5 Ways Purchase Order Financing Boosts Cash Flow

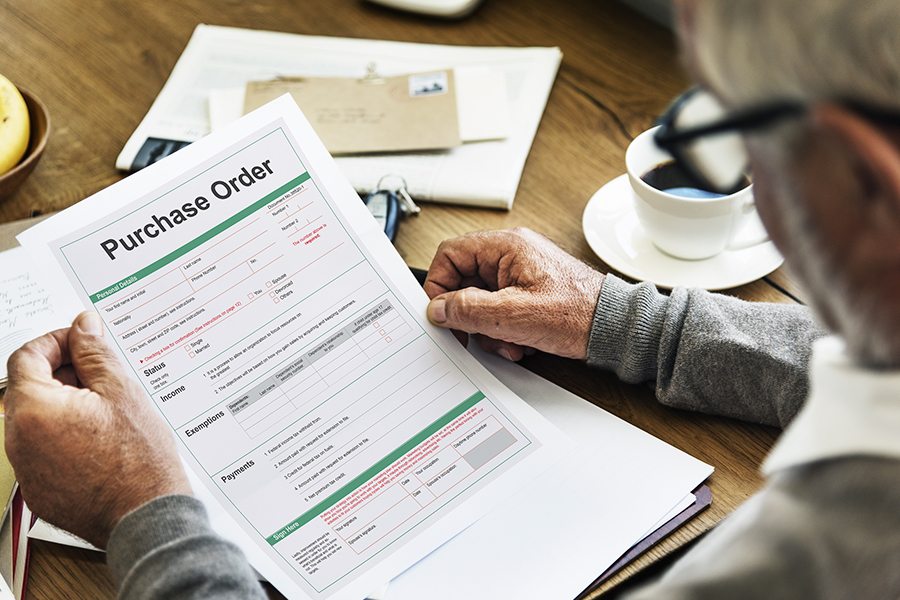

In the fast-paced world of business, maintaining a healthy cash flow can be as crucial as securing your next big client. Purchase Order (PO) Financing emerges as a strategic tool that not only provides immediate liquidity but also supports the growth trajectory of businesses, particularly in industries with long payment cycles or those facing cash flow challenges. Here, we delve into five ways in which purchase order financing can dramatically enhance your company's cash flow, streamline operations, and set the stage for expansion.

1. Immediate Working Capital

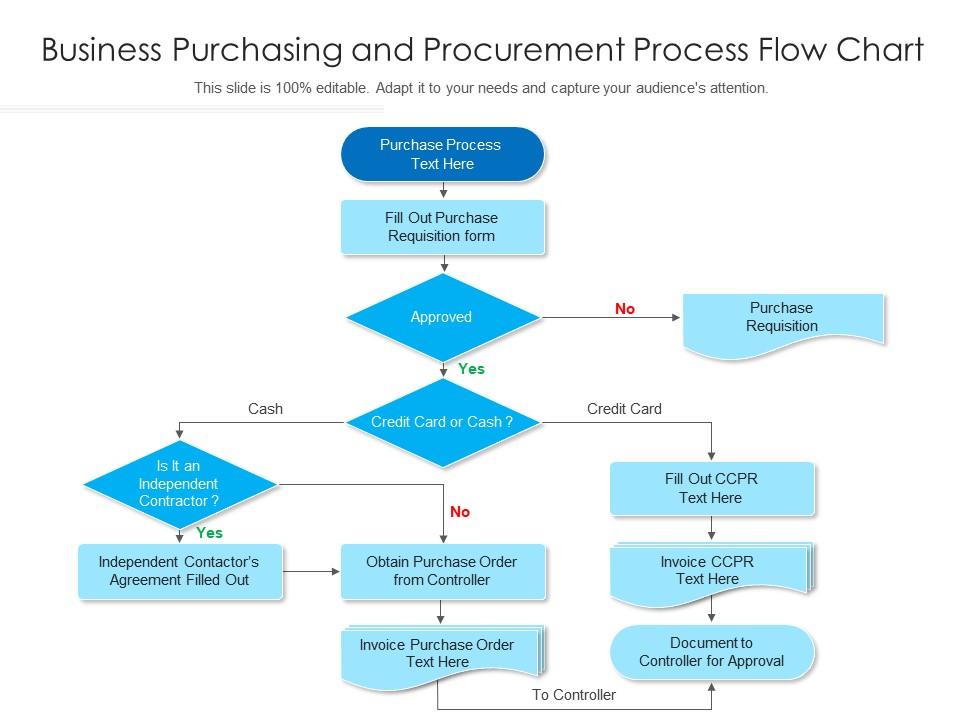

One of the primary advantages of PO financing is the immediate infusion of working capital it provides. When a customer places an order, often they expect delivery within a specified timeframe. The cash flow gap that exists between when you order goods or materials from your suppliers and when your customer pays you upon delivery can be critical. This period might not always align with your payment terms or might stretch your financial resources thin. With PO financing, the financier pays your suppliers directly, allowing you to:

- Fulfill Orders: Pay for raw materials or inventory to complete orders on time.

