7 Secrets to Navigating Stock Prices in 2023

In the dynamic world of finance, understanding how to navigate stock prices has become an essential skill for investors looking to make profitable decisions. With the ever-changing market conditions, new technologies, and shifting geopolitical landscapes in 2023, staying ahead requires more than just a basic grasp of economics or finance. Here, we'll explore seven secrets that can give you an edge in interpreting and leveraging stock market trends this year.

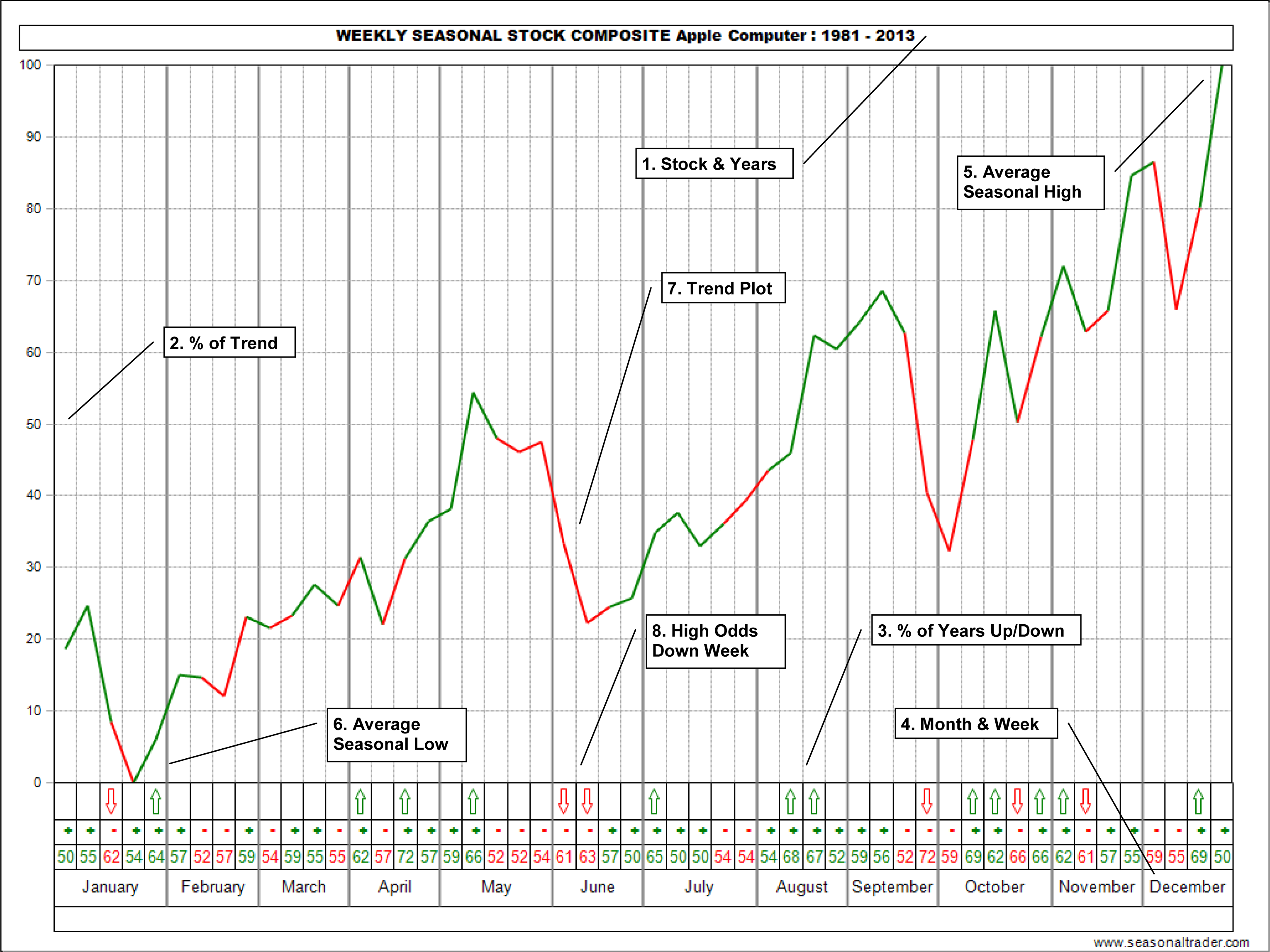

Secret 1: Leverage Advanced Charting Tools

Modern investors have access to a plethora of stock charting tools that go beyond simple price and volume charts. Tools like Bloomberg Terminal, TradingView, and MetaStock offer advanced charting capabilities that can analyze trends, patterns, and even predict future movements.

- Technical Analysis Indicators: Use indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands to gauge market momentum, trend direction, and volatility.

- Algorithmic Trading: Algorithms can analyze vast amounts of data to predict stock price movements with higher accuracy.

