5 Essential Tips for Private Car Sale Financing

In the dynamic world of car sales, buying and selling a vehicle privately can often be a challenging but rewarding process. One of the key aspects to consider in this scenario is financing, which can significantly affect both the buyer's affordability and the seller's terms. Understanding the different options available for financing a private car sale can empower both buyers and sellers, making the process smoother and potentially more profitable. This article delves into the five essential tips for managing financing during a private car sale, offering guidance that can lead to beneficial outcomes for all parties involved.

The Role of Financing in Private Car Sales

Financing plays a critical role in private car sales. It determines not only how much a buyer can afford but also how quickly a seller can liquidate their asset. Here’s why financing matters:

- Access to More Buyers: Offering financing options can attract a broader audience, including those who might not have immediate cash but are ready to commit through payments.

- Interest Earnings: Sellers who finance their vehicles can earn interest over the loan term, potentially increasing their overall returns.

- Negotiation Leverage: Knowledge about financing terms gives both parties leverage in negotiating the sale price and conditions.

Tip 1: Understand Your Financing Options

Before diving into a private car sale, both parties should be well-informed about the financing options:

- Self-Financing: This involves the seller providing credit to the buyer. It requires the seller to be financially stable enough to cover the car’s value until full payment is received.

- Bank Loans: Buyers can seek loans from banks or credit unions, which often provide competitive rates but might require more documentation and time.

- Peer-to-Peer Lending: Platforms like LendingClub or Prosper allow individuals to lend and borrow money without traditional bank intermediaries.

- Online Lenders: Online financing platforms offer quicker processing times with varying rates depending on credit scores.

- Car Lease Buyouts: If the vehicle was leased, the lessee might opt to buy it out, which can be financed through specific lease-end financing options.

⚠️ Note: Always ensure you understand the terms of any financing agreement, especially regarding interest rates, payment schedules, and penalties for late payments.

Tip 2: Evaluate Creditworthiness

Both buyers and sellers should assess creditworthiness before finalizing any financial arrangement:

- Check Credit Scores: A good credit score can lead to better loan terms. Buyers might want to improve their credit score before applying for a loan.

- Use Credit Reports: Review credit reports for any discrepancies or areas for improvement which could affect loan approvals or rates.

- Negotiate Terms Based on Credit: A higher credit score might allow for lower interest rates or better terms when negotiating a deal.

