5 Ways Shire Finance Boosts Your Savings Game

Understanding personal finance is crucial in today's economic landscape, where every decision can significantly impact your financial well-being. Whether you're saving for retirement, aiming to build an emergency fund, or simply trying to live within your means, effective money management is key. This is where Shire Finance comes into play, offering innovative tools and strategies to enhance your savings game. Here are five ways Shire Finance can revolutionize how you save.

1. Goal-Oriented Savings Plans

Shire Finance provides personalized savings plans based on your financial goals. They offer:

- Short-term goals: Savings plans for vacations, holiday shopping, or special events.

- Medium-term goals: Funds for education, buying a car, or home renovation.

- Long-term goals: Retirement planning, creating a legacy, or purchasing property.

These plans are designed with your timeline and risk tolerance in mind, ensuring that you reach your financial milestones without undue stress.

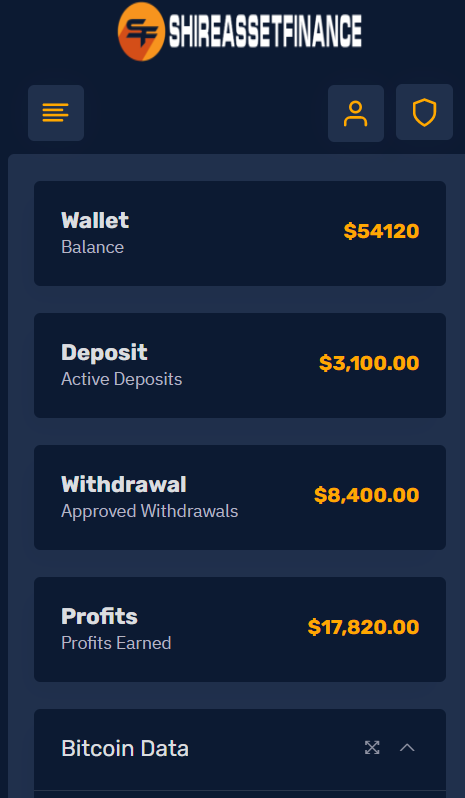

2. Automated Saving and Investing

Automation is a powerful tool for saving consistently:

- Automatic transfers to your savings or investment accounts can be set up easily.

- Round-up features where everyday purchases are rounded up to the nearest dollar, with the change being automatically saved or invested.

- Biweekly or monthly contributions to funds you’ve chosen, making saving as easy as earning.

💡 Note: Automating your savings ensures you save without having to think about it, which is particularly useful for those who find it hard to save manually.

3. Debt Management Tools

Debt can be a significant hurdle in saving. Shire Finance includes:

- Debt Consolidation to reduce interest rates and streamline payments.

- Debt Snowball or Avalanche methods to strategically pay off high-interest debts first.

- Budgeting tools to track spending and reallocate money towards debt reduction.

These tools help you lower your debt burden, freeing up more cash for savings.

4. Financial Education and Coaching

Shire Finance goes beyond just providing tools; it educates users:

- Workshops and webinars on saving strategies, investment options, and budgeting.

- Personalized coaching from financial experts, which can be invaluable for novices.

- Extensive online resources including articles, videos, and interactive tools.

Knowledge is power, especially in finance. By understanding how to manage your money, you’re better equipped to save effectively.

5. Rewards and Incentives

Saving can sometimes feel like a chore, but Shire Finance makes it fun:

- Savings Goals Achievements - Earn badges or points for hitting savings targets.

- Referral Programs - Earn money or benefits by inviting friends or family to join.

- Cashback on Savings - Small percentages returned as you save or invest, encouraging continuous saving.

By making saving rewarding, Shire Finance taps into the psychology of positive reinforcement, making you more likely to keep saving.

At the core of Shire Finance's offerings is the belief that saving should not only be easy but also engaging. Through innovative technology, personalized support, and community-driven rewards, Shire Finance helps you navigate the complexities of personal finance. By integrating these five strategies into your financial planning, you can see your savings grow more efficiently and effectively than ever before. Let's transform your saving habits with these tools and watch as your financial future becomes brighter day by day.

What makes Shire Finance different from other financial apps?

+

Shire Finance stands out by combining automated tools, personalized plans, and educational resources to provide a holistic approach to savings. They emphasize not just saving but the entire spectrum of personal finance management.

Can I still use Shire Finance if I have existing debts?

+

Yes, Shire Finance provides specific tools to manage and reduce debt, allowing you to save while addressing your financial liabilities.

How does the reward system work?

+

Shire Finance offers rewards for hitting saving milestones, referring others to the platform, and participating in their community activities. These rewards can include cashback, points, or badges that can be redeemed for various benefits.