- Candlestick Patterns**: Learn patterns like Doji, Hammer, and Engulfing to understand potential reversals or continuation in price action.

📈 Note: While these tools provide valuable insights, they’re not foolproof. Always combine them with your own research and risk assessment.

Secret 2: Understand the Impact of Global Events

The stock market doesn’t operate in a vacuum. Events like geopolitical tensions, economic reports, and natural disasters can cause fluctuations in stock prices. Here’s how you can stay informed:

- Economic Calendars: Keep track of key economic releases, Fed meetings, or employment data that can influence market sentiment.

- Geopolitical Monitoring: Use apps or news aggregators to stay updated on international news that could impact global markets.

- Sentiment Analysis: Analyze social media, forums, and financial news for investor sentiment which often precedes market movement.

Secret 3: Behavioral Finance Insights

Human psychology plays a significant role in investment decisions. Understanding how emotions like fear, greed, and overconfidence affect the market can provide a competitive edge:

- Overreaction to News: Investors often overreact to news, causing stock prices to deviate from their intrinsic values.

- Confirmation Bias: Investors tend to seek information that confirms their existing beliefs, potentially leading to poor investment choices.

- Herd Behavior: Market trends can sometimes be driven by the collective actions of investors rather than fundamental analysis.

Secret 4: Incorporate Machine Learning and AI

With the advent of big data and AI, stock market predictions are becoming increasingly sophisticated:

- Predictive Analytics: AI can analyze historical data to forecast stock prices with greater accuracy than traditional methods.

- Sentiment Analysis: AI can sift through millions of online conversations to gauge public sentiment towards stocks or industries.

- Algorithmic Trading: Machine learning algorithms can execute trades at optimal times, reducing human error and emotional trading.

🧠 Note: AI and ML are tools that augment, not replace, human decision-making. Ethical considerations and regulatory compliance must be considered when using these technologies.

Secret 5: Diversification as a Core Strategy

Even with all the tools at our disposal, the adage “don’t put all your eggs in one basket” remains crucial:

- Across Sectors: Invest in different sectors to mitigate industry-specific risks.

- Geographic Diversification: Consider international investments to spread risk across different economic environments.

- Asset Classes: Mix stocks with bonds, commodities, real estate, or even cryptocurrencies for a balanced portfolio.

Secret 6: Regular Reassessment of Investment Strategies

Markets evolve, and so should your investment strategies. Here’s how to stay agile:

- Re-evaluate Regularly: Quarterly reviews can help adapt to changing market conditions.

- Rebalance Portfolio: Adjust holdings to maintain your target asset allocation.

- Stay Educated: Keep learning about new financial instruments, strategies, and technologies.

📘 Note: Market reassessment isn’t just about avoiding losses; it’s also about seizing new opportunities as they arise.

Secret 7: Emotional Discipline

Perhaps the most overlooked aspect of stock market investing is managing one’s emotions:

- Stick to Your Plan: Have a strategy and stick to it, avoiding impulsive decisions driven by fear or greed.

- Avoid Chasing Trends: Jumping on the latest hot stock without due diligence often leads to buying high and selling low.

- Risk Management: Use stop-loss orders and set limits on potential losses to protect your capital.

As we’ve navigated through these seven secrets, it’s clear that while the stock market in 2023 is complex, with the right tools, knowledge, and discipline, investors can position themselves advantageously. The key takeaways include leveraging advanced charting for insights, understanding global events, appreciating the role of psychology in market movements, employing AI for analysis, diversifying investments, reassessing strategies regularly, and mastering emotional discipline. Remember, the stock market is not just a game of numbers; it’s also about people, psychology, and the ever-evolving economic landscape.

What are some reliable tools for stock market analysis in 2023?

+

Some reliable tools for stock market analysis in 2023 include Bloomberg Terminal for comprehensive market data, TradingView for community-driven charts, MetaStock for technical analysis, and various AI and ML-based platforms like AlphaSense for sentiment analysis.

How important is diversification in stock investing?

+

Diversification is crucial in stock investing as it helps spread risk across different investments. It mitigates industry-specific or geographic-specific risks and can improve returns by capturing gains from various sectors or asset classes.

What role do emotions play in stock market investing?

+

Emotions like fear, greed, and overconfidence can significantly influence investment decisions. They can lead to impulsive buying or selling, chasing trends without due diligence, and abandoning well-thought-out strategies during market volatility.

Can AI predict stock market trends?

+

AI can analyze vast amounts of historical data and real-time market data to provide predictive insights with greater accuracy than traditional methods. However, AI predictions are not infallible; they should be used to inform, not dictate, investment decisions.

What should I consider when reassessing my investment strategy?

+

When reassessing your investment strategy, consider changes in market conditions, your risk tolerance, financial goals, performance of your investments, and new opportunities or technologies in the market. Regularly review and adjust your portfolio to keep it aligned with your investment objectives.