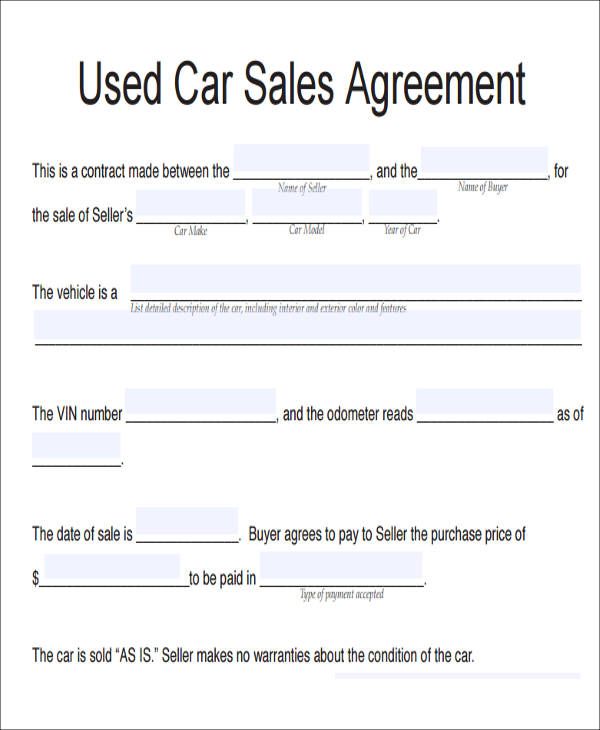

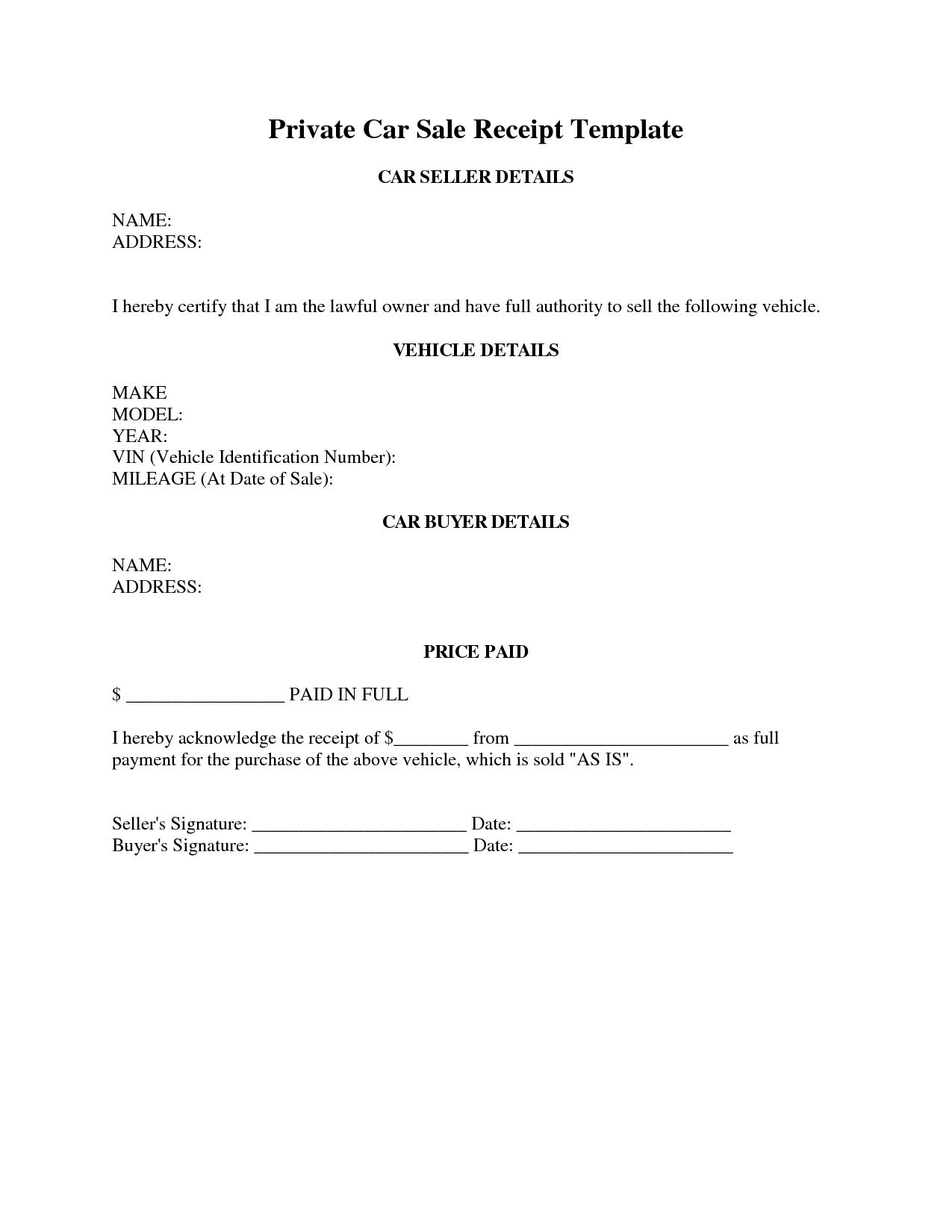

Tip 3: Legal Documentation and Agreements

Financing a car sale privately means there’s a need for robust legal documentation:

- Promissory Note: This document outlines the terms of repayment, including interest rates, payment schedule, and consequences of default.

- Loan Agreement: A comprehensive agreement that details all terms of the loan, securing both parties’ interests.

- Vehicle Title Transfer: Ensure the title transfer process is legally sound, especially if the car is used as collateral.

📝 Note: Always consult with a legal professional when drafting or signing financing agreements to avoid any legal complications down the line.

Tip 4: Use of Escrow Services

To safeguard the interests of both the buyer and seller, consider using an escrow service:

- Neutral Third Party: An escrow service holds funds until all terms of the agreement are met, providing peace of mind for both parties.

- Protection Against Fraud: Escrow services reduce the risk of fraud by ensuring funds are only released upon fulfillment of conditions.

- Streamlined Process: They can streamline the transaction, especially when dealing with large sums and financing.

Here’s a simple example of how an escrow transaction might work:

| Step | Action |

|---|---|

| 1 | Buyer and Seller agree on terms and deposit funds into escrow. |

| 2 | Escrow verifies funds. |

| 3 | Upon verification, the escrow releases funds to the seller, and the title is transferred to the buyer. |

Tip 5: Insurance Considerations

When financing a vehicle, insurance plays a crucial role:

- Lender’s Interest: Most lenders require comprehensive insurance coverage to protect their interest in the vehicle.

- Policy Transfer: If the car has existing insurance, understand the process and costs of transferring or updating the policy.

- Gap Insurance: Consider gap insurance if the vehicle depreciates faster than the loan is being paid off.

Financing a private car sale, when done correctly, can be an excellent way to navigate the complexities of vehicle transactions. By understanding and leveraging the various financing options, ensuring legal documentation is in order, using escrow services, and considering insurance implications, both buyers and sellers can achieve a fair and mutually beneficial deal. Remember, while the process might seem daunting, proper preparation, clear communication, and thorough documentation can lead to a successful sale or purchase, fostering trust and minimizing risks. The key is to approach this process with knowledge and caution, ensuring that all parties are protected and satisfied with the transaction outcome.

Can I finance a car if I have bad credit?

+

Yes, it’s possible to finance a car with bad credit. You might have to look for lenders specializing in subprime lending or consider getting a co-signer with good credit to secure better loan terms.

What is the benefit of using an escrow service?

+

Escrow services provide a neutral third-party to manage the funds and transaction, ensuring that neither the buyer nor the seller can default without repercussions. This adds an extra layer of security to the deal.

Do I need gap insurance when financing a car?

+

Gap insurance might be beneficial if your car depreciates faster than you can pay off the loan. It covers the “gap” between what your insurance pays out after a total loss and what you owe on the car.