- They are often high cost due to their short-term nature and risk.

In summary, businesses can choose from various short-term financing options, each with its own set of advantages and considerations. Selecting the right method depends on your business's current financial health, its future revenue projections, and the purpose for which the funds are needed. With careful planning, you can leverage these options to not only keep your business running smoothly but also to take advantage of opportunities for growth and expansion.

What is the difference between invoice financing and factoring?

+

Invoice financing involves using your invoices as collateral for a loan, meaning you still collect payment from your customers. In contrast, with factoring, you sell your invoices outright to a factor who then handles collections and gives you an advance on the invoice amount.

Can startups access short-term financing?

+

Yes, startups can access short-term financing, but they might face more challenges due to their lack of established credit history. Options like MCAs or P2P lending might be more accessible than traditional bank loans.

Are there any risks with short-term financing?

+

Yes, the primary risks include higher interest rates, potential debt traps, and the risk of damaging business relationships if repayments are delayed, especially in cases of trade credit or factoring.

What can short-term finance be used for?

+

Short-term financing can cover various needs like managing cash flow, buying inventory, funding a small project, or bridging the gap until longer-term financing is secured.