- Maintain Inventory: Keep sufficient stock to meet sudden increases in demand or prepare for upcoming sales seasons.

- Reduce the Working Capital Stress: Access funds to manage day-to-day operational expenses without dipping into your reserves.

💡 Note: Make sure your PO finance provider understands your industry well, offering tailored financing options that align with your operational needs.

2. Accelerates Business Growth

PO financing is not just about filling the financial void; it’s an accelerator for growth. Here’s how it can fuel your expansion:

- Scale Operations: With more orders fulfilled, you can expand your market presence and capture new territories or customer segments.

- Seize Opportunities: Leverage financing to quickly respond to market opportunities or competitor moves.

- Improve Credit Rating: Timely delivery and growth can enhance your business credit, making you eligible for more traditional forms of finance in the future.

3. Mitigates Risk of Losing Large Orders

Turning down large orders due to insufficient working capital can be a massive setback. PO financing steps in to:

- Secure Large Deals: Finance the purchase of materials or goods to fulfill sizable orders without straining your finances.

- Prevent Lost Revenue: Keep your order book full, ensuring consistent revenue flow and business growth.

4. Enhances Supplier Relationships

Good relationships with suppliers are gold in business. With PO financing:

- Timely Payments: Pay suppliers promptly, which can lead to better terms and priority when ordering.

- Negotiating Power: With consistent and timely payments, you're in a stronger position to negotiate for discounts or better payment terms.

5. Reduces Dependence on Traditional Finance

The traditional finance route, like bank loans or lines of credit, might not always be ideal due to high interest rates, stringent collateral requirements, or the time it takes to secure funding. PO financing:

- Bypasses Collateral Needs: The financing is often non-recourse, meaning the financier assumes the risk if the customer does not pay, thereby reducing your need for collateral.

- Quick Funding: Approval and funds are usually quicker compared to traditional loans, ensuring you can meet urgent financial needs for order fulfillment.

- Cost-Effective: Typically, the fees for PO financing are less than what banks might charge, especially for short-term financing needs.

In summary, purchase order financing is a dynamic tool that aligns perfectly with the needs of modern businesses. By providing working capital to fulfill orders, fostering growth, securing large deals, improving supplier relationships, and reducing the reliance on conventional financing, PO financing acts as a catalyst for success in competitive markets.

When leveraged correctly, it not only boosts cash flow but also strengthens your business's financial backbone, empowering you to seize opportunities without the delay or the burden of traditional financial constraints.

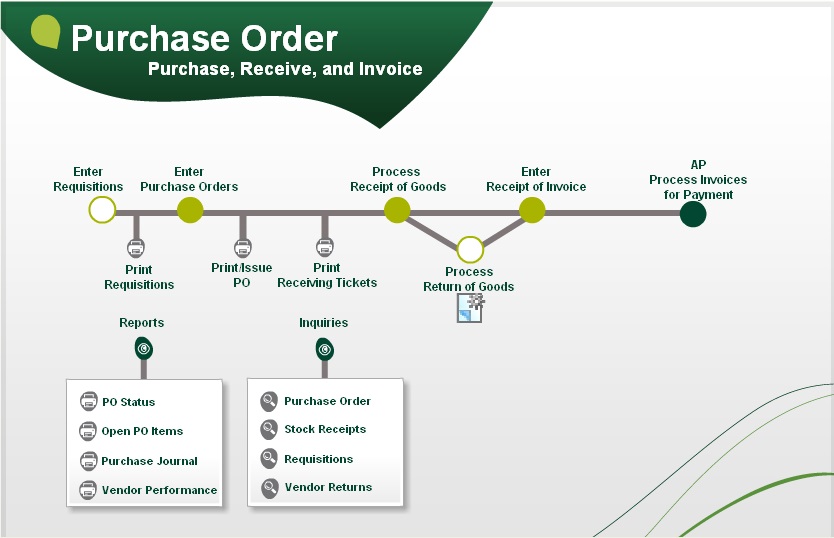

What is purchase order financing?

+

Purchase order financing is when a third-party financier advances funds to cover the costs of fulfilling orders on behalf of a business that has received confirmed purchase orders but lacks the cash to fulfill them.

How does PO financing differ from invoice factoring?

+

Invoice factoring involves selling your invoices to a third party at a discount, whereas PO financing is about funding the purchase of goods or services needed to fulfill an order. Factoring provides funds post-order fulfillment, while PO financing does so before.

What types of businesses benefit most from PO financing?

+

Businesses in manufacturing, distribution, wholesaling, or those with high inventory costs often benefit from PO financing, especially those with large orders, longer production cycles, or seasonal sales spikes.