5 Essential Tips for Investing in UK Share Prices

Investing in the UK stock market can be an exciting yet daunting endeavour, whether you're a seasoned investor or just starting out. Understanding how to navigate through the ups and downs of share prices can significantly impact your investment success. Here are five essential tips to help you make informed decisions when investing in UK share prices.

1. Understand Market Cycles

The stock market moves in cycles, influenced by a myriad of economic factors including interest rates, inflation, and consumer confidence. Recognizing these cycles:

- Expansion - where the economy is growing, and stock prices generally rise.

- Peak - when growth slows down, and stock prices might be at their highest.

- Contraction (Recession) - characterized by economic downturn, and stock prices fall.

- Trough - the market bottoms out, often presenting buying opportunities.

Being aware of where the market might be in its cycle can help you adjust your investment strategy accordingly.

💡 Note: While historical data can guide predictions, no one can predict market movements with absolute certainty.

2. Research and Analysis

Before you invest, thorough research is crucial:

- Fundamental Analysis: Delve into a company's financial health by examining its revenues, profits, liabilities, and other factors. This can be done using:

- Income Statement

- Balance Sheet

- Cash Flow Statement

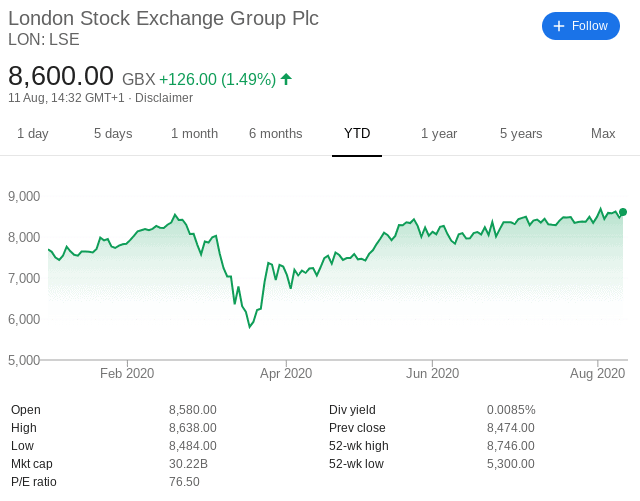

- Technical Analysis: Analyze stock charts for patterns that might suggest future price movements.

- Sentiment Analysis: Understand market sentiment through news, analyst reports, and public opinion.

🧐 Note: Different stocks require different levels of analysis. Tech companies might require more focus on growth prospects, while traditional industries might look at dividend yields and stability.

3. Diversify Your Portfolio

Diversification is the practice of spreading investments across various sectors or industries to mitigate risk:

| Industry | Percentage of Portfolio |

|---|---|

| Technology | 20% |

| Healthcare | 15% |

| Financial Services | 15% |

| Energy | 10% |

| Consumer Goods | 10% |

| Utilities | 10% |

| Real Estate | 10% |

| Miscellaneous | 10% |

🛡 Note: Diversification doesn't eliminate all risks, but it helps in balancing potential losses across different assets.

4. Stay Informed and Adapt

Economic policies, political changes, and global events can all affect the UK stock market. To adapt:

- Follow credible financial news.

- Attend webinars, seminars, or investment forums.

- Read analyst reports from trusted financial institutions.

- Keep an eye on UK economic indicators like GDP growth, unemployment rates, and inflation.

👀 Note: Be cautious of overreacting to short-term news; focus on how it might influence the long-term health of companies and the economy.

5. Invest for the Long Term

While short-term trading can yield quick profits, the real power of the stock market often comes from long-term investment:

- Compounding: Reinvesting dividends can significantly increase your wealth over time.

- Time in the Market: Staying invested allows you to weather market volatility better than those trying to time the market.

- Learn from Experience: Over time, you'll understand your investment preferences and become more adept at making decisions.

Investing in UK shares, especially in well-managed companies, can provide not only income through dividends but also capital growth. By adhering to these five tips, you'll be better equipped to navigate the complexities of the UK stock market.

What should I look for when analyzing a company?

+

Examine financial statements, growth prospects, market position, management quality, and economic conditions affecting the sector.

How often should I review my investment portfolio?

+

Regularly, perhaps quarterly or semi-annually, to ensure your investments align with your financial goals and current market conditions.

Can international events influence UK share prices?

+

Yes, global economic events can significantly impact UK stocks, particularly multinational companies or sectors sensitive to international